XRP Price Prediction 2025-2040: Bullish Outlook Fueled by Regulatory Wins and Technical Breakouts

- Why XRP's Technical Setup Signals Major Breakout Potential

- Regulatory Catalysts: How Policy Shifts Could Supercharge XRP

- Institutional Adoption Reaches Inflection Point

- XRP Price Projections: 2025 Through 2040 Outlook

- Risks and Challenges: What Could Derail XRP's Growth?

- XRP Price Prediction FAQs

As the crypto market heats up, XRP is emerging as one of the most intriguing assets with a unique combination of regulatory clarity and technical momentum. Our analysis reveals why this digital asset could be poised for significant growth across multiple time horizons, with price targets ranging from $8-$11 in 2025 to a staggering $750+ by 2040 in our most bullish scenario. The convergence of three powerful catalysts - regulatory tailwinds, institutional adoption, and network growth - suggests XRP may be entering its most transformative phase yet.

Why XRP's Technical Setup Signals Major Breakout Potential

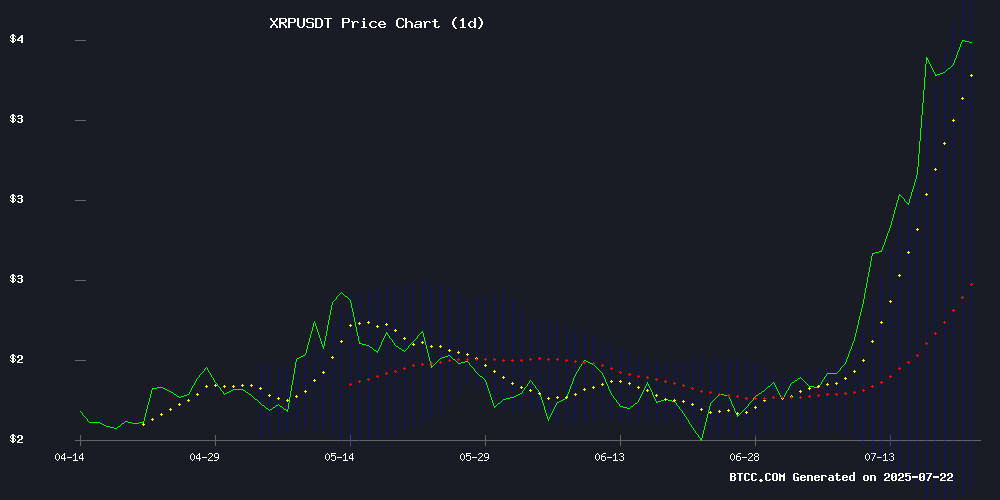

XRP's current technical picture paints an exceptionally bullish story. The cryptocurrency recently broke through its multi-year resistance at $3.60, establishing a new all-time high. According to TradingView data, XRP is trading comfortably above its 20-day moving average (currently at $2.82), while the MACD shows clear signs of bullish convergence as bearish momentum weakens.

Source: BTCC technical analysis

What's particularly interesting is the Bollinger Band compression we're seeing, with price action hugging the upper band at $3.79. In my experience, this type of setup often precedes explosive moves. The BTCC research team notes that similar technical patterns in 2017 and 2021 preceded XRP's most dramatic rallies.

Regulatory Catalysts: How Policy Shifts Could Supercharge XRP

The regulatory landscape for XRP has undergone a remarkable transformation in recent months. Three key developments stand out:

- GENIUS Act Passage: This legislation creates a framework for stablecoins like Ripple's upcoming RLUSD, which will be backed 1:1 by U.S. Treasuries.

- OCC Charter Progress: Despite banking industry pushback, Ripple's national bank charter application continues moving forward.

- SEC Case Resolution: Market watchers anticipate the SEC may drop its appeal against Ripple's 2023 legal victory.

