Bitcoin Hits ATH Then Drops 4%—Here’s the Real Story Behind the Dip

Bitcoin just carved a new all-time high—then immediately shed 4% of its value. What gives?

Market Whiplash: A Classic Crypto Two-Step

Fresh peaks often trigger profit-taking. Traders cash in, shorts get squeezed, and algos amplify the move. Textbook volatility for an asset that laughs at 'overbought' signals.

The Institutional Effect

Wall Street’s latest bitcoin ETF inflows hit record highs this week. But when big money moves, liquidity vampires follow—flash crashes get baked into the cake.

Meanwhile in TradFi Land…

Gold bugs and bond traders are still waiting for their 'safe haven' narrative to materialize. Any decade now.

Bottom line: Corrections fuel the next leg up. Always have. The only surprise? How few people remember that.

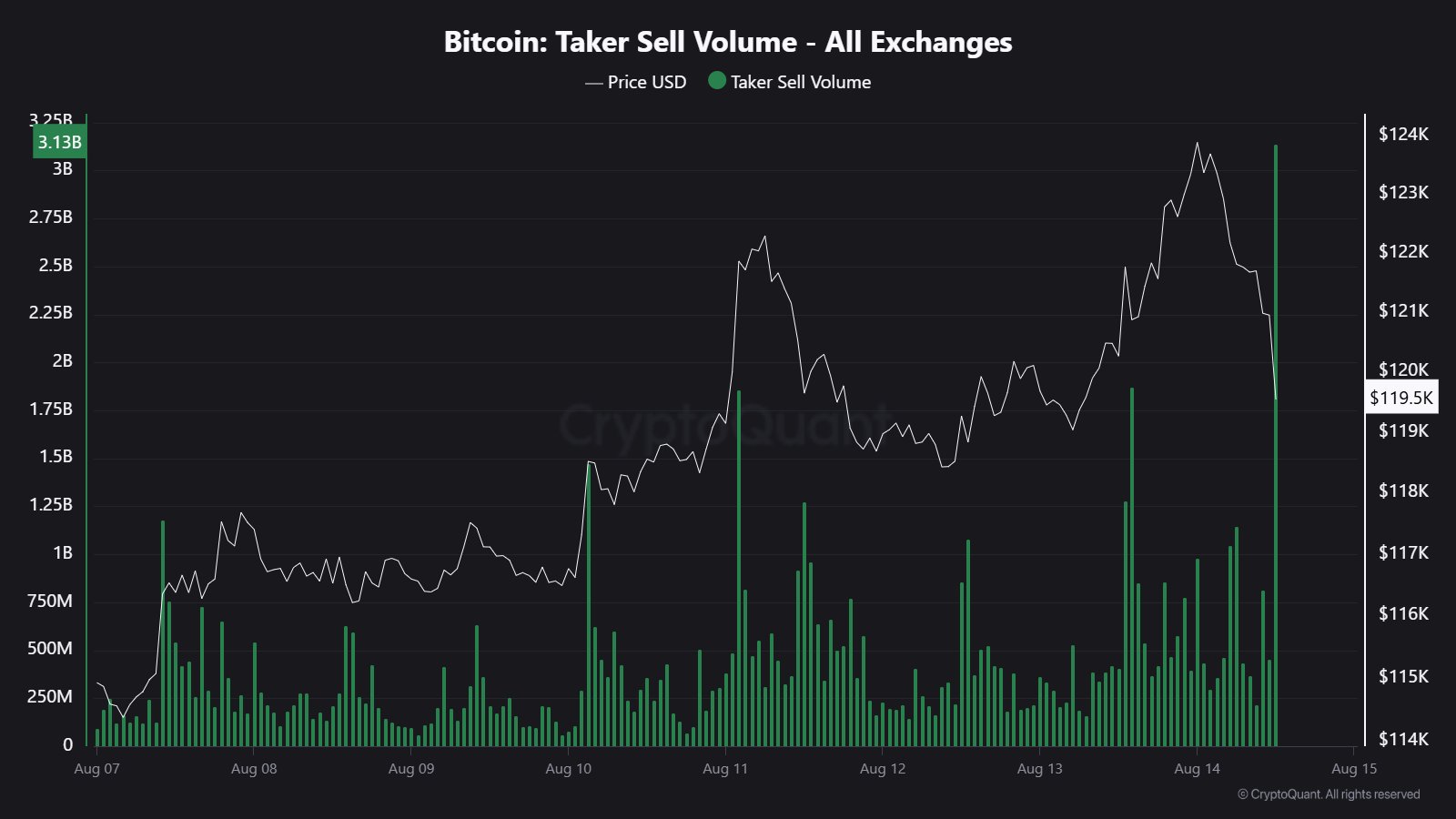

Bitcoin Taker Sell Volume/JA Martunn

This indicator tracks the total volume of Bitcoin liquidated by holders instantly. The spike suggests that users are taking liquidity off the market through sell orders, adding selling pressure to Bitcoin’s price.

Meanwhile, a recently released economic indicator is also fueling this dump. The US producer price index (PPI) rose to 3.3%, which is higher than expected. For the uninitiated, this indicates that the price producers receive for their products has increased, signaling rising inflation.

While the core consumer price index (CPI) looked good, the high PPI raises concerns over the inflation situation in the United States. This is also a setback to the highly expected interest rate cut in September, with Polymarket showing a drop in the odds of the event happening.

Crypto Liquidation Spike Amid Bitcoin Downturn

Bitcoin’s massive correction has spurred a broader market downturn, with over $1 billion in open positions liquidated in the past 24 hours. Of this figure, $218 million were BTC positions, with $149.5 million longs and $68.6 million worth of shorts.

Remarkably, Ethereum had a higher liquidation figure, with $309.9 million in Leveraged trading positions chalked off. Notably, $222.3 million of them are bull bets, while $87.6 million are bear positions. The largest single liquidation order happened with an ETH/USDT trade on OKX, where a user lost $6.25 million.

Don't Panic Sell Your Bitcoin: Reactions

