Ethereum Price Prediction: Soaring to $5K or Plunging to $3K? Key Insights Unveiled

Ethereum teeters on a razor's edge—bulls eye $5,000 while bears whisper $3,000. The ultimate tug-of-war plays out as volatility spikes.

Technical Tensions Mount

Chart patterns scream divergence. Resistance levels crack under pressure while support holds—for now. Every trader watches the same key indicators, praying their bias prevails.

Market Forces Collide

Institutional inflows clash with retail jitters. Whales accumulate on dips, yet leverage flushes shake weak hands. The network burns ETH faster than ever—deflation meets speculation head-on.

Regulatory Shadows Loom

Global policymakers circle like vultures. Another round of vague statements could trigger either breakout or breakdown. Because nothing fuels crypto like uncertainty wrapped in bureaucratic jargon.

Will Ethereum defy gravity or succumb to gravity? One thing's certain—traditional finance still can't tell the difference between a blockchain and a block of cheese.

Key Insights

- Ethereum price could fall as whales sit on similar profit conditions seen during the cycle peak in 2021.

- Whale dumped 100,000 ETH worth millions in the last 3 days.

- Analyst Michael van de Poppe predicted a fall below $4,000 if ETH fails to build upside momentum.

Ethereum price climbs over 2% to surpass $4,600 in response to a 25 bps rate cut by the U.S. Federal Reserve.

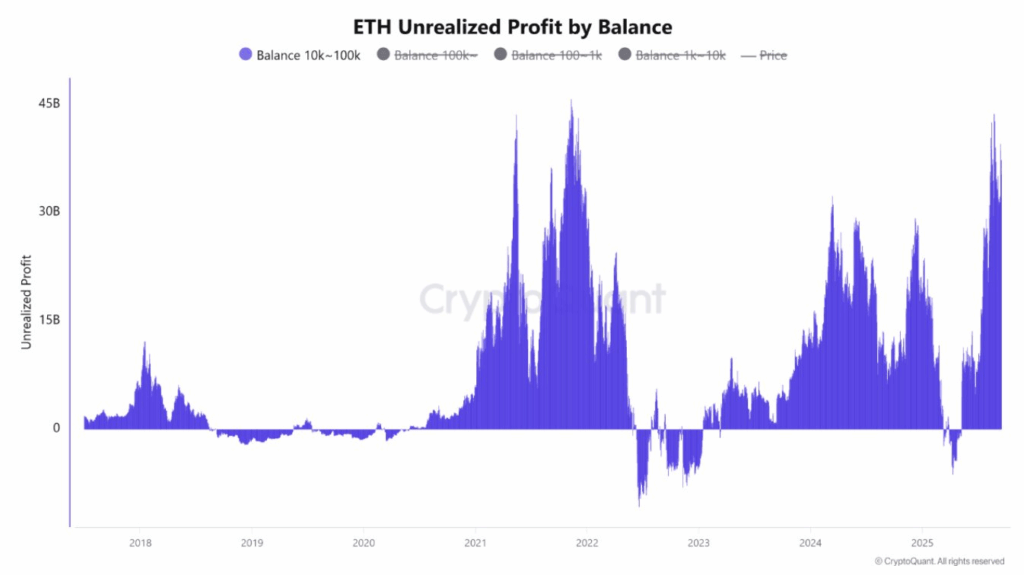

However, new on-chain data suggests whales could start offloading holdings as their unrealized profit reaches the 2021 cycle peak. It has raised concerns among traders, prompting analysts to consider a correction.

Ethereum Price May Fall on Selling Pressure by Whales

ETH unrealized profits of mid-sized whales hit levels last seen at ATH in November 2021, according to CryptoQuant’s ETH Unrealized Profit by Balance data.

This signals that mid-sized whales are sitting on significant gains, similar to the profit conditions observed during the market peak in November 2021.

Ether whales holding 10K–100K ETH may consider selling their holdings, triggering a fall in ethereum price.

Historically, whales have sold some of their holdings as their unrealized profits jumped significantly higher. It followed increased selling pressure in the crypto market.

Notably, whales have continued to reduce their holdings in the last few months. As The Coin Republic reported, Ether whales holding 1K-100K ETH have also sold 90,000 ETH worth nearly $500 million in the last 2 days.

Meanwhile, this doesn’t specifically indicate an immediate or sharp correction in Ethereum price. Instead, Ether whales’ liquidations signal profit-taking, portfolio rebalancing, or shifts in market positioning by large holders.

Meanwhile, a whale has dumped 5,000 ETH worth $22.84 million to crypto exchange Binance, a on-chain platform reported on September 18. The whale made an overall profit of $5.08 million.

Spot Ether ETF Outflows Amid Citigroup’s Bearish Ethereum Price Prediction

Spot Ethereum exchange-traded funds recorded consecutive outflows for many days. After $68.40 million in ETH sold by BlackRock and Fidelity on Tuesday, the US Spot Ethereum ETF recorded a net outflow of $1.89 million on Wednesday.

This signaled that institutional investors continue to sell despite a 25 bps Fed rate cut. Fidelity’s FETH reported an outflow of $29.19 million, and Bitwise’s ETHW saw $9.7 million in outflow, as per Farside Investors data.

It likely happened after Wall Street giant Citigroup’s Ethereum price prediction to end the year at $4,300.

The bank claims ETH price could fall to $2,200 in a bearish case based on Ethereum’s on-chain value amid layer-2 growth.

This is in contrast to others, such as Standard Chartered, which predicted ethereum price to rally above $5,000 amid a rise in corporate Ethereum treasuries.

Moreover, Citigroup also predicted an Ethereum price rally toward $6,400 in the bullish case. The firm based its analysis on institutional demand for spot Ethereum ETFs.

Analysts Predict ETH Price Could Fall to $4,000

Popular analyst Michael van de Poppe reiterated that Ethereum price is still holding above the crucial area. In case the area is lost, a fall below $4,000 to follow.

Analyst Ted Pillows claimed ETH price is sluggish and consolidating below the $4,700 resistance level.

He predicted that the price could start falling towards $4,000 if it fails to rebound above the current resistance level.

Moreover, analyst Ali Martinez pointed out that the TD Sequential indicator has flashed a sell signal on Ethereum.

He predicted ETH price to drop to $4,570 again. This indicates multiple headwinds, along with technical indicators, signal a potential drop in Ethereum.

Meanwhile, Ethereum price pared earlier gains and fell back below $4,600. This comes as analysts considered a correction amid sluggish price action.

ETH price was trading NEAR $4,580, up nearly 2% in the last 24 hours. The 24-hour low and high were $4,429 and $4,643, respectively. Furthermore, trading volume jumped above 35% over the last 24 hours.