Glassnode Reveals: Bitcoin Isn’t Peaking—It’s Just Getting Started in This Bull Market

Bitcoin's bull run isn't over—it's barely warmed up. Glassnode's latest analysis slams the brakes on 'top callers,' showing why BTC's rally still has room to run.

Mid-cycle, not meltdown. Forget the doomscroll headlines—on-chain metrics scream accumulation, not distribution. Retail's still under-allocated, whales aren't dumping, and those 'overheated' signals? Mostly hedge fund managers covering their shorts.

The real tell? Miner reserves haven't budged. These hodl-happy network validators would be the first to panic-sell if a true top was in. Instead, they're stacking sats like Wall Street stacks fees.

One cynical truth: The same institutions calling this a bubble are quietly rebalancing their portfolios toward crypto. Classic 'sell the narrative, buy the dip' hypocrisy.

Bottom line: This market cycle looks more like 2017's middle innings than 2021's final frenzy. Time to tune out the noise and let the data do the talking.

Bitcoin STH Cost Basis Model | Glassnode

Before the drop, bitcoin first broke above the STH cost basis during this bull run in late 2024, shortly after Donald Trump's election victory. The rally lifted the price past $100,000, and Bitcoin held above $90,000 and $100,000 until the February setback. As of now, Bitcoin trades around $116,359, well above the $106,100 threshold.

However, even with this strong position, Bitcoin still struggles to move past the average entry price of recent short-term top buyers, another important metric. This figure sits at $116,900. Glassnode warned that failing to break above this level could extend the current sideways movement or even trigger another drop back toward $110,000.

