US Inflation Misses Forecasts—Bitcoin Primed for Volatility Surge

Wall Street’s inflation panic got a surprise sedative today—now watch crypto traders overdose on hopium.

When the CPI print landed softer than expected, traditional markets sighed with relief. But Bitcoin? It’s already lacing up its boots for the next macro-driven price tantrum.

The Fed’s favorite excuse (’inflation remains stubborn’) just got weaker—and that changes everything. Lower rates ahead? Check. Weaker dollar? Likely. Institutional FOMO? Inevitable.

Of course, Goldman Sachs will still find a way to blame crypto for whatever goes wrong next.

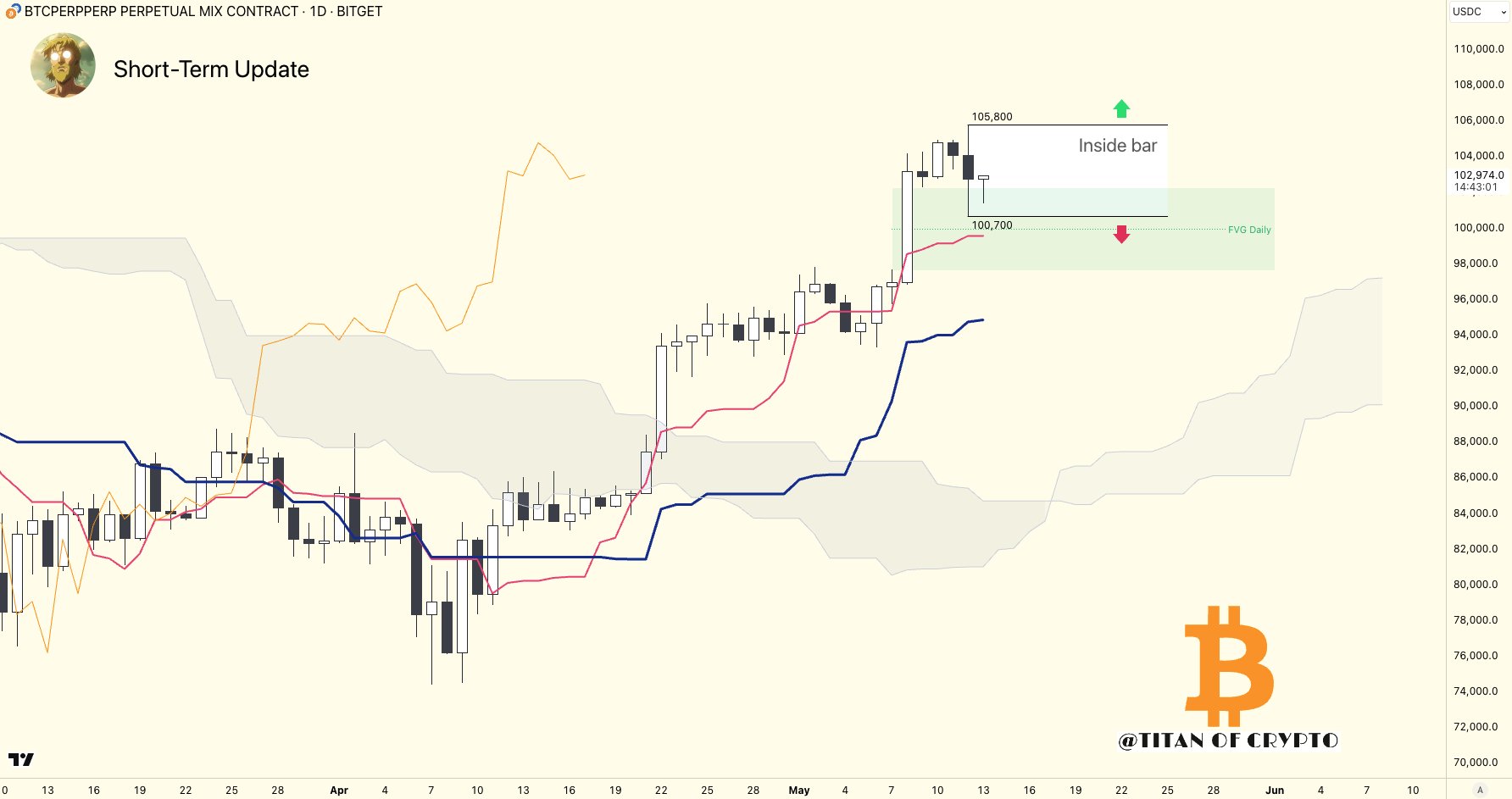

Bitcoin 1D Chart | Washigorira

Meanwhile, following the CPI announcement, analyst Femto XBT provided a bullish take, highlighting that the weekly chart for bitcoin remains positive.

https://twitter.com/FemtoXBT/status/1922283845220737446

He emphasized that long-term buyers are maintaining their positions, suggesting the path to a new all-time high could be near. He identified $104,000 as the key weekly open level, with $106,000 standing as the next target that could mark a record high for Bitcoin.

Essentially, Bitcoin’s short-term pullback appears to be a healthy consolidation. Lower-than-expected inflation increases the likelihood of a dovish Fed pivot, which historically benefits risk-on assets like crypto. In particular, Bitcoin tends to rally when investors anticipate lower interest rates.

Bitcoin 1D Chart | Washigorira

Meanwhile, following the CPI announcement, analyst Femto XBT provided a bullish take, highlighting that the weekly chart for bitcoin remains positive.

https://twitter.com/FemtoXBT/status/1922283845220737446

He emphasized that long-term buyers are maintaining their positions, suggesting the path to a new all-time high could be near. He identified $104,000 as the key weekly open level, with $106,000 standing as the next target that could mark a record high for Bitcoin.

Essentially, Bitcoin’s short-term pullback appears to be a healthy consolidation. Lower-than-expected inflation increases the likelihood of a dovish Fed pivot, which historically benefits risk-on assets like crypto. In particular, Bitcoin tends to rally when investors anticipate lower interest rates.