Bulgaria’s Bitcoin Fire Sale: How 82% of Its National Debt Vanished Overnight

Talk about a fiscal facepalm. Bulgaria once held a Bitcoin stash that—if kept—would now cover 82% of its national debt. Instead? They cashed out early. Classic government timing.

The HODL That Wasn’t

While bureaucrats were busy ‘mitigating risk,’ Bitcoin did what it does best: mooned. The coins Bulgaria sold for pennies now amount to a staggering 82% of its sovereign debt. That’s not a typo—it’s a masterclass in misreading the future of money.

Crypto vs. Sovereign Balance Sheets

Imagine a parallel universe where Bulgaria’s treasury just… chilled. No panic sells, no ‘responsible asset management.’ Just a cold wallet sitting pretty while fiat economies crumble under inflation. (Spoiler: That universe has better-funded hospitals.)

The Punchline

Next time a finance minister scoffs at ‘volatile’ crypto, remember: Bulgaria could’ve nearly zeroed its debt—if only it trusted math over spreadsheets.

The Forgotten bitcoin Trove

Meanwhile, back in 2017, Bulgarian authorities seized 213,519 BTC in a crackdown on organized cybercrime. At the time, Bitcoin was trading below $3,000, valuing the haul at less than $640 million. Interestingly, reports suggest the government sold the BTC in 2018, though the details remain unclear.

Fast forward to July 2025, Bitcoin has reached an all-time high of $123,200. That same stash would now be worth approximately $26.3 billion at peak valuation or BGN 44.29 billion at current exchange rates.

