Bitcoin Primed for Explosive Growth—Analyst Predicts $180K Rally in 2025

Brace for impact: A prominent analyst just dropped a bombshell Bitcoin price target that’ll make even the most hardened crypto skeptics do a double-take. The forecast? A jaw-dropping rally to $180,000 before year-end.

What’s fueling the surge? While traditional markets wobble under inflationary pressures and central bank theatrics, Bitcoin’s scarcity and institutional adoption are quietly building a perfect storm. The catalyst? Let’s just say Wall Street’s latecomers are finally realizing gold 2.0 won’t wait for their paperwork.

Of course, seasoned crypto vets will smirk at the ‘discovery’—after all, they’ve been stacking sats while suits debated ‘digital tulips.’ One thing’s certain: when the suits finally arrive, they’ll pay retail.

Bitcoin's Halving Performance / Klarch

Furthermore, he clarified that Bitcoin’s multiple all-time highs this year do not signal the top. The asset reached a new all-time high of $109,350 on Inauguration Day in January and again at $112,000 on May 22, and the analyst believes it is the second of many for this cycle, rather than a sign of the top.

Analyst Says $180,000 is Bitcoin’s Target.

Meanwhile, Klarch highlighted key factors suggesting that Bitcoin would rally to new highs, specifically up to 74% from the current price to $180,000. One of these factors is the continuous influx of liquidity into the crypto market.

Bitcoin remains an asset in high demand, with institutional traction further adding to the catalyst's impact. Incessant purchases from Strategy and other firms, as well as from US Bitcoin spot ETFs, have made the leading cryptocurrency relatively scarce.

As a result, the analysis suggests Bitcoin would rally on this propellant, potentially targeting $180,000. Furthermore, he noted that considering the length of historical cycles, there is still more time for Bitcoin’s bull season.

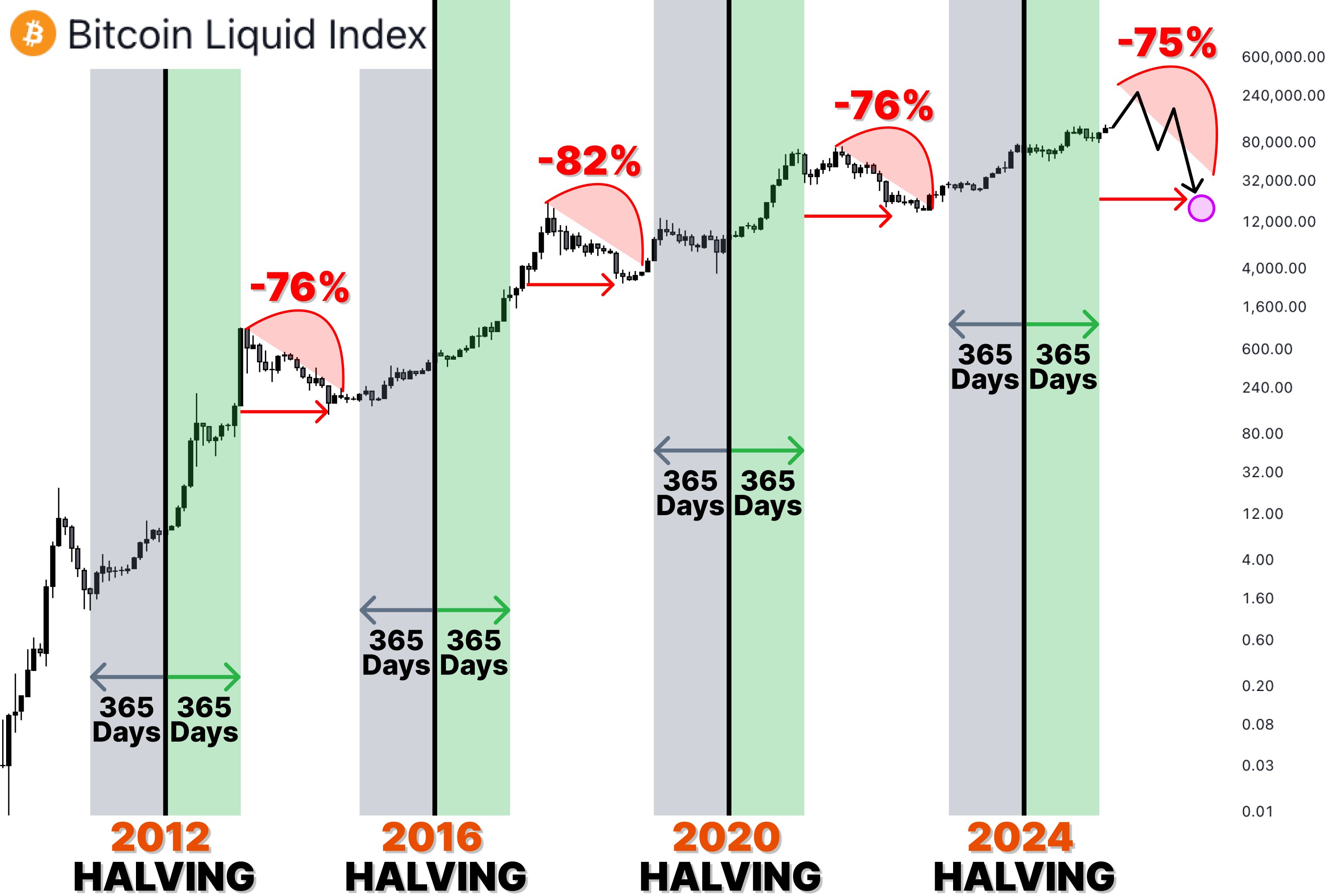

First, he highlighted that Bitcoin’s up season typically lasts between 12 months and 18 months after the halving event. More interesting is that the asset is still in its growth stage.

