XRP Price Prediction 2025: Can Regulatory Breakthroughs Fuel a $6 Surge?

- XRP Technical Analysis: July 2025 Outlook

- Regulatory Crossroads: SEC Case Nears Resolution

- Whale Activity and Market Psychology

- Elliott Wave Theory: $6 Target in Sight?

- Fundamental Developments

- Market Data Snapshot

- Institutional Perspective

- Risk Factors to Consider

- XRP Price Prediction FAQ

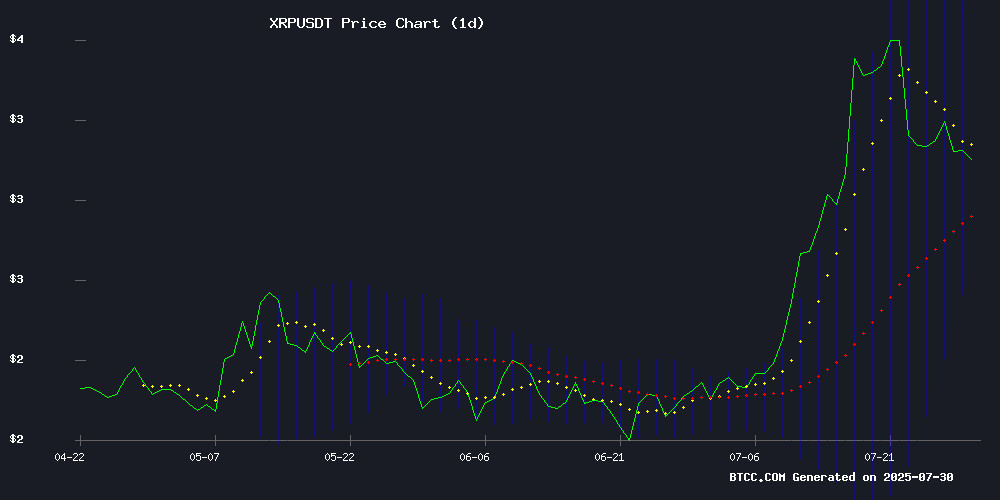

XRP stands at a critical juncture in July 2025, trading around $3.13 with mixed technical signals. While the MACD shows weak bullish momentum, whales continue accumulating despite volatility. The pending SEC resolution (August 15 deadline) and potential Wave 5 rally could propel XRP toward $6, but traders should watch the $3 support closely. This analysis combines technical indicators, regulatory developments, and market psychology to assess XRP's near-term trajectory.

XRP Technical Analysis: July 2025 Outlook

According to TradingView data, XRP currently trades at $3.137, slightly below its 20-day moving average of $3.1681, indicating neutral-to-bearish short-term momentum. The MACD histogram shows a slight bullish crossover at +0.1180, but remains in negative territory. Bollinger Bands suggest volatility contraction with price hovering NEAR the middle band at $3.1681.

Key technical levels to watch:

- Resistance: $3.6611 (Upper Bollinger Band)

- Support: $3.080 (recent Fibonacci level) followed by $2.6750 (Lower Bollinger Band)

Regulatory Crossroads: SEC Case Nears Resolution

The prolonged Ripple-SEC legal battle approaches a potential conclusion, with the regulator required to file a status update by August 15, 2025. Judge Analisa Torres' 2023 ruling that secondary market XRP sales don't constitute securities remains contested, though recent joint motions suggest possible settlement discussions.

Market impact could be significant:

- Bullish scenario: SEC drops appeal → regulatory clarity → institutional adoption

- Bearish scenario: Protracted litigation → continued uncertainty → suppressed price action

Whale Activity and Market Psychology

Blockchain data reveals aggressive accumulation by large holders:

| Date | XRP Purchased | USD Value |

|---|---|---|

| July 15-20 | 2.2 billion | $6.6B |

| July 25 | 60 million | $180M |

| July 28 | 130 million | $390M |

This whale activity suggests confidence in XRP's long-term prospects despite recent volatility. However, the price has remained range-bound, indicating other market forces at play.

Elliott Wave Theory: $6 Target in Sight?

Technical analysts observe a potential Wave 4 consolidation, with expectations for a Wave 5 rally that could reach $6. The pattern WOULD complete as follows:

- Wave 1: $1.20 → $2.40 (100% increase)

- Wave 2: $2.40 → $1.80 (25% retracement)

- Wave 3: $1.80 → $3.66 (103% increase)

- Wave 4: $3.66 → $3.08 (current)

- Wave 5: Projected $3.08 → $5.85+

Fundamental Developments

Recent news impacting XRP's valuation:

- Positive: Ripple Payments expansion to 3 new markets, Trump administration's pro-crypto stance

- Negative: $17M XRP theft case involving George Jones' widow, declining trading volumes

Market Data Snapshot

Current XRP metrics (CoinMarketCap data):

- Price: $3.137 (-1.08% daily)

- Market Cap: $184.95B

- 24h Volume: $5.76B (-18%)

- Circulating Supply: 58.98B XRP

Institutional Perspective

Wall Street analyst Geoff Kendrick maintains bullish outlook:

- 2025 target: $5.50

- 2028 target: $12.50

Risk Factors to Consider

Potential downside catalysts:

- SEC case extends beyond August

- Break below $3 support

- Broader crypto market correction

- Regulatory crackdowns in key markets

XRP Price Prediction FAQ

What is the short-term outlook for XRP?

The short-term outlook appears neutral-to-bullish if XRP maintains the $3 support level. Technical indicators suggest consolidation before a potential MOVE higher, with key resistance at $3.66.

When will the SEC case be resolved?

The SEC must file a status update by August 15, 2025. While this doesn't guarantee resolution, market participants view it as a potential inflection point in the long-running litigation.

Why are whales accumulating XRP?

Large holders likely anticipate positive regulatory developments and believe current prices undervalue XRP's utility in cross-border payments. Their accumulation reduces circulating supply, which could support higher prices.

Is $6 a realistic target for XRP?

From a technical perspective, the $6 target aligns with Wave 5 projections in Elliott Wave theory. Fundamentally, it would require regulatory clarity and increased institutional adoption to sustain such valuation.

What are the main risks to XRP's price?

Key risks include adverse SEC developments, loss of $3 support triggering stop-losses, declining trading volumes, and broader crypto market downturns. The $17M theft case also highlights security concerns.