Bitcoin’s 70% Surge Potential: ETF Inflows & Bullish Metrics Signal Imminent Breakout to Fresh Highs

Bitcoin teeters on the edge of explosive growth—ETF inflows surge while underlying metrics scream bullish.

Breaking the Ceiling

Market indicators align like stars for Bitcoin's next leg up. A 70% probability isn't just hopeful—it's statistically grounded in cold, hard data. ETF flows aren't just trickling in; they're flooding the gates, pushing institutional adoption into overdrive.

The Mechanics Behind the Move

Technical patterns suggest momentum building toward uncharted territory. No crystal balls needed here—just pure on-chain analytics and institutional demand converging at the right time. Even traditional finance skeptics can't ignore the numbers stacking up.

Why This Time Feels Different

Past rallies often relied on retail hype. This one? Powered by Wall Street's sudden love affair with crypto—though let's be real, they're just chasing returns they missed out on for a decade. The irony of banks now fueling Bitcoin's rise isn't lost on anyone.

Bottom line: All signs point toward breakout mode. Whether it's new highs or just another fakeout, one thing's clear—the market's betting big on Bitcoin's next chapter.

In brief

- Bitcoin holds near $117K with balanced STH metrics, signaling neither overbought nor oversold market conditions.

- Axel Adler Jr. predicts a 70% chance of BTC rallying higher or consolidating in the next two weeks.

- Futures premium and $2.3B ETF inflows add bullish momentum, strengthening the market’s upside potential.

- Liquidity gaps near $114K could trigger short dips, but a close above $117.5K may confirm fresh highs ahead.

Bitcoin Poised for Breakout as STH Metrics Signal Balanced Market, Says Axel Adler Jr.

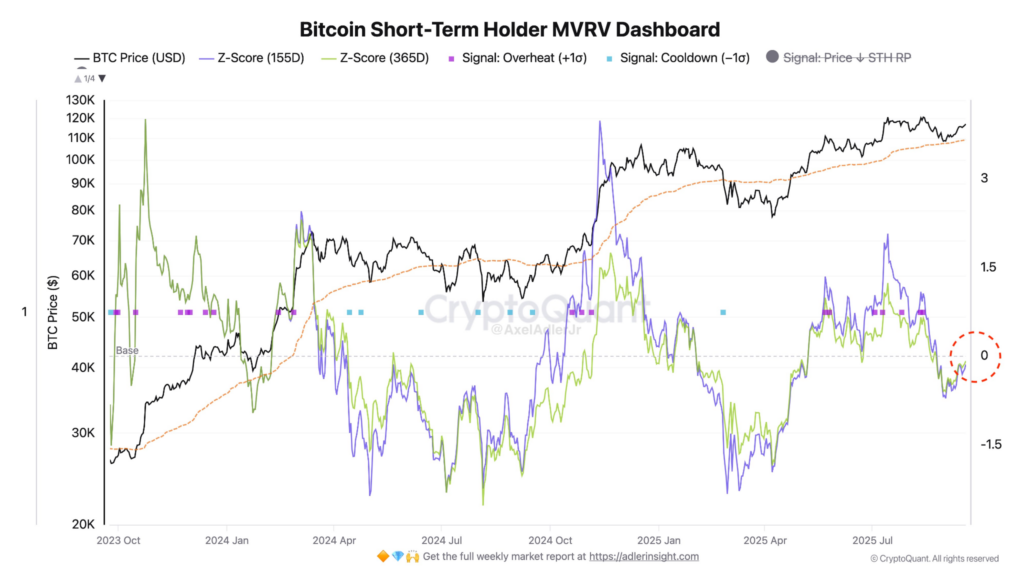

Axel Adler Jr. maintained that market conditions are balanced and well aligned, so bitcoin can take the next leg higher soon. To support his outlook, the market expert pointed to the Short-Term Holder (STH) MVRV Z-Scores, a visual indicator that provides insight into Bitcoin’s market cycle phases.

Data shows that the STH score for both the 155-day and 365-day holders is around zero, a sign that the asset is neither overbought nor oversold.

Bitcoin is currently hovering just above the STH realized price, with the current trend setup hinting at a possible price breakout following a one-to-two-week consolidation period. Citing seasonal drivers, Adler Jr. predicts an “Uptober incoming”.