The profit-taking spree did not impress a faction of the crypto community. For context, a user stated that those selling their BTC after the new all-time high do “deserve to be broke.”

Another prominent market participant, Quinten, disapproved of selling Bitcoin due to an economic metric. Notably, BTC has shown resilience in the face of macroeconomic factors, rebounding each time it dumps on account of such development, and the user believes that selling has never been the best approach.

Bitcoin Taker Sell Volume/JA Martunn

This indicator tracks the total volume of Bitcoin liquidated by holders instantly. The spike suggests that users are taking liquidity off the market through sell orders, adding selling pressure to Bitcoin’s price.

Meanwhile, a recently released economic indicator is also fueling this dump. The US producer price index (PPI) rose to 3.3%, which is higher than expected. For the uninitiated, this indicates that the price producers receive for their products has increased, signaling rising inflation.

While the core consumer price index (CPI) looked good, the high PPI raises concerns over the inflation situation in the United States. This is also a setback to the highly expected interest rate cut in September, with Polymarket showing a drop in the odds of the event happening.

Crypto Liquidation Spike Amid Bitcoin Downturn

Bitcoin’s massive correction has spurred a broader market downturn, with over $1 billion in open positions liquidated in the past 24 hours. Of this figure, $218 million were BTC positions, with $149.5 million longs and $68.6 million worth of shorts.

Remarkably, Ethereum had a higher liquidation figure, with $309.9 million in Leveraged trading positions chalked off. Notably, $222.3 million of them are bull bets, while $87.6 million are bear positions. The largest single liquidation order happened with an ETH/USDT trade on OKX, where a user lost $6.25 million.

Don't Panic Sell Your Bitcoin: Reactions

The profit-taking spree did not impress a faction of the crypto community. For context, a user stated that those selling their BTC after the new all-time high do “deserve to be broke.”

Another prominent market participant, Quinten, disapproved of selling Bitcoin due to an economic metric. Notably, BTC has shown resilience in the face of macroeconomic factors, rebounding each time it dumps on account of such development, and the user believes that selling has never been the best approach.