Tron just flexed its muscles—hard. The network minted a jaw-dropping $2 billion in USDT as daily transactions nearly doubled overnight. Someone’s betting big on stablecoin demand… or maybe just printing monopoly money for the crypto casino.

Behind the surge? Speculation’s running wild, but the numbers don’t lie: Tron’s becoming the go-to highway for stablecoin traffic. Meanwhile, traditional finance still thinks wire transfers are ‘fast.’

One thing’s clear—when Tron sneezes, the crypto markets catch a cold. Buckle up.

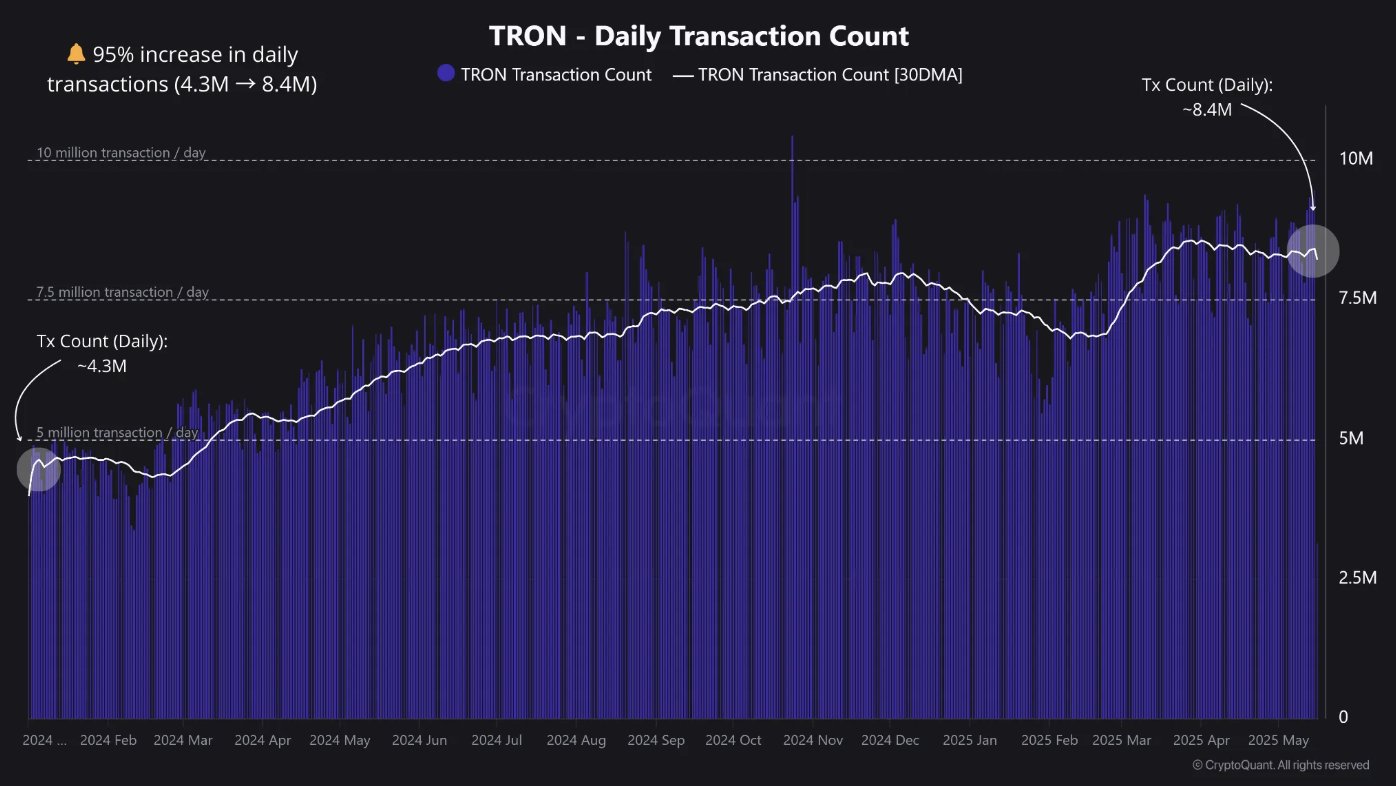

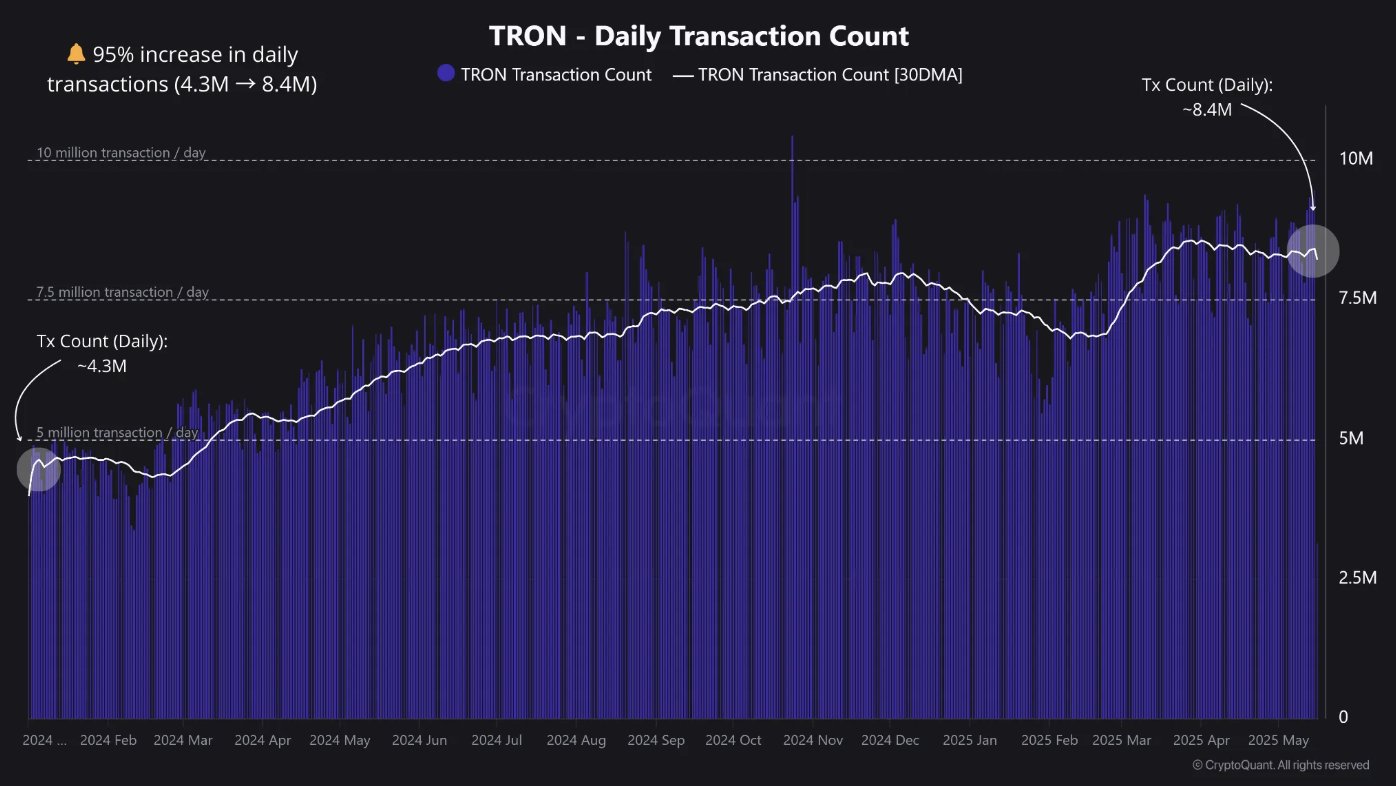

Tron 30D Average Daily Transaction

However, the 30-day moving average sieved the spikes and presented a clear picture of the network’s actual activities.

