BtcTurk Halts Withdrawals Following $48M Multi-Chain Exploit – Here’s What Went Down

Crypto exchange BtcTurk slams the brakes on withdrawals after a $48 million cross-chain heist—because what’s a bull market without a little chaos?

Anatomy of a Hack: How Attackers Exploited Multi-Chain Weaknesses

The breach unfolded across multiple blockchain networks, proving once again that interoperability comes with a price. Security teams are now scrambling to trace the digital breadcrumbs while traders face frozen funds.

Damage Control Mode: Exchange Response Under Microscope

BtcTurk’s ‘temporary’ suspension raises eyebrows—standard procedure or signs of deeper trouble? Meanwhile, the usual suspects (a.k.a. ‘white hat’ investigators) are already sniffing around the stolen funds.

Silver Lining Playbook: Why This Won’t Derail Crypto’s Momentum

Let’s be real—$48 million is just lunch money for Bitcoin whales. The market’s shrugged off bigger blows, and this won’t stop the institutional FOMO train. Just another Tuesday in decentralized finance.

Bottom line: Exchanges promise ironclad security… until they don’t. Pro tip: Not your keys, not your crypto—even your ‘trusted’ custodian is one smart contract bug away from becoming a cautionary tale.

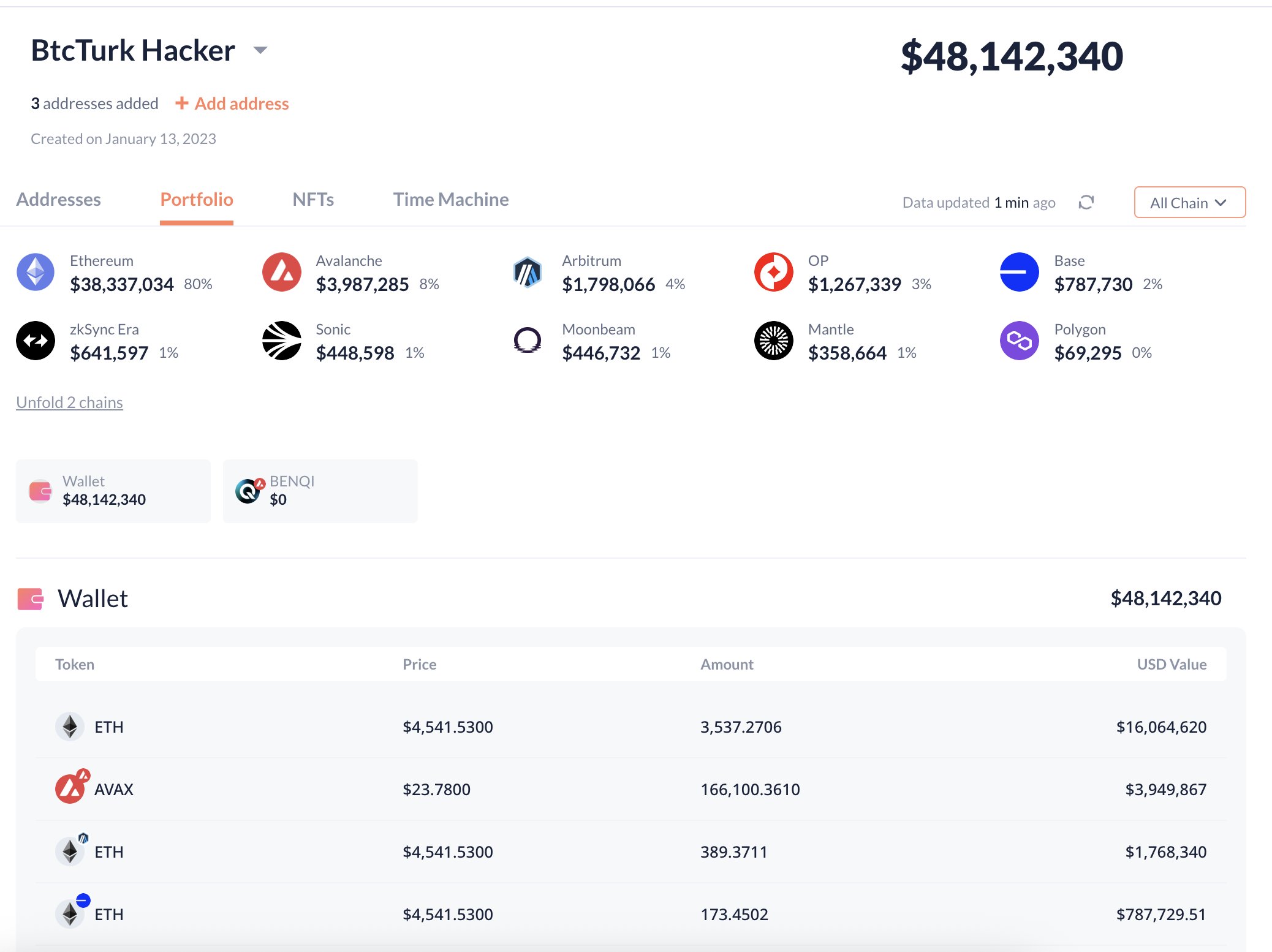

Blockchain data shows that the attacker has begun swapping the stolen tokens for ethereum via MetaMask swaps. While Cyvers pegged the suspicious outflow at $48 million, other blockchain trackers report varying figures.

For instance, CertiK estimates that the damage could exceed $50 million. CertiK also identified three wallets involved in the incident: two Ethereum addresses and one Solana address.

Following the alert, BtcTurk announced that it had suspended deposits and withdrawals for cryptocurrencies. However, the exchange confirmed that trading and fiat currency transactions remain operational.

In its statement, BtcTurk assured users that the majority of the exchange’s assets are in secure cold wallets and remain unaffected by the breach. Moreover, the exchange noted that it has informed the appropriate authorities regarding the incident.

Not the First Major Security Incident

The hack comes just over a year after a June 2024 incident, in which attackers stole $55 million from BtcTurk’s hot wallets. That breach was attributed to compromised private keys. Binance helped recover roughly 10% of the stolen funds by freezing $5.3 million linked to the attackers.

