Bitcoin Targets $106K—10x Research Doubles Down on Bullish Outlook

As BTC smashes through resistance levels, analysts at 10x Research aren’t just riding the hype train—they’re shoveling coal into the furnace. Their updated price target suggests the rally’s got legs, even as skeptics mutter about ’irrational exuberance’ between sips of overpriced CBD lattes.

Why the confidence? Institutional inflows, ETF approvals, and that classic crypto narrative: ’This time it’s different.’ Meanwhile, Wall Street’s still trying to explain why they called it a ’bubble’ at $20K.

One thing’s certain: when Bitcoin zigzags past six figures, even the suits start paying attention—right before they quietly adjust their risk models.

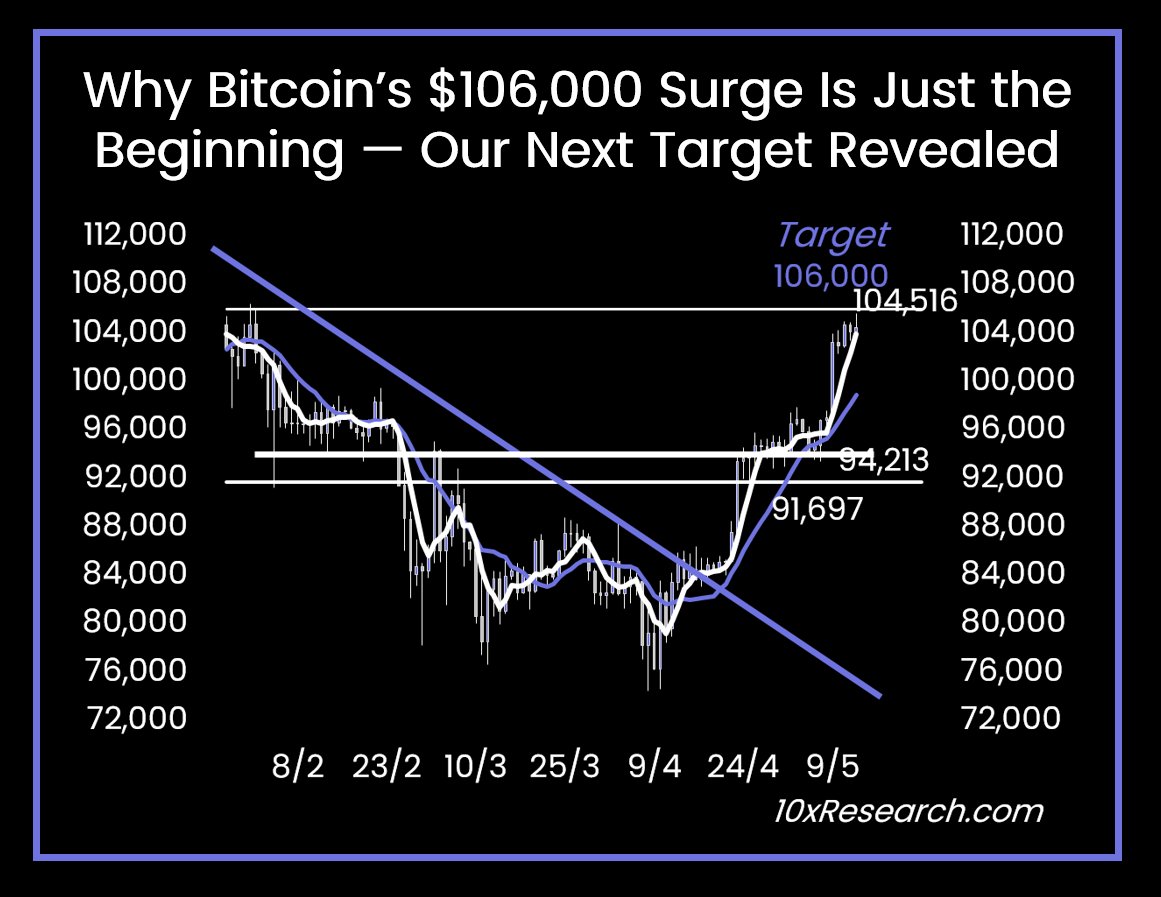

However, bitcoin eventually formed a series of higher lows throughout April despite a broader consolidation trend. It secured a breakout above the trendline in late April, and this was followed by continued upward movement, confirming a reversal pattern.