Meanwhile, Maartunn stressed that the glaring traction, possibly steered by factors like growing user interaction and increased stablecoin transfers, indicates stable and increasing user influx to the Tron network.

Tether Mints $2B on the Tron Network

Market intelligence platform Arkham reported minting activity between the

Tether Treasury and the Tron network.

The prominent stablecoin issuer created and moved 2 billion USDT from its “Black Hole Address” to the Tether multisignature wallet over two distinct transactions before deploying the tokens on Tron.

Tether $2B Minting on Tron

As usual, Tether’s CEO, Paolo Ardoino, confirmed the transaction, noting it is authorized but not issued, specifically for inventory replenishment on the Tron network. However, Tether’s transparency page shows that the minted USDT is already in circulation, as just $126 million is left in that category, signaling rapid demand for stablecoins on the chain.

Meanwhile, today’s transaction takes the total authorized minting on the Tron network to $75.7 billion, surpassing Ethereum’s $74.5 billion to become the leading chain in USDT supply. Furthermore, Tron’s $75.6 billion net circulation also trumps Ethereum’s $71.2 billion.

Tether’s market cap has now reached $152 billion, making it the third most valuable cryptocurrency, behind Bitcoin and Ethereum.

Possible Market Implications

Meanwhile, TRON has barely reacted to the escalating bullish momentum around its ecosystem. The 10th largest

cryptocurrency by market cap is up a moderate 12% in the past month and down slightly in the last seven days, despite the broader market’s positive trend.