Nearly 82% of the National Debt

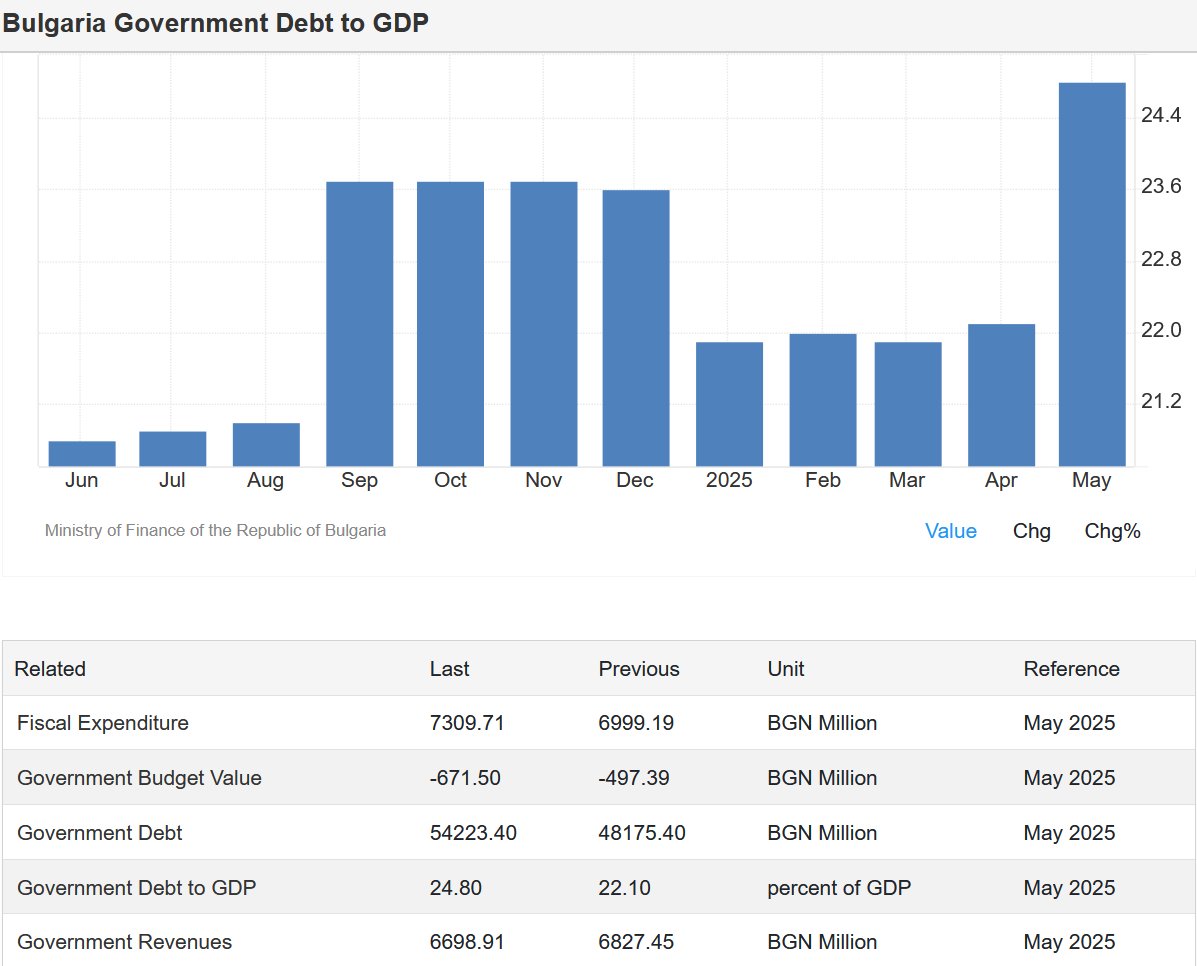

To put this in perspective, the unrealized value of the Bitcoin once held by the Bulgarian government now equals nearly 82% of its total public debt. This suggests that simply holding the seized BTC could have helped the country cover nearly all of its debt obligations.

German Government’s $6B Bitcoin Fumble

Meanwhile, Bulgaria is not alone in this missed opportunity. Between June and July 2024, the German government made waves in the crypto space by continuously selling off BTC. In particular, it liquidated 49,858 BTC at an average price of $57,900, netting $2.89 billion.

However, just a year later, the price of BTC has more than doubled. Had the government held on to its Bitcoin, it would now be sitting on a fortune exceeding $6.1 billion.

A Costly Lesson in Long-Term Vision

The BTC sagas of Bulgaria and Germany remind the public about crypto’s long-term potential and the cost of underestimating it. Even the U.S. government has acknowledged losing a $17 billion fortune due to a lack of long-term vision for Bitcoin.

These early exits are now some of the most expensive missed opportunities in government financial history.

However, in recent times, governments are increasingly re-evaluating their stance on holding Bitcoin. Notably, the U.S. government has prohibited the sale of seized BTC, instead choosing to consolidate assets into a national reserve for long-term purposes.

Meanwhile, nations like El Salvador, having shown early foresight, doubled down on their Bitcoin holdings, a strategy that is now paying off handsomely.

The Forgotten bitcoin Trove

Meanwhile, back in 2017, Bulgarian authorities seized 213,519 BTC in a crackdown on organized cybercrime. At the time, Bitcoin was trading below $3,000, valuing the haul at less than $640 million. Interestingly, reports suggest the government sold the BTC in 2018, though the details remain unclear.

Fast forward to July 2025, Bitcoin has reached an all-time high of $123,200. That same stash would now be worth approximately $26.3 billion at peak valuation or BGN 44.29 billion at current exchange rates.

Nearly 82% of the National Debt

To put this in perspective, the unrealized value of the Bitcoin once held by the Bulgarian government now equals nearly 82% of its total public debt. This suggests that simply holding the seized BTC could have helped the country cover nearly all of its debt obligations.

German Government’s $6B Bitcoin Fumble

Meanwhile, Bulgaria is not alone in this missed opportunity. Between June and July 2024, the German government made waves in the crypto space by continuously selling off BTC. In particular, it liquidated 49,858 BTC at an average price of $57,900, netting $2.89 billion.

However, just a year later, the price of BTC has more than doubled. Had the government held on to its Bitcoin, it would now be sitting on a fortune exceeding $6.1 billion.

A Costly Lesson in Long-Term Vision

The BTC sagas of Bulgaria and Germany remind the public about crypto’s long-term potential and the cost of underestimating it. Even the U.S. government has acknowledged losing a $17 billion fortune due to a lack of long-term vision for Bitcoin.

These early exits are now some of the most expensive missed opportunities in government financial history.

However, in recent times, governments are increasingly re-evaluating their stance on holding Bitcoin. Notably, the U.S. government has prohibited the sale of seized BTC, instead choosing to consolidate assets into a national reserve for long-term purposes.

Meanwhile, nations like El Salvador, having shown early foresight, doubled down on their Bitcoin holdings, a strategy that is now paying off handsomely.