Ethereum Whale Bleeds $26M in 20x Short Squeeze as ETH Soars—Foundation Cashes Out 5K Coins

Talk about bad timing. Just as Ethereum rockets upward, one whale gets caught in a brutal 20x leverage trap—now nursing a $26 million paper wound.

Meanwhile, the ETH Foundation picks the peak to dump over 5,000 ETH. Classic 'buy the rumor, sell the news'—except they wrote the rumor.

Market movers or market manipulators? When foundations trade their own tokens, it's just 'smart portfolio management'... until the SEC calls it something else.

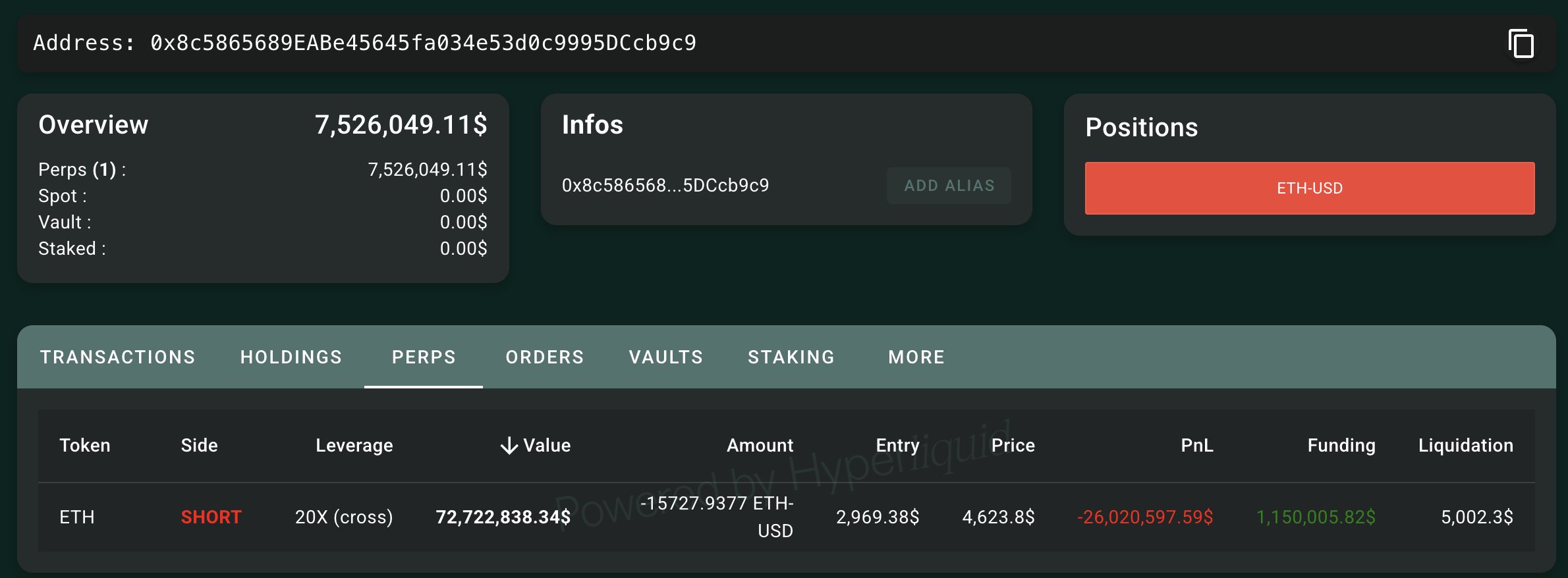

20x Short Whale on Unrealized $26M Loss

Remarkably, the whale has been adding margin to his position as Ethereum’s price increased. He deposited 3.58 million USDC on July 18 and another 8.6 million USDC on August 9, all of which are at risk of going under the water if Ethereum’s bullish momentum persists.

For context, ethereum has rallied a staggering 86.8% from its opening price of $2,486 on July 1 to its current market price of $4,644, spurred by growing institutional interest. Ether’s 8% growth yesterday, which has spilled into today, leaves it just 5% away from its current all-time high of $4,891.

Ethereum Foundation Wallet Sells 5,094 ETH

Meanwhile, a wallet tied to the Ethereum Foundation is dumping Ether despite its price rally. Lookonchain first reported the development on August 13, as the address “0xF39d” sold a total of 5,094 ($23.6 million) ETH over multiple transactions.

First, the wallet moved 1,696 ETH over two transactions on August 12 for 7.72 million DAI at $4,556. Then it sold another 1,100 ETH ($5.06 million) by 0:27 (UTC) today. A few minutes later, the address sold 2,300 ETH ($10.5 million) over five transactions, culminating in the 5,094 ETH.

In return, the wallet received a total of 18.71 million DAI stablecoin. However, it currently holds 11.58 million DAI, having moved over 7.1 million DAI to a DSProxy address.

Notably, the address originally received 20,756 ETH ($95.5 million) from the Ethereum Foundation wallet “EF 1” back in 2017. With the sale, which is its first major transaction in 128 days, the wallet now holds 100 ETH ($463,937).

20x Short Whale on Unrealized $26M Loss

Remarkably, the whale has been adding margin to his position as Ethereum’s price increased. He deposited 3.58 million USDC on July 18 and another 8.6 million USDC on August 9, all of which are at risk of going under the water if Ethereum’s bullish momentum persists.

For context, ethereum has rallied a staggering 86.8% from its opening price of $2,486 on July 1 to its current market price of $4,644, spurred by growing institutional interest. Ether’s 8% growth yesterday, which has spilled into today, leaves it just 5% away from its current all-time high of $4,891.

Ethereum Foundation Wallet Sells 5,094 ETH

Meanwhile, a wallet tied to the Ethereum Foundation is dumping Ether despite its price rally. Lookonchain first reported the development on August 13, as the address “0xF39d” sold a total of 5,094 ($23.6 million) ETH over multiple transactions.

First, the wallet moved 1,696 ETH over two transactions on August 12 for 7.72 million DAI at $4,556. Then it sold another 1,100 ETH ($5.06 million) by 0:27 (UTC) today. A few minutes later, the address sold 2,300 ETH ($10.5 million) over five transactions, culminating in the 5,094 ETH.

In return, the wallet received a total of 18.71 million DAI stablecoin. However, it currently holds 11.58 million DAI, having moved over 7.1 million DAI to a DSProxy address.

Notably, the address originally received 20,756 ETH ($95.5 million) from the Ethereum Foundation wallet “EF 1” back in 2017. With the sale, which is its first major transaction in 128 days, the wallet now holds 100 ETH ($463,937).