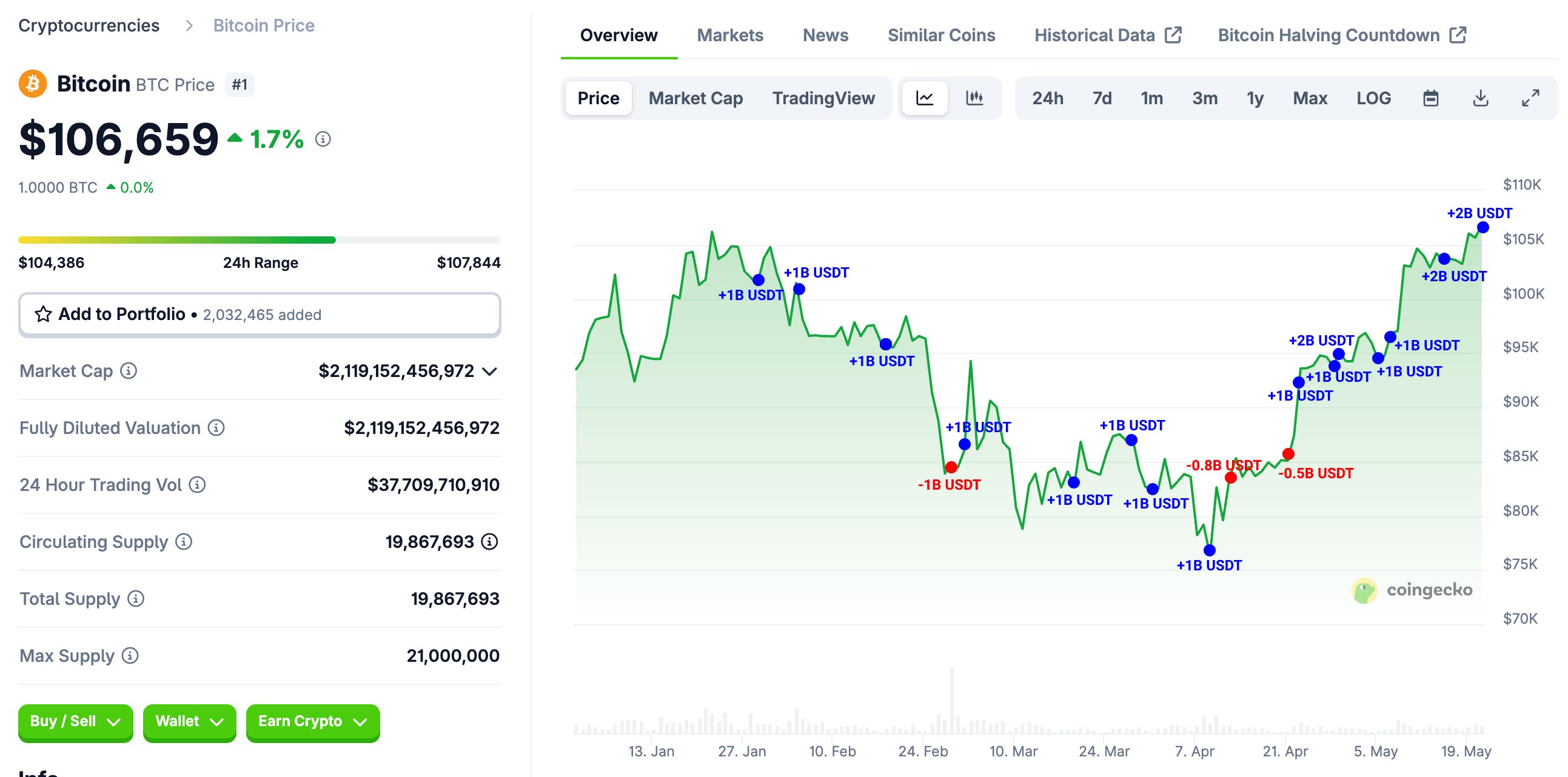

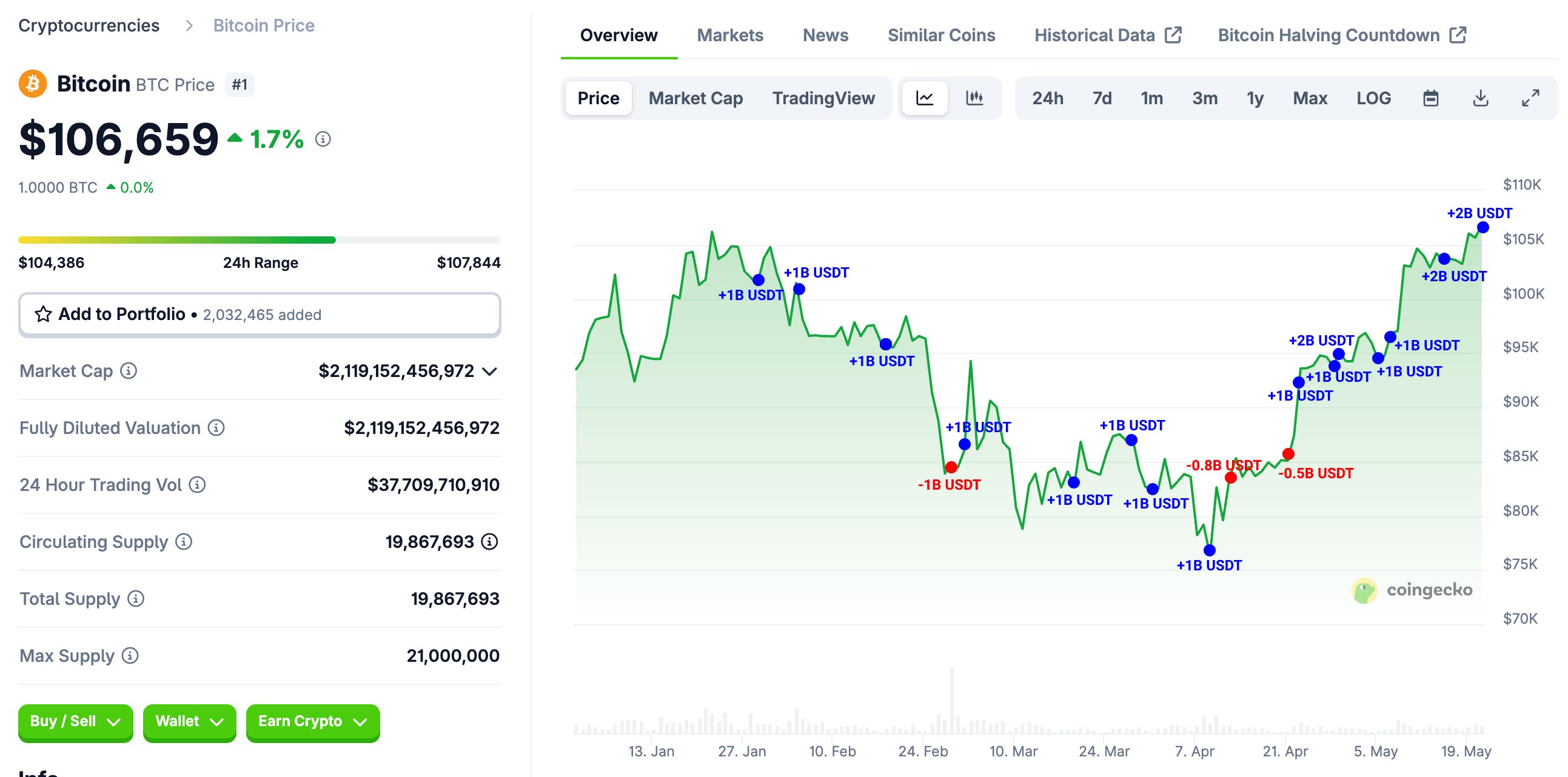

However, on a larger scale, Tether’s liquidity injection into the crypto market precedes higher prices. On-chain analytical firm Lookonchain highlighted what this trend means for Bitcoin in a tweet today, providing context for a possible rally to a new all-time high.

For perspective, Lookonchain identified a correlation between Tether’s minting and a Bitcoin rally. The tweet noted that Bitcoin reclaimed $100,000 after three months, owing to the leading stablecoin issuer’s $6 billion USDT minting between April 23 and May 7.

It observed a similar occurrence on May 15, when Bitcoin broke through $105,000 after Tether minted $2 billion USDT. With the latest minting, the analytical firm suggested that the pioneering cryptocurrency could surpass $109,300 if the upsurge pattern repeats.

Bitcoin’s Upsurge Correlation with Tether Minting

In the meantime,

BTC trades at $107,293, well above yesterday’s historical closing of $106,909.

Tron 30D Average Daily Transaction

However, the 30-day moving average sieved the spikes and presented a clear picture of the network’s actual activities.

Meanwhile, Maartunn stressed that the glaring traction, possibly steered by factors like growing user interaction and increased stablecoin transfers, indicates stable and increasing user influx to the Tron network.

Tether Mints $2B on the Tron Network

Market intelligence platform Arkham reported minting activity between the Tether Treasury and the Tron network.

The prominent stablecoin issuer created and moved 2 billion USDT from its “Black Hole Address” to the Tether multisignature wallet over two distinct transactions before deploying the tokens on Tron.

Tron 30D Average Daily Transaction

However, the 30-day moving average sieved the spikes and presented a clear picture of the network’s actual activities.

Meanwhile, Maartunn stressed that the glaring traction, possibly steered by factors like growing user interaction and increased stablecoin transfers, indicates stable and increasing user influx to the Tron network.

Tether Mints $2B on the Tron Network

Market intelligence platform Arkham reported minting activity between the Tether Treasury and the Tron network.

The prominent stablecoin issuer created and moved 2 billion USDT from its “Black Hole Address” to the Tether multisignature wallet over two distinct transactions before deploying the tokens on Tron.