Bitcoin’s Growth Spurt: Why Each New High Costs a Fortune

Bitcoin isn’t just climbing—it’s hauling an ever-heavier price tag with every milestone. Glassnode’s latest analysis reveals a brutal truth: the deeper BTC digs into mainstream finance, the more capital it demands to fuel its next leg up.

The Law of Diminishing (Monetary) Returns

Forget ‘number go up’—now it’s ‘money go in.’ Early rallies? Pocket change. Today’s price action? A billionaire’s playground where even whales check their liquidity twice. (Cue Wall Street eye-rolls about ‘digital gold’ requiring more firepower than actual Fort Knox.)

The Provocative Close

So here we are—watching Bitcoin graduate from speculative toy to institutional beast. One question remains: when the music stops, who’s left holding the bag… and will it be lined with blockchain-sewn velvet?

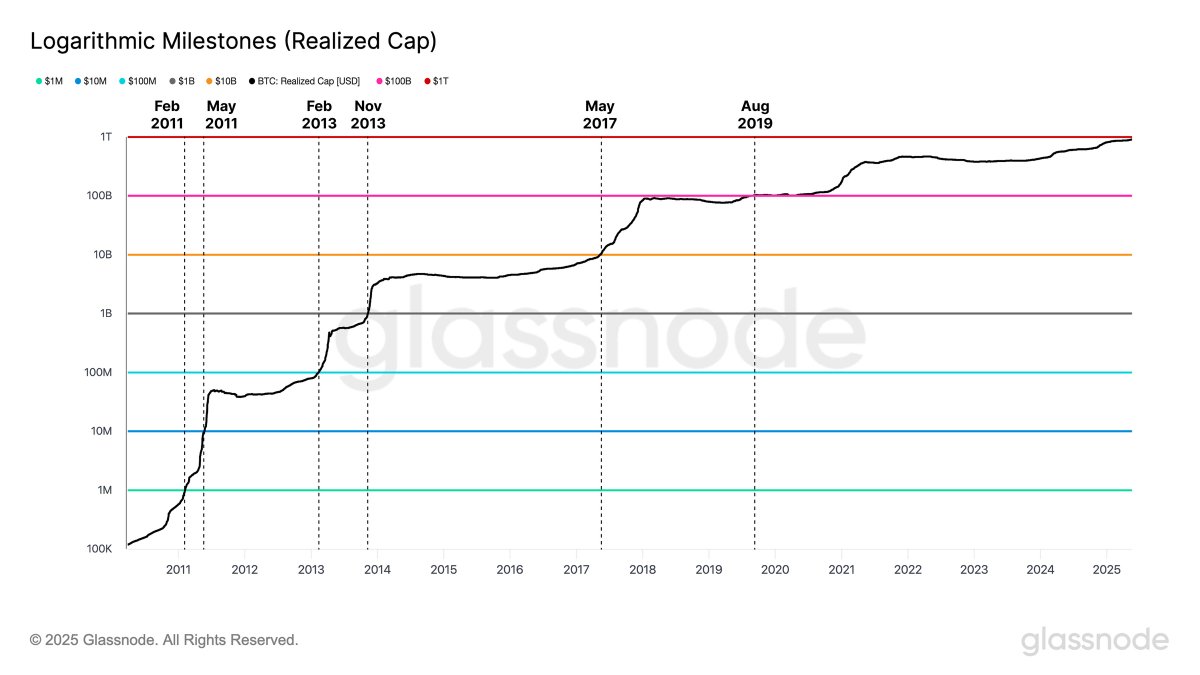

From early 2011 to February 2013, realized cap jumped from $1 million to $1 billion, reflecting the rapid accumulation of value during Bitcoin’s early adoption phase.

However, the following years exhibited slower growth. The realized cap reached $10 billion in November 2013 and did not hit $100 billion until May 2017.

Notably, Glassnode’s data shows it has taken nearly six years since then to approach the $1 trillion threshold in 2025. This trend, as highlighted by the flattening curve on the chart, suggests that each subsequent growth milestone requires increasingly more capital inflow.

The implications of this data suggest Bitcoin’s expansion is no longer driven by speculative surges but by broader, more gradual adoption. Glassnode attributes this change to the asset’s maturity, stating that each leap in value as bitcoin evolves becomes more capital-intensive.

Bitcoin is Still Setting New Records

In spite of the broader slowdown in long-term capital growth, Bitcoin has continued to post new milestones in recent days. The digital asset notched its highest daily closing price in its 15-year trading history on May 20, with market data from Barchart confirming a close at $106,909. This figure surpassed the previous record of $106,487, which had been set just two days earlier.

This record-breaking daily close followed another significant achievement, Bitcoin’s highest-ever weekly close.

As the market maintained its bullish tone, breaking an all-time high, many industry commentators like Arthur Hayes are expecting BTC to reach a $1 million value someday.

From early 2011 to February 2013, realized cap jumped from $1 million to $1 billion, reflecting the rapid accumulation of value during Bitcoin’s early adoption phase.

However, the following years exhibited slower growth. The realized cap reached $10 billion in November 2013 and did not hit $100 billion until May 2017.

Notably, Glassnode’s data shows it has taken nearly six years since then to approach the $1 trillion threshold in 2025. This trend, as highlighted by the flattening curve on the chart, suggests that each subsequent growth milestone requires increasingly more capital inflow.

The implications of this data suggest Bitcoin’s expansion is no longer driven by speculative surges but by broader, more gradual adoption. Glassnode attributes this change to the asset’s maturity, stating that each leap in value as bitcoin evolves becomes more capital-intensive.

Bitcoin is Still Setting New Records

In spite of the broader slowdown in long-term capital growth, Bitcoin has continued to post new milestones in recent days. The digital asset notched its highest daily closing price in its 15-year trading history on May 20, with market data from Barchart confirming a close at $106,909. This figure surpassed the previous record of $106,487, which had been set just two days earlier.

This record-breaking daily close followed another significant achievement, Bitcoin’s highest-ever weekly close.

As the market maintained its bullish tone, breaking an all-time high, many industry commentators like Arthur Hayes are expecting BTC to reach a $1 million value someday.