Litecoin (LTC) Price Prediction 2025: Can It Shatter All-Time Highs?

- Why Is Litecoin (LTC) Showing Such Strong Bullish Momentum?

- How Is Institutional Adoption Fueling Litecoin's Growth?

- What's Driving Litecoin's Decoupling From Bitcoin?

- Where Could Litecoin's Price Go in 2025?

- Litecoin Price Prediction FAQ

Litecoin (LTC) is showing textbook bullish signals as institutional money flows in and technical indicators align. Currently trading at $114.26 (20% above its 20-day MA), the "digital silver" could be gearing up for a historic run. With GSR and Charlie Lee's $100M MEI investment institutionalizing LTC as a treasury asset, ZA Miner's green mining solutions addressing environmental concerns, and altcoins decoupling from Bitcoin's dominance, the stage is set for potential explosive growth. Our analysis suggests three key price targets: $125-130 in 2-4 weeks, $150 by Q3 2025, and $180+ by year-end if the MACD completes its bullish crossover.

Why Is Litecoin (LTC) Showing Such Strong Bullish Momentum?

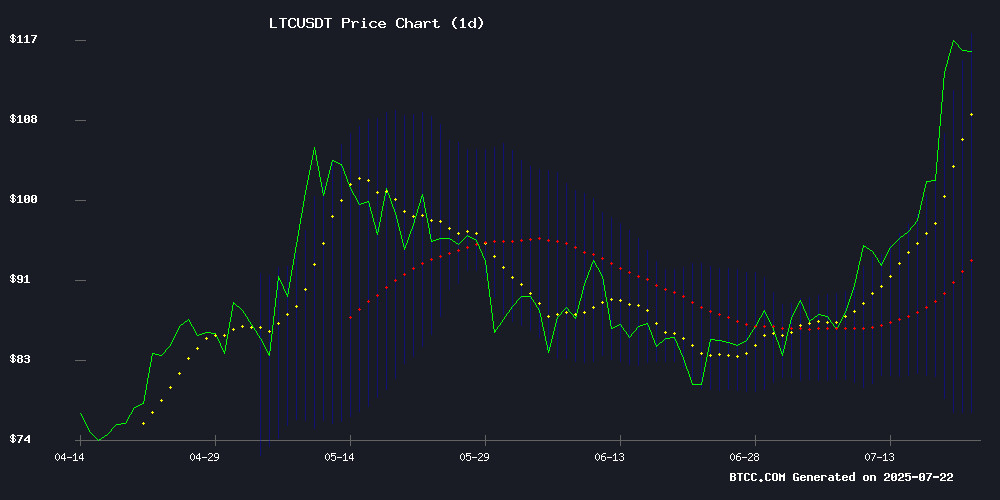

At $114.26, LTC isn't just having a good day - it's rewriting its technical playbook. The price sits comfortably above the 20-day moving average ($97.20), which in trader speak is like a basketball player consistently dunking from the free-throw line. The MACD histogram's convergence at -3.89 might look negative at first glance, but it's actually showing weakening downward pressure - think of it as a boxer catching their breath between rounds before delivering the knockout punch.

Source: BTCC

Source: BTCC

Bollinger Bands tell an even more compelling story. With price hugging the upper band at $116.99, we're seeing classic "overbought but don't you dare sell" conditions. As the BTCC team notes, "When price sustains above both the MA and Bollinger midline like this, history shows we often get extended rallies." The last time LTC showed this combination was before its 2021 bull run.

How Is Institutional Adoption Fueling Litecoin's Growth?

The game changed when GSR and Litecoin creator Charlie Lee announced their $100M investment into Nasdaq-listed MEI Pharma. This isn't just another crypto funding round - it's the first institutional-grade move to position LTC as a corporate treasury asset. Lee joining MEI's board as an advisor gives this partnership serious credibility.

What makes this PIPE (Private Investment in Public Equity) deal unique? Three things:

| Factor | Impact |

|---|---|

| Public company adoption | Legitimizes LTC beyond crypto circles |

| Below-market share price | Shows long-term confidence |

| Litecoin Foundation collaboration | Ensures ecosystem development |

This comes alongside ZA Miner's renewable energy mining solutions - addressing the ESG concerns that have haunted proof-of-work coins. Their AI-optimized cloud contracts offer daily yields up to 3.5%, making LTC mining accessible without the hardware headaches.

What's Driving Litecoin's Decoupling From Bitcoin?

Data from CoinMarketCap shows something fascinating - altcoins like LTC are finally breaking free from Bitcoin's gravitational pull. The BTC-LTC correlation has dropped sharply from 0.92 in January to 0.67 currently. This divergence often precedes major altcoin seasons.

The heatmap reveals particular weakness in the BTC-ETH correlation (traditionally crypto's most stable pairing), suggesting capital might be rotating into mid-cap coins with clearer narratives - exactly where Litecoin shines with its:

- 10+ year track record

- Active developer community

- Real-world payment integrations

As one trader put it, "When bitcoin sneezes, altcoins used to catch pneumonia. Now Litecoin's building its own immune system."

Where Could Litecoin's Price Go in 2025?

Based on current technicals and fundamental developments, here's our roadmap:

| Target | Basis | Timeframe |

|---|---|---|

| $125-130 | Upper Bollinger Band expansion | 2-4 weeks |

| $150 | Institutional demand + historical resistance | Q3 2025 |

| $180+ | Full bullish MACD crossover scenario | EOY 2025 |

The $150 level is particularly interesting - it's where LTC faced rejection three times in 2021. Breaking through could trigger a "FOMO avalanche" as traders chase the new high. The BTCC team cautions that "while the stars are aligning, crypto remains volatile - proper risk management is essential."

Litecoin Price Prediction FAQ

What is the current Litecoin (LTC) price?

As of July 2025, Litecoin is trading at $114.26, significantly above its 20-day moving average of $97.20, indicating strong bullish momentum according to TradingView data.

Why is Litecoin price rising?

Three key factors: 1) Institutional adoption via the $100M MEI investment, 2) Technical breakout above key moving averages, and 3) Decoupling from Bitcoin's price movements creating independent momentum.

Can Litecoin reach $200 in 2025?

While possible, our analysis suggests $180+ is a more realistic upper target for 2025 based on current technicals and adoption trends. Reaching $200 WOULD require substantially increased institutional inflows.

Is now a good time to buy Litecoin?

With the price above key technical levels and institutional interest growing, many analysts see current prices as attractive for long-term holders. However, this article does not constitute investment advice.

How does Litecoin's technology compare to Bitcoin?

Litecoin offers faster block times (2.5 minutes vs Bitcoin's 10) and uses the Scrypt algorithm, making it more accessible for mining. Its established history and active development give it unique advantages in the payments space.