Bitcoin Braces for Stormy Seas as $10B Options Expiry Looms—Traders Buckle Up

Volatility’s back on the menu for Bitcoin—just in time for a $10 billion options expiry that could shake the market. Analysts like Nic Puckrin warn of turbulent price action ahead, with traders scrambling to hedge or capitalize on the chaos.

Wall Street’s usual playbook? Probably irrelevant. When crypto derivatives hit these scales, even the ’smart money’ starts sweating. Expect fireworks—or a spectacular implosion of overleveraged positions.

One thing’s certain: in crypto, ’risk management’ often just means praying louder. Buckle up.

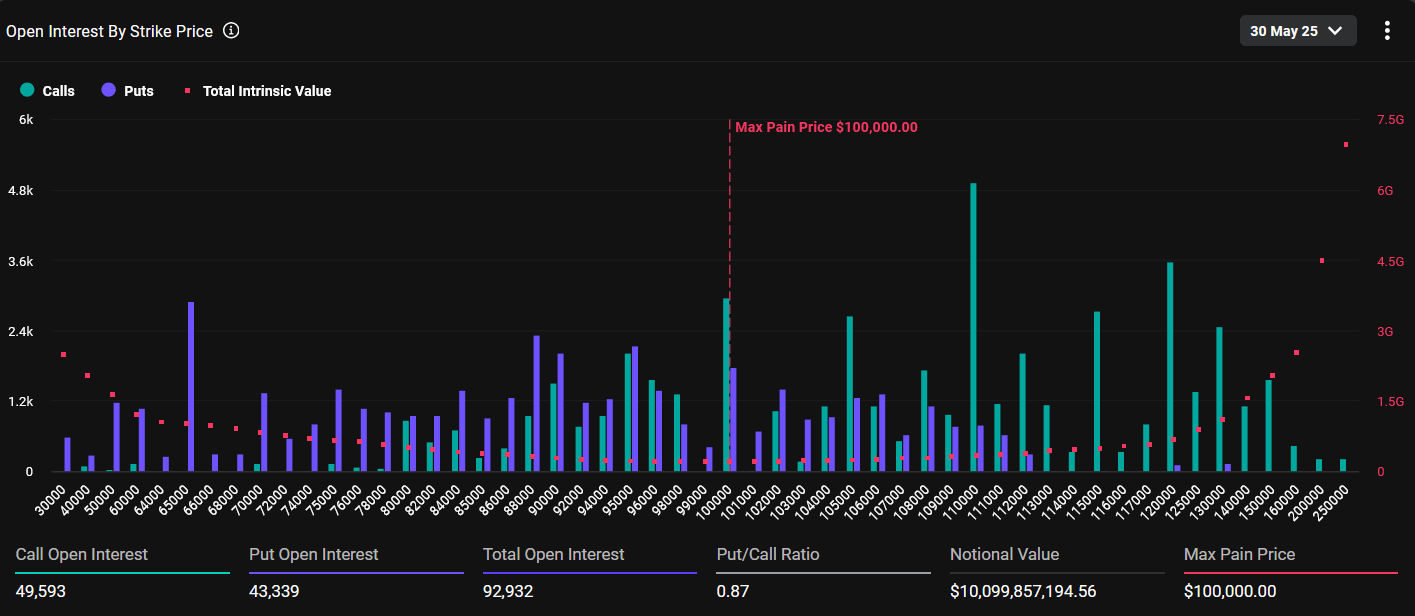

According to his analysis, a total of 92,932 contracts remain open, with 49,593 calls and 43,339 puts. This results in a put/call ratio of 0.87, reflecting slightly more calls than puts, which can suggest bullish sentiment. The combined notional value of these contracts reaches an enormous $10 billion, underlining the financial magnitude of this expiry.

The open interest clusters notably between the $95,000 and $110,000 strike prices. These strikes hold “high delta” options that are NEAR or at the money, making them more reactive to price movements.

The chart also points to a max pain price around $100,000, where options holders are likely to experience the greatest losses if the price settles there. Market makers may push BTC towards this level to minimize payouts.

Meanwhile, calls concentrate near $110,000 and puts near $95,000, indicating a tug-of-war in expectations around the $100,000 mark. Puckrin indicated that heightened volatility could unfold in the coming hours.

Derivatives Market and Trader Positioning

Meanwhile, derivatives data reveals rising trading activity amid these developments. Bitcoin’s overall trading volume increased by 10.82%, hitting $109.3 billion. Total open interest slightly declined by 1.14% to $77.68 billion, but options open interest specifically rose by 2.12% to $49.7 billion, consistent with the growing positioning in the options market.

According to his analysis, a total of 92,932 contracts remain open, with 49,593 calls and 43,339 puts. This results in a put/call ratio of 0.87, reflecting slightly more calls than puts, which can suggest bullish sentiment. The combined notional value of these contracts reaches an enormous $10 billion, underlining the financial magnitude of this expiry.

The open interest clusters notably between the $95,000 and $110,000 strike prices. These strikes hold “high delta” options that are NEAR or at the money, making them more reactive to price movements.

The chart also points to a max pain price around $100,000, where options holders are likely to experience the greatest losses if the price settles there. Market makers may push BTC towards this level to minimize payouts.

Meanwhile, calls concentrate near $110,000 and puts near $95,000, indicating a tug-of-war in expectations around the $100,000 mark. Puckrin indicated that heightened volatility could unfold in the coming hours.

Derivatives Market and Trader Positioning

Meanwhile, derivatives data reveals rising trading activity amid these developments. Bitcoin’s overall trading volume increased by 10.82%, hitting $109.3 billion. Total open interest slightly declined by 1.14% to $77.68 billion, but options open interest specifically rose by 2.12% to $49.7 billion, consistent with the growing positioning in the options market.