Outlook Strengthens as Futures Premium and ETF Inflows Signal Bullish Momentum

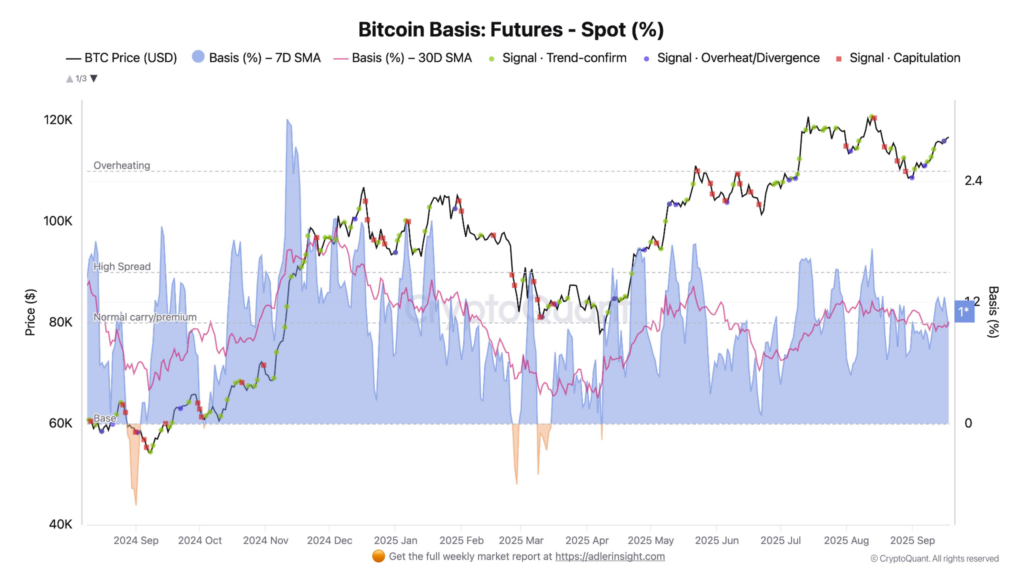

Axel Adler Jr. further backed his bullish forecast with Bitcoin derivatives data, which track asset prices, volumes, and trading activity. According to the chart, Bitcoin futures are trading higher than spot prices. In addition, the weekly basis is currently above one month, a setup which usually suggests a bullish trend.

Still, the Bitcoin researcher warned that traces of minor overheating were spotted just before the recent FOMC meeting. The average cost basis went up despite low trading activity, suggesting that some traders might have been chasing the MOVE late.

Even so, Adler Jr. explained that the base case remains strong, and “there’s a 70% chance the next two weeks will see a stepwise uptrend or sideways consolidation.”

Growing institutional demand further reinforces this bullish Bitcoin outlook. Last week, BTC ETFs pulled in over $2.3 billion in capital investment, the strongest weekly performance in three months. Given the increased exposure and bullish technical indicators, investors are confident the coin will start another bullish run.

Is Bitcoin on Track for $124K, or Will Liquidity Gaps Trigger a Pullback First?

Bitcoin has surged about 8.5% since the end of last month, from around $107,600 to $117,246 at the time of writing. But the sharp price swing has left liquidity gaps, which could trigger a short-term dip before the uptrend continues. On top of that, September often has a bearish track record, adding to the risk of a pullback.

Here are other notable Bitcoin trends for investors to note:

- Bullish sentiment dominates current Bitcoin price predictions.

- 95% price growth over the past year highlights strong performance.

- Outperformed 92% of the top 100 crypto assets during the same period.

- Trading above the 200-day SMA with 15 green days in the last 30.

Bitcoin’s year-to-date performance has largely defied expectations of a pullback. For most of 2025, the OG crypto has favored bigger liquidity zones, like major highs and lows, over smaller liquidity levels. A similar trend occurred in July, when BTC skipped past liquidity around $105,000 and quickly pushed to new highs after breaking the daily structure.

Experts note that a similar formation is appearing, and if Bitcoin closes above $117,500, it WOULD validate another daily break of structure (BOS). Assuming this happens, the asset’s chances of dropping below the $114,000 mark would drastically reduce. More so, such a move would confirm Adler Jr.’s fresh all-time high prediction.

Even though there’s still a chance that Bitcoin could test lower price levels, favorable macroeconomic outlooks, such as the proposed BITCOIN Act and growing ETF inflows, suggest buyers might step in sooner. A strong entry by buyers would effectively prevent a bigger pullback. Whether the asset stalls or touches levels beyond $124,000 will depend on the balance between liquidity gaps and bullish momentum.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.