Bitcoin Smashes $104K as Whale Movements and Soaring Open Interest Signal Imminent ATH

Whales are circling—Bitcoin’s open interest just hit record levels while big-money players accumulate. The last time these signals flashed? December 2020, right before BTC’s historic bull run.

Derivatives markets scream FOMO: aggregate open interest across major exchanges spiked 40% in 72 hours. Meanwhile, cold wallets linked to institutional players show seven-figure inflows. ’Smart money’ positioning looks eerily similar to the $69K breakout.

Here’s the kicker—this rally lacks the retail frenzy of 2021. No Elon memes, no ’to the moon’ TikToks... just hedge funds and family offices quietly front-running the next ETF approval. Classic Wall Street: privatize the gains, socialize the FOMO.

Bitcoin Price Chart

The bullish trend triggered a breakout from a falling wedge pattern and surpassed the 78.6% Fibonacci level, around $92,000, as well as the key psychological barrier at $100,000. Currently, bitcoin is facing resistance at the overhead supply zone near $104,000.

As Bitcoin reaches this critical juncture, technical indicators are signaling a loss of momentum. The RSI has reversed within the overbought zone and now threatens to fall below the 14-day average. Additionally, the MACD and signal lines are close to a bearish crossover. These signals suggest the possibility of a short-term top forming.

If BTC fails to break above the current resistance, a retest of the $97,000 level appears likely. Further support lies at the 78.6% Fibonacci level, near $92,000.

Optimistically, a successful breakout above the $104K resistance could set the stage for a rally toward the 1.272 Fibonacci extension level at $127,800.

Declining Whale Inflows

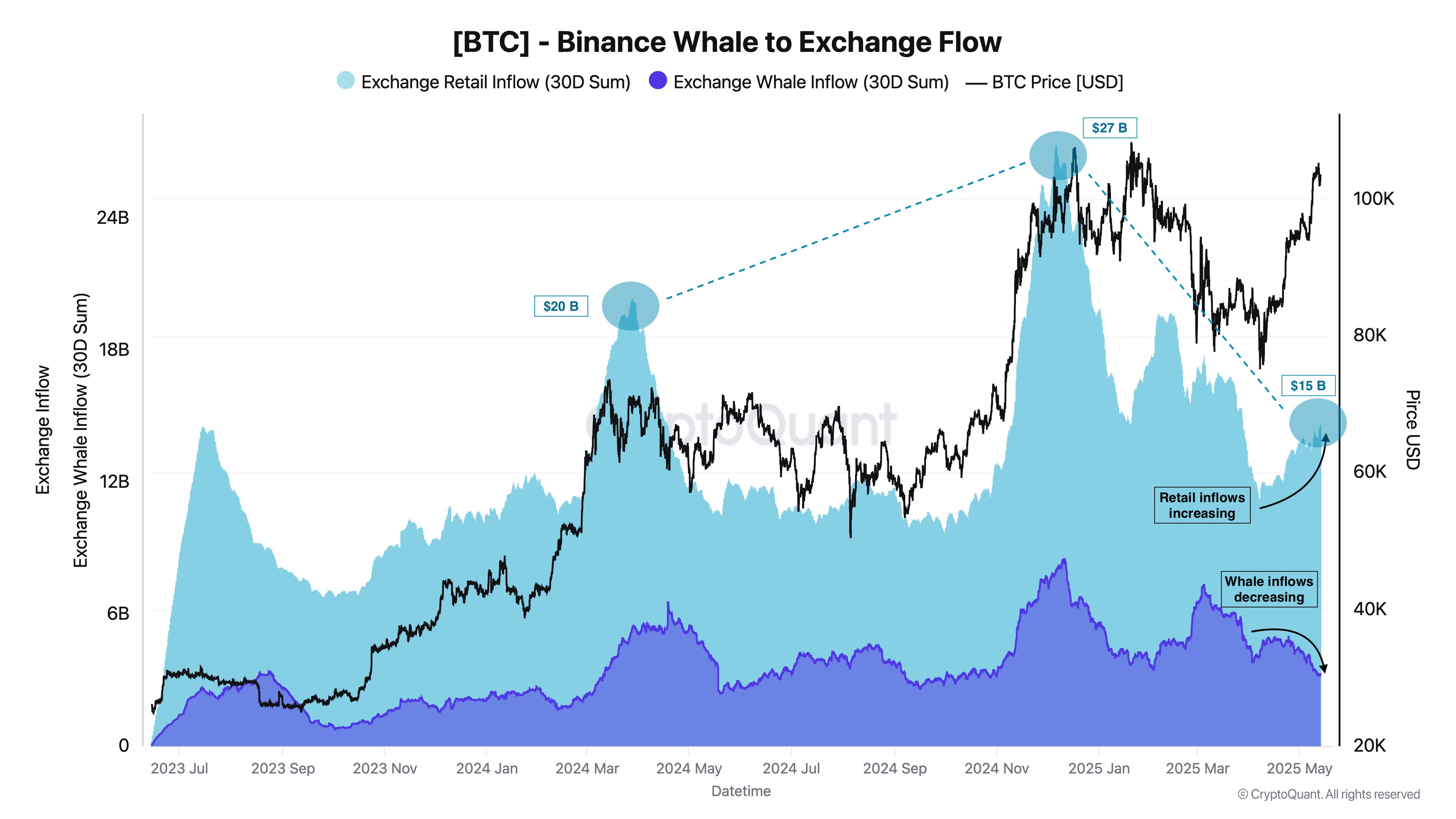

According to a recent tweet by CryptoQuant analyst DarkFost, a divergence has emerged between whale and retail investor activity on Binance. Since early April, Bitcoin’s bullish momentum has strengthened.

However, whale inflows to exchanges have continued to decline, while retail inflows have surged from $12 billion to $15 billion. Less capital from whales entering exchanges suggests confidence in the market for more upside. Moreover, additional data suggests whales have even accumulated over 83K BTC since last month.

Bitcoin Price Chart

The bullish trend triggered a breakout from a falling wedge pattern and surpassed the 78.6% Fibonacci level, around $92,000, as well as the key psychological barrier at $100,000. Currently, bitcoin is facing resistance at the overhead supply zone near $104,000.

As Bitcoin reaches this critical juncture, technical indicators are signaling a loss of momentum. The RSI has reversed within the overbought zone and now threatens to fall below the 14-day average. Additionally, the MACD and signal lines are close to a bearish crossover. These signals suggest the possibility of a short-term top forming.

If BTC fails to break above the current resistance, a retest of the $97,000 level appears likely. Further support lies at the 78.6% Fibonacci level, near $92,000.

Optimistically, a successful breakout above the $104K resistance could set the stage for a rally toward the 1.272 Fibonacci extension level at $127,800.

Declining Whale Inflows

According to a recent tweet by CryptoQuant analyst DarkFost, a divergence has emerged between whale and retail investor activity on Binance. Since early April, Bitcoin’s bullish momentum has strengthened.

However, whale inflows to exchanges have continued to decline, while retail inflows have surged from $12 billion to $15 billion. Less capital from whales entering exchanges suggests confidence in the market for more upside. Moreover, additional data suggests whales have even accumulated over 83K BTC since last month.