Bitcoin Diamond Hands Dig In: Supply Crunch Looms as Long-Term Holders Go on Strike

The hodl mentality has gone nuclear—Bitcoin’s OG investors are locking down their stacks tighter than a Wall Street bonus clause. On-chain data reveals long-term holders now treat BTC like a digital heirloom, not a tradeable asset.

Supply shock incoming? With institutional FOMO accelerating and the halving’s scarcity mechanics kicking in, latecomers may soon face a brutal reality: no coins left at any price. The last time this happened, BTC ripped 300% in 12 months.

Meanwhile, traditional finance still can’t decide if Bitcoin is a ’risk asset’ or inflation hedge—maybe because their spreadsheets can’t model something that outperforms both. Tick tock, next block.

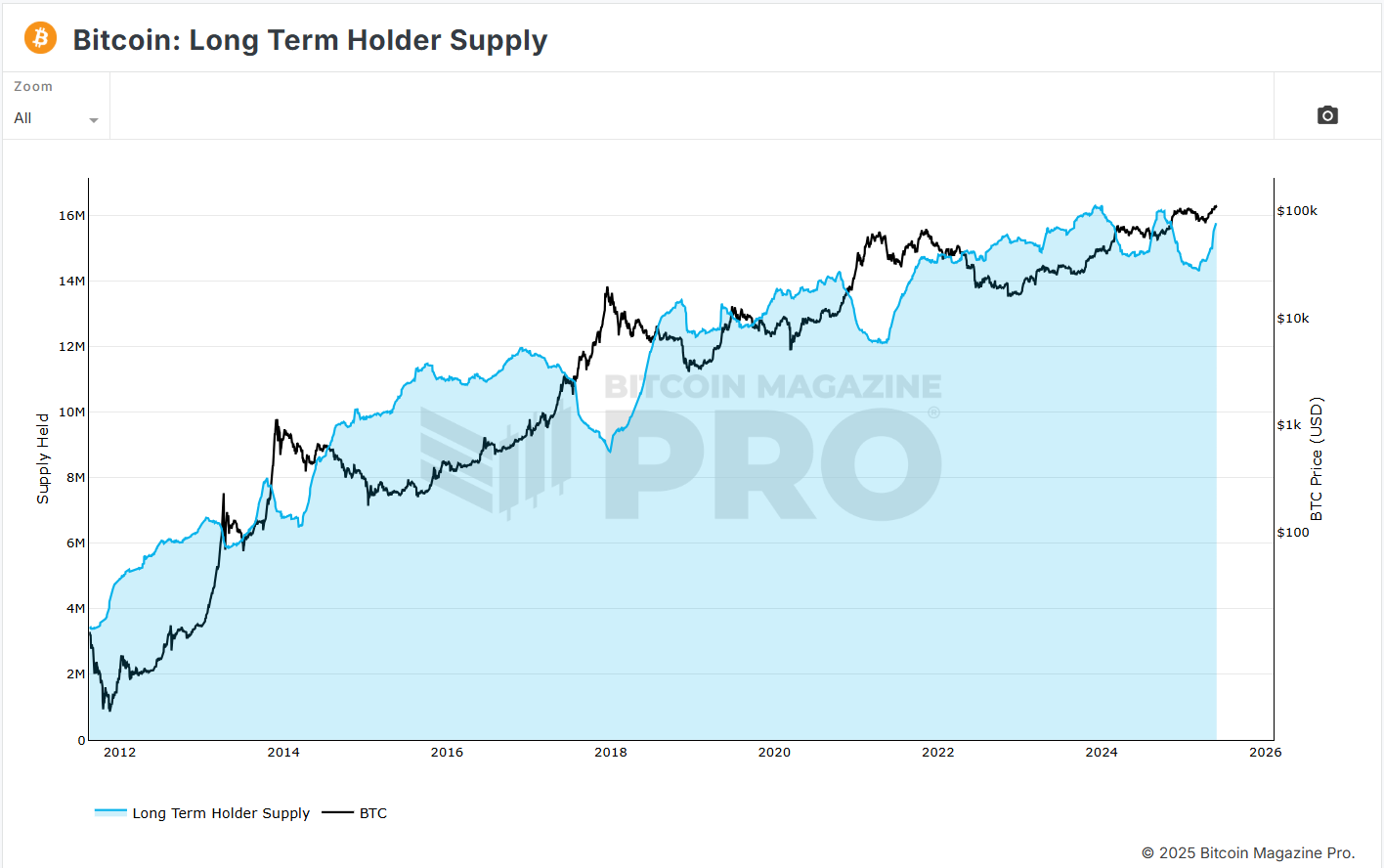

Bitcoin Long Term Holder SupplyBitcoin Long-Term Holder Supply

Historical cycles offer further context. During previous bull markets in 2013, 2017, and 2021, LTH supply typically declined as holders moved assets into circulation to capitalize on higher prices.

However, the current trend diverges from this pattern, with accumulation continuing despite elevated price levels. Notably, brief declines in LTH supply during May 2024 and March 2025 did not disrupt the broader upward trajectory in holdings.

Analysts at Bitcoin Magazine Pro note in an X post that the market’s most experienced participants are not willing to sell at current price levels. They warn that continued accumulation may soon reduce available Bitcoin for late entrants.