The 2024 incident also had ripple effects on the broader market. It caused price drops in certain tokens after the hacker offloaded large amounts on the open market.

The latest exploit highlights ongoing vulnerabilities in BtcTurk’s security practices regarding the management of users' crypto assets. The exchange says its investigation is ongoing, and withdrawals will remain suspended until further notice.

Meanwhile, other crypto exchanges have also been targeted in recent times. The largest crypto heist to date occurred in March, when bad actors successfully siphoned $1.5 billion from ByBit. The event attracted global attention due to the scale and the parties involved.

Blockchain data shows that the attacker has begun swapping the stolen tokens for ethereum via MetaMask swaps. While Cyvers pegged the suspicious outflow at $48 million, other blockchain trackers report varying figures.

For instance, CertiK estimates that the damage could exceed $50 million. CertiK also identified three wallets involved in the incident: two Ethereum addresses and one Solana address.

Following the alert, BtcTurk announced that it had suspended deposits and withdrawals for cryptocurrencies. However, the exchange confirmed that trading and fiat currency transactions remain operational.

In its statement, BtcTurk assured users that the majority of the exchange’s assets are in secure cold wallets and remain unaffected by the breach. Moreover, the exchange noted that it has informed the appropriate authorities regarding the incident.

Not the First Major Security Incident

The hack comes just over a year after a June 2024 incident, in which attackers stole $55 million from BtcTurk’s hot wallets. That breach was attributed to compromised private keys. Binance helped recover roughly 10% of the stolen funds by freezing $5.3 million linked to the attackers.

The 2024 incident also had ripple effects on the broader market. It caused price drops in certain tokens after the hacker offloaded large amounts on the open market.

The latest exploit highlights ongoing vulnerabilities in BtcTurk’s security practices regarding the management of users' crypto assets. The exchange says its investigation is ongoing, and withdrawals will remain suspended until further notice.

Meanwhile, other crypto exchanges have also been targeted in recent times. The largest crypto heist to date occurred in March, when bad actors successfully siphoned $1.5 billion from ByBit. The event attracted global attention due to the scale and the parties involved.