At the point of breakout, several technical signals turned favorable. The Relative Strength Index (RSI) crossed the 50% threshold, suggesting strengthening momentum. Notably, analysts also observed a bullish divergence between price action and RSI readings, as Bitcoin printed a lower low that was not matched by the RSI.

This divergence aligned with the firm’s long-term strategy on call spreads, which has performed successfully as Bitcoin approached $106,000. Notably, 10x Research has now pushed its Bitcoin target upward, suggesting that the $106,000 is only Bitcoin’s steppingstone. However, the firm has hidden this new target behind a paywall.

Macro Conditions Support the Upside

Meanwhile, recent observations by 10x Research point to a changing market structure. The firm attributes the potential move to a combination of macroeconomic developments and increased demand through spot markets.

Easing inflation concerns and strategic buying have contributed to the rally. Additionally, growth in options trading has introduced new dynamics to Bitcoin’s price action. Platforms like Bybit now offer options, creating avenues for traders to leverage volatility and hedge positions.

Also note that in a May 9 update, 10x Research advised traders to retain existing $100K call spreads while rolling into June expiry spreads at $110K–$120K. The recommendation also includes hedging through short positions in the S&P 500. This trade setup reflects expectations of continued upside in the near term.

Technical Patterns Suggest Further Upside Toward $112K

Meanwhile, according to The Crypto Basic, the current price setup on the 4-hour chart indicates a breakout from an expanding wedge pattern. The recent upward surge has formed a 24-hour high of $105,706 while carving out a parallel channel.

Notably, a morning star pattern has emerged, often associated with breakout rallies. However, despite the price gain, the RSI has not shown a corresponding increase in this timeframe, suggesting a potential bearish divergence.

This lack of momentum may prompt a short-term retest of the previously broken trendline. For further gains, Bitcoin must close above the channel’s upper boundary. If achieved, the price could target the R1 pivot resistance near $108,284, with potential to extend toward R2 at $112,439.

However, bitcoin eventually formed a series of higher lows throughout April despite a broader consolidation trend. It secured a breakout above the trendline in late April, and this was followed by continued upward movement, confirming a reversal pattern.

At the point of breakout, several technical signals turned favorable. The Relative Strength Index (RSI) crossed the 50% threshold, suggesting strengthening momentum. Notably, analysts also observed a bullish divergence between price action and RSI readings, as Bitcoin printed a lower low that was not matched by the RSI.

This divergence aligned with the firm’s long-term strategy on call spreads, which has performed successfully as Bitcoin approached $106,000. Notably, 10x Research has now pushed its Bitcoin target upward, suggesting that the $106,000 is only Bitcoin’s steppingstone. However, the firm has hidden this new target behind a paywall.

Macro Conditions Support the Upside

Meanwhile, recent observations by 10x Research point to a changing market structure. The firm attributes the potential move to a combination of macroeconomic developments and increased demand through spot markets.

Easing inflation concerns and strategic buying have contributed to the rally. Additionally, growth in options trading has introduced new dynamics to Bitcoin’s price action. Platforms like Bybit now offer options, creating avenues for traders to leverage volatility and hedge positions.

Also note that in a May 9 update, 10x Research advised traders to retain existing $100K call spreads while rolling into June expiry spreads at $110K–$120K. The recommendation also includes hedging through short positions in the S&P 500. This trade setup reflects expectations of continued upside in the near term.

Technical Patterns Suggest Further Upside Toward $112K

Meanwhile, according to The Crypto Basic, the current price setup on the 4-hour chart indicates a breakout from an expanding wedge pattern. The recent upward surge has formed a 24-hour high of $105,706 while carving out a parallel channel.

Notably, a morning star pattern has emerged, often associated with breakout rallies. However, despite the price gain, the RSI has not shown a corresponding increase in this timeframe, suggesting a potential bearish divergence.

This lack of momentum may prompt a short-term retest of the previously broken trendline. For further gains, Bitcoin must close above the channel’s upper boundary. If achieved, the price could target the R1 pivot resistance near $108,284, with potential to extend toward R2 at $112,439.