https://twitter.com/glassnode/status/1953414568065245682

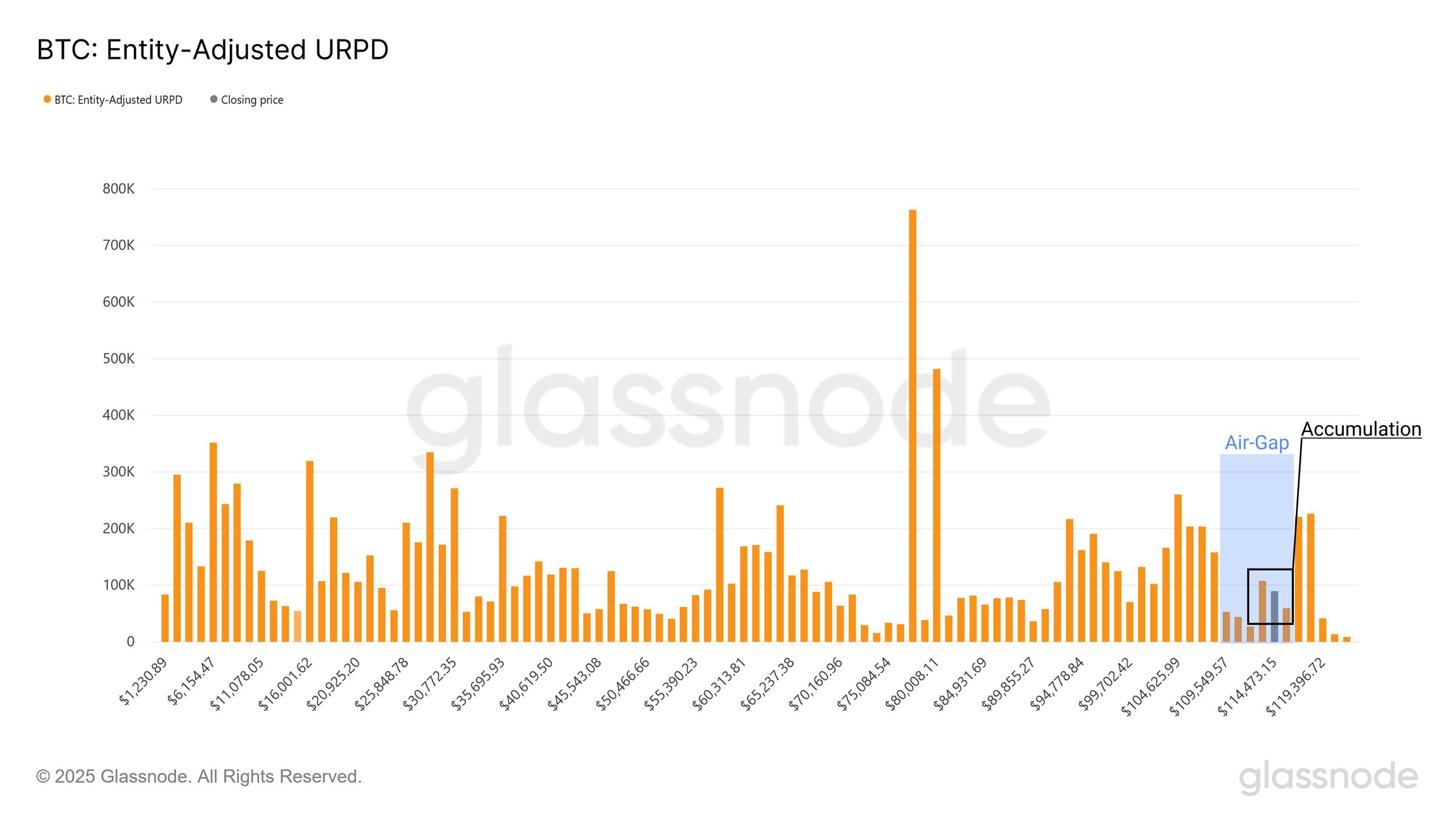

Bitcoin Seeing Accumulation, but Needs Higher Pressure to Form Solid Base

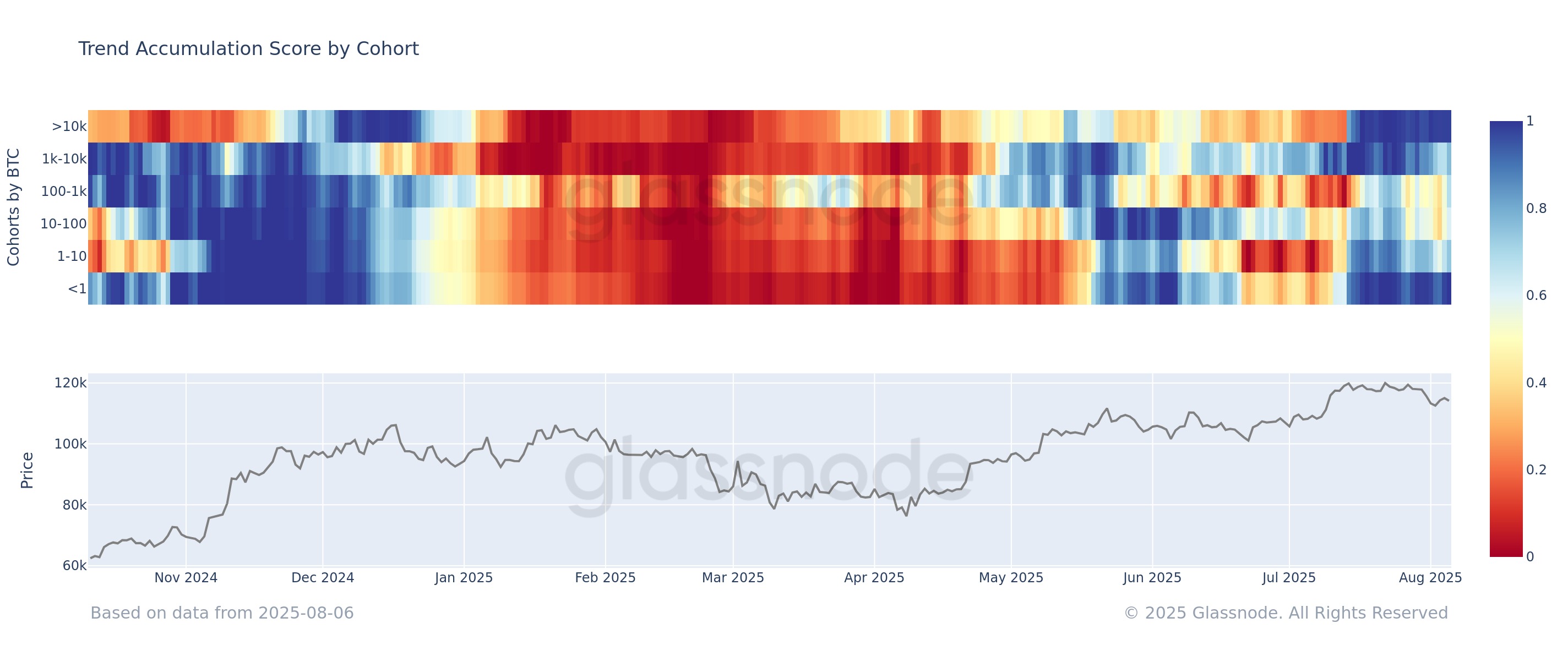

In another analysis, the firm confirmed that over the past 15 days, both whales, those holding over 10,000 BTC, and small holders with less than 1 BTC have steadily added to their positions. .

Bitcoin STH Cost Basis Model | Glassnode

Before the drop, bitcoin first broke above the STH cost basis during this bull run in late 2024, shortly after Donald Trump's election victory. The rally lifted the price past $100,000, and Bitcoin held above $90,000 and $100,000 until the February setback. As of now, Bitcoin trades around $116,359, well above the $106,100 threshold.

However, even with this strong position, Bitcoin still struggles to move past the average entry price of recent short-term top buyers, another important metric. This figure sits at $116,900. Glassnode warned that failing to break above this level could extend the current sideways movement or even trigger another drop back toward $110,000.

https://twitter.com/glassnode/status/1953414568065245682

Bitcoin Seeing Accumulation, but Needs Higher Pressure to Form Solid Base

In another analysis, the firm confirmed that over the past 15 days, both whales, those holding over 10,000 BTC, and small holders with less than 1 BTC have steadily added to their positions. .