Massive $4.3B Crypto Options Expiry Looms: Bitcoin, Ethereum, XRP Face ’Triple Witching’ Showdown

Wall Street meets crypto chaos as derivatives traders brace for impact.

Options Armageddon Approaches

A staggering $4.3 billion in Bitcoin, Ethereum, and XRP contracts hit expiration simultaneously—just ahead of the quarterly 'triple witching' event that traditionally shakes traditional markets. This convergence could trigger volatility fireworks across crypto exchanges.

Gamma Exposure Tinderbox

Market makers scramble to hedge positions as massive open interest nears expiry. The concentration of at-the-money options creates a gamma squeeze scenario where price moves could accelerate violently in either direction. Liquidity providers dance on a knife's edge.

Crypto's Derivatives Coming of Age

Today's expiry volume signals institutional adoption isn't just talk—it's manifesting in complex derivatives activity that would make even traditional quants sweat. The market's growing sophistication brings both opportunity and unprecedented risk dimensions.

Triple Witching's Crypto Debut

While stock traders dread quarterly expirations, crypto faces its first major test against this triple-threat phenomenon. How digital assets handle the pressure could redefine their correlation—or lack thereof—with traditional finance cycles.

Because nothing says 'mature asset class' like betting the farm on derivatives even the creators might not fully understand.

Key Insights:

- In the latest crypto news, $3.5 billion Bitcoin options are set to expire on Deribit on Friday.

- Ethereum options of notional value $0.85 billion are also set to expire.

- Over $100 million in XRP options triggers a fall in XRP price.

In crypto news today, Bitcoin, Ethereum, XRP traders brace for $4.3 billion options expiry. The large expiry could cause a short-term volatility in the crypto prices.

This will trigger the market cap to fall below $4 trillion again, after the recent post-FOMC rally.

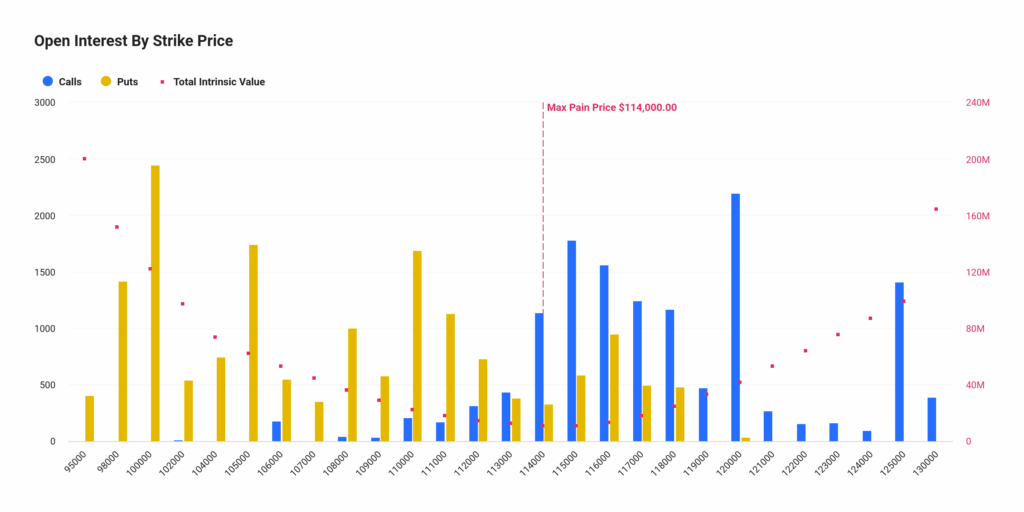

Crypto News: $3.5 Billion Bitcoin Options Expiry

29K BTC options with a notional value of $3.5 billion to expire on the largest derivatives crypto exchange Deribit on September 19. The put-call ratio was 1.35.

This crypto news indicated traders were massively bearish, placing more put bets than calls after the latest crypto prices rebound.

Moreover, the max pain price was $114,000, lower than the market price of $116,554 at the time of writing.

This implied a high chance of a pullback in Bitcoin USD, with traders adjusting their positions amid intense volatility ahead of “triple witching” next Friday.

However, the 24-hour call volume was higher than the 24-hour put volume. The put-call ratio was 0.77, indicating traders were buying more call options.

As per Greekslive, key options metrics indicate declining implied volatility (IV). The short-to-medium-term IV for Bitcoin USD has fallen below 30%.

Put option block trades and their transaction share have risen steadily this month, reflecting risk hedging as the primary strategy.

Bitcoin price was trading 0.70% lower at $116,432 at the time of writing. The 24-hour low and high were $116,420 and $117,911, respectively.

Furthermore, the trading volume has decreased by 34% in the last 24 hours, indicating a lack of interest among traders.