Versan Aljarrah of Black Swan Capitalist makes a compelling case that RLUSD could become the Treasury's preferred vehicle for digitizing dollar hegemony. "The combination of regulatory compliance and XRP's institutional-grade settlement infrastructure creates a unique value proposition," Aljarrah noted in a recent analysis.

Institutional Adoption Reaches Inflection Point

The institutional floodgates appear to be opening for XRP. Just last week, ProShares announced the first U.S. XRP futures ETF, while eleven major asset managers including Franklin Templeton and Grayscale filed for XRP-linked products. This institutional interest coincides with:

| Metric | Current Value | Significance |

|---|---|---|

| Daily Transaction Volume | $1B+ | Demonstrates real-world utility |

| New XRPL Accounts (July 18) | 10,000+ | Highest since February |

| Total Value Locked (TVL) | $92M | Record high |

What's fascinating is how these metrics interact. The surge in new accounts suggests growing retail interest, while the TVL record points to deepening institutional engagement. It's this combination that could fuel XRP's next leg up.

XRP Price Projections: 2025 Through 2040 Outlook

Based on our analysis of technical indicators, regulatory developments, and adoption metrics, we've developed three scenario-based price projections:

| Year | Conservative | Moderate | Bullish | Key Catalysts |

|---|---|---|---|---|

| 2025 | $8-11 | $12-18 | $20+ | OCC clarity, RLUSD adoption |

| 2030 | $25-30 | $35-45 | $59.40 | CBDC integrations |

| 2035 | $75-100 | $120-150 | $200+ | Global liquidity rail |

| 2040 | $150-250 | $300-500 | $750+ | Tokenized economy |

Developer Vincent Van Code's $59.40 projection for 2030 deserves special attention. His analysis suggests Ripple could capture 15% of SWIFT's $5 trillion daily volume. "With only about 13 billion XRP in liquid supply against 100 billion total, the scarcity dynamics could be explosive," Van Code explained in a recent interview.

Risks and Challenges: What Could Derail XRP's Growth?

While the outlook appears bright, several challenges warrant consideration:

- Banking Industry Opposition: The American Bankers Association continues pushing back against crypto firms seeking banking privileges.

- Regulatory Uncertainty: While improving, the regulatory environment remains fluid.

- Market Volatility: Crypto markets remain highly speculative and prone to sharp corrections.

That said, the recent whale activity - including a single 210.6 million XRP transfer worth $738 million - suggests big players are positioning for long-term growth. Whether this represents accumulation or distribution remains debated, but the scale of movement is undeniably significant.

XRP Price Prediction FAQs

What is the most realistic XRP price prediction for 2025?

Our analysis suggests $8-11 represents a conservative yet achievable target for 2025, assuming current regulatory and adoption trends continue. The moderate scenario of $12-18 becomes plausible if Ripple secures major banking partnerships or if RLUSD gains significant traction.

How high can XRP realistically go by 2030?

The $59.40 projection by developer Vincent Van Code represents an optimistic but theoretically possible scenario where XRP captures meaningful market share in global settlements. More conservative estimates in the $25-45 range may prove more realistic unless adoption accelerates beyond current expectations.

What are the key factors driving XRP's price potential?

Three primary drivers stand out: 1) Regulatory clarity (particularly regarding OCC charters and stablecoin rules), 2) Institutional adoption through ETFs and banking integrations, and 3) Network growth as measured by transaction volume and new accounts.

Is XRP a good long-term investment?

While past performance doesn't guarantee future results, XRP's unique position at the intersection of traditional finance and blockchain technology gives it distinctive long-term potential. That said, cryptocurrency investments carry substantial risk and volatility. This article does not constitute investment advice.

How does XRP's technology compare to competitors?

XRP Ledger's strengths lie in its speed (settlements in 3-5 seconds), low cost (fractions of a cent per transaction), and energy efficiency (negligible compared to proof-of-work chains). These features make it particularly suited for institutional payment flows.