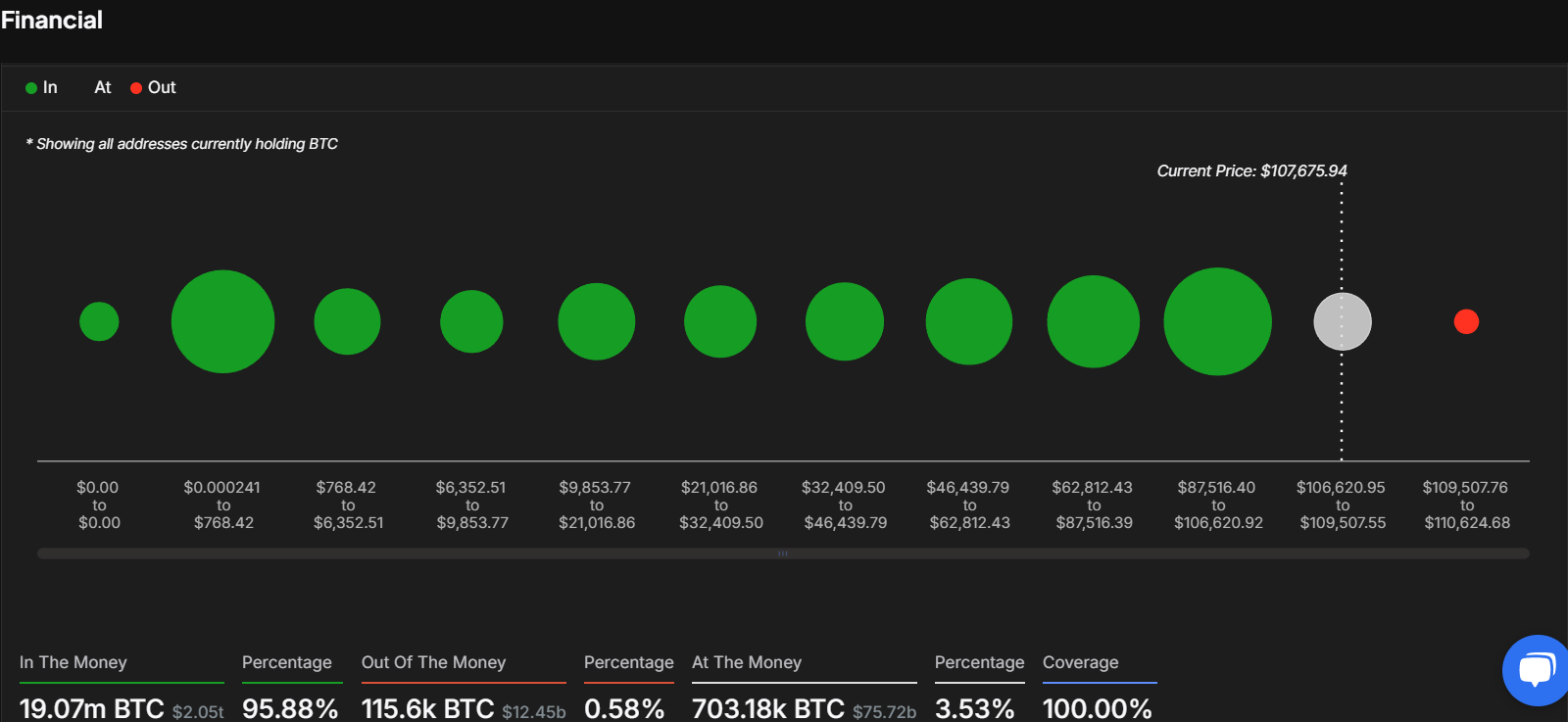

Majority of Bitcoin Holders Are in Profit

Supporting this accumulation narrative, on-chain analysis from IntoTheBlock offers further insight into address-level positioning. Based on the price of $107,675.94, approximately 95.88% of all BTC, totaling 19.07 million coins, are currently “In the Money.”

Additionally, 703,180 BTC, or 3.53% of supply, are classified “At the Money,” representing recent buyers who entered during the current price range.

Only 115,600 BTC, or 0.58% of the total supply, are considered “Out of the Money,” suggesting minimal unrealized losses. This marginal figure indicates that most BTC holders acquired their coins at lower prices.

Bitcoin Long Term Holder SupplyBitcoin Long-Term Holder Supply

Historical cycles offer further context. During previous bull markets in 2013, 2017, and 2021, LTH supply typically declined as holders moved assets into circulation to capitalize on higher prices.

However, the current trend diverges from this pattern, with accumulation continuing despite elevated price levels. Notably, brief declines in LTH supply during May 2024 and March 2025 did not disrupt the broader upward trajectory in holdings.

Analysts at Bitcoin Magazine Pro note in an X post that the market’s most experienced participants are not willing to sell at current price levels. They warn that continued accumulation may soon reduce available Bitcoin for late entrants.

Majority of Bitcoin Holders Are in Profit

Supporting this accumulation narrative, on-chain analysis from IntoTheBlock offers further insight into address-level positioning. Based on the price of $107,675.94, approximately 95.88% of all BTC, totaling 19.07 million coins, are currently “In the Money.”

Additionally, 703,180 BTC, or 3.53% of supply, are classified “At the Money,” representing recent buyers who entered during the current price range.

Only 115,600 BTC, or 0.58% of the total supply, are considered “Out of the Money,” suggesting minimal unrealized losses. This marginal figure indicates that most BTC holders acquired their coins at lower prices.