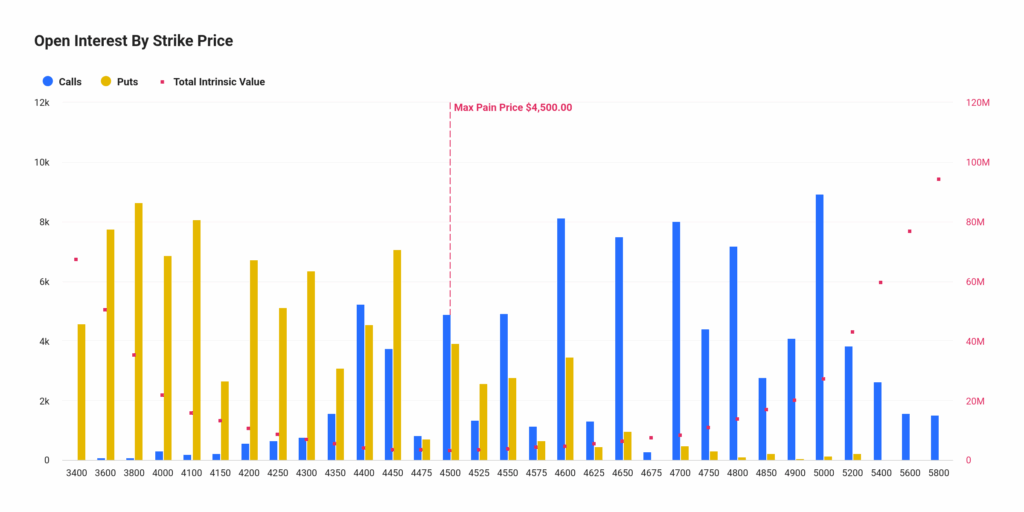

Ethereum Options with $0.85 Billion in Notional Value to Expire

In ethereum crypto news, 178K ETH options with a notional value of almost $0.85 billion are set to expire. The put-call ratio was 1, suggesting a slightly bearish sentiment among traders.

Also, the max pain point was $4,500, above the current market price. Moreover, the call bets are higher at the strike price, indicating bias towards a lower price to minimize losses.

In the last 24 hours, put volume was lower than the call volume, with a put-call ratio of 0.85. This suggested an expected rebound in ethereum price by traders.

According to Greekslive, ETH’s primary IV terms are all below 60%, with short-to-medium-term IV dipping under 50%, signaling low volatility levels.

As The Coin Republic reported earlier, analysts, including Michael van de Poppe predicted Ethereum price could drop to $4,000 if it fails to climb to $4,700.

The bearish sentiment could erode in the coming week ahead of the monthly expiry.

ETH price fell more than 1% in the past 24 hours, with the price trading at $4,512. The 24-hour low and high were $4,510 and $4,636, respectively.

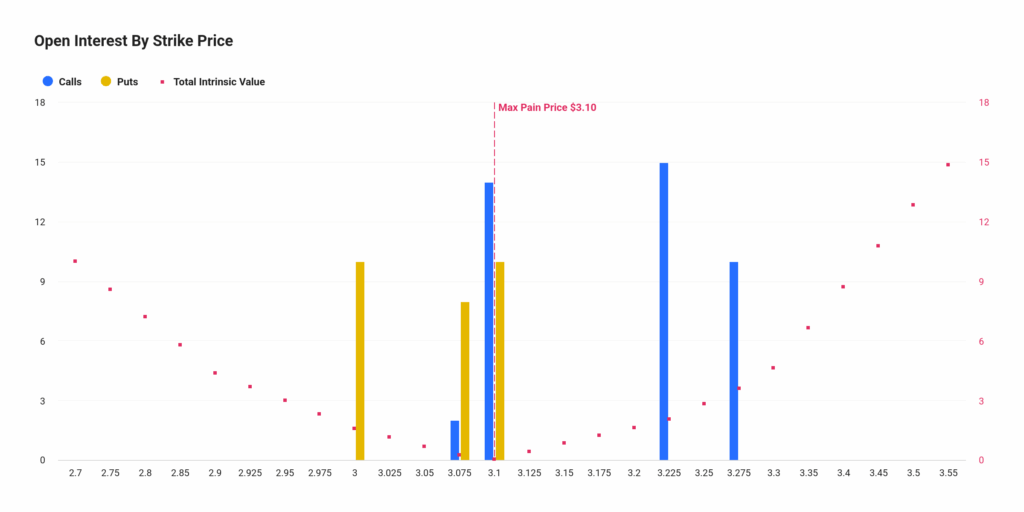

XRP Crypto Price May Drop Ahead of Quarterly Expiry

The altcoins also face a dip waning risk-bet appetite of traders on the crypto prices. Notably, xrp price was one of the laggards among the top players in the crypto market.

Meanwhile, 28,068 XRP options with a notional value of more than $100 million are set to expire. The put-call ratio was 0.34, suggesting bullish sentiment among traders.

The max pain point was $3.10, above the market price of $3.02 at the time of writing.

However, traders expect the price to consolidate for longer despite the REX-Osprey XRP ETF recording massive buying on the first day.

Analyst Dom asserted that bulls failed to hold $3.12 area this week, increasing challenges for a push to $3.30.

He predicted a price target of $3.34 for the crypto after breaking out of a triangle, with XRP price expected to hit a new ATH if bulls support.

XRP price slipped 3% in the last 24 hours, with the price exchanging hands at $3.03. The intraday low and high were $3.03 and $3.14, respectively.

Moreover, trading volume dropped massively by more than 30%. It signals further downside in XRP price due to renewed selling pressure.