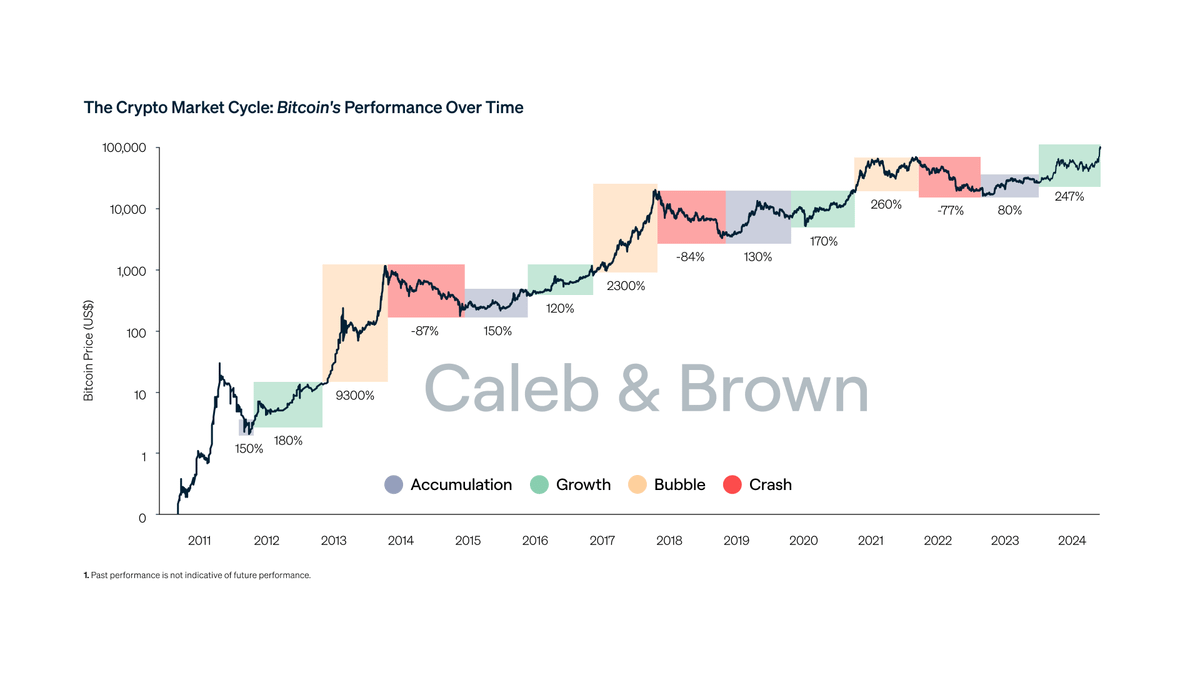

An accompanying chart illustrates that Bitcoin undergoes three distinct phases in each cycle: accumulation, growth, bubble, and crash stages. As the name implies, the bubble phase is characterized by massive price upticks that quickly burst, often followed by a market crash.

Bitcoin's Halving Performance / Klarch

Furthermore, he clarified that Bitcoin’s multiple all-time highs this year do not signal the top. The asset reached a new all-time high of $109,350 on Inauguration Day in January and again at $112,000 on May 22, and the analyst believes it is the second of many for this cycle, rather than a sign of the top.

Analyst Says $180,000 is Bitcoin’s Target.

Meanwhile, Klarch highlighted key factors suggesting that Bitcoin would rally to new highs, specifically up to 74% from the current price to $180,000. One of these factors is the continuous influx of liquidity into the crypto market.

Bitcoin remains an asset in high demand, with institutional traction further adding to the catalyst's impact. Incessant purchases from Strategy and other firms, as well as from US Bitcoin spot ETFs, have made the leading cryptocurrency relatively scarce.

As a result, the analysis suggests Bitcoin would rally on this propellant, potentially targeting $180,000. Furthermore, he noted that considering the length of historical cycles, there is still more time for Bitcoin’s bull season.

First, he highlighted that Bitcoin’s up season typically lasts between 12 months and 18 months after the halving event. More interesting is that the asset is still in its growth stage.

An accompanying chart illustrates that Bitcoin undergoes three distinct phases in each cycle: accumulation, growth, bubble, and crash stages. As the name implies, the bubble phase is characterized by massive price upticks that quickly burst, often followed by a market crash.