Gold Devours Bitcoin’s Momentum—Can BTC Reverse the Tide This September?

Gold's stealing the spotlight—and the capital—while Bitcoin watches from the sidelines. The shiny metal’s traditional safe-haven appeal is pulling investors away from digital volatility, leaving crypto enthusiasts wondering if this is just a temporary setback or a deeper trend.

Market Shifts Favoring Metal Over Code

Institutional money continues flowing into gold ETFs and physical holdings, drawn by stability amid economic uncertainty. Bitcoin’s narrative as 'digital gold' faces its toughest test yet, with gold posting consistent gains while crypto markets churn.

Technical Signals to Watch

Key resistance levels loom for BTC—breaking through could trigger renewed momentum. Trading volumes and whale activity suggest accumulation patterns emerging, hinting at potential September surprises.

Macro Factors at Play

Interest rate expectations and geopolitical tensions fuel gold's rally. Bitcoin increasingly correlates with risk-on assets rather than acting as the uncorrelated store of value its proponents promised—another case of traditional finance eating crypto’s homework.

The September Countdown

Historically volatile for crypto, this month could define Bitcoin’s narrative for the remainder of the year. Either it reclaims its hedge status or confirms gold’s dominance—because nothing says 'safe haven' like a metal we dig out of the ground instead of code we mine with computers.

Bitcoin price traded at $108,591 on August 30, while Gold continued to show a stronger performance.

Analysts such as Mike McGlone and Michaël van de Poppe have highlighted important price levels to watch.

With September approaching, many expect the month to test whether Bitcoin can shake off its recent weakness and stage a reversal.

Gold Outperforms as Bitcoin Struggles Near Key Levels

It is worth mentioning that Gold held the advantage over bitcoin in recent months as the better performer.

Bloomberg’s Mike McGlone explained that gold had gained more ground since BTC first moved above $100,000 about ten months earlier.

He noted that if the United States stock market weakened further, gold might keep its edge.

Bitcoin’s recent price action showed pressure. The coin traded at $108,591.75 at the end of August, a daily rise of 0.27%.

However, the weekly chart showed a drop of 5.22% and the 30-day record revealed a fall of 7.97%.

Traders also pointed to $112,000 as a level that Bitcoin failed to break, with the price retreating back to $108,000 after rejection.

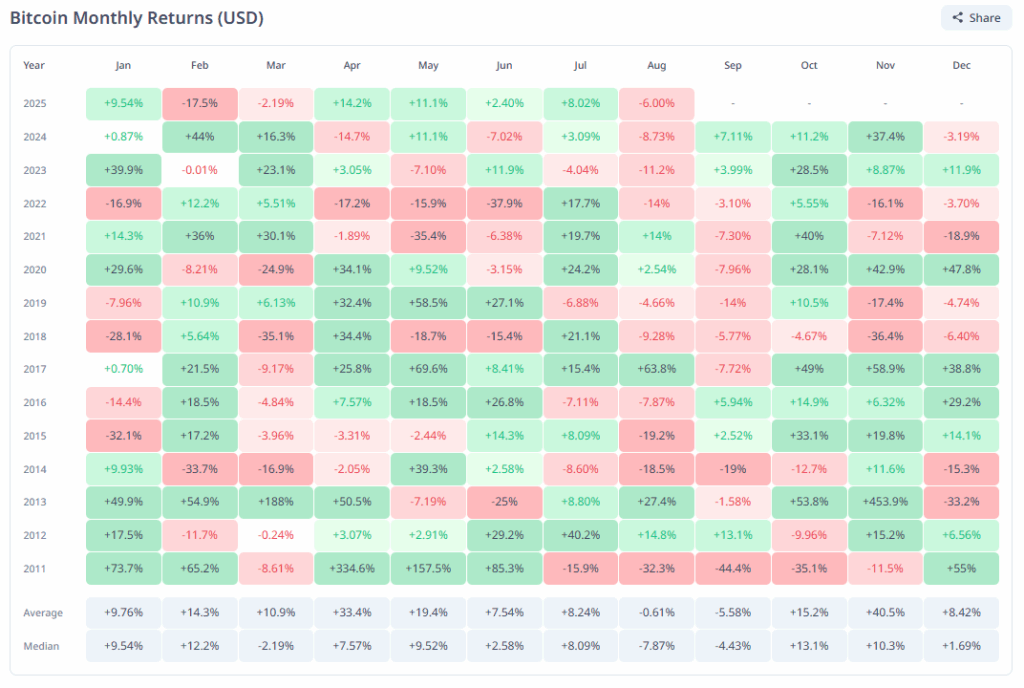

Monthly returns showed mixed results. While July closed with an 8.02% gain, August ended with a loss of 6.15%.

This raised concerns among investors looking to September, a month that had often proved difficult for BTC in past years.

Analysts Highlight the Big Catch Around $103,000

Michaël van de Poppe, a crypto analyst, said Bitcoin had not yet completed its correction.

He described $112,000 as the resistance point the market had to clear. The top analyst also warned of a possible MOVE down to $103,000 before the next strong rebound could begin.

This possible bottom was what many traders referred to as the “big catch.” A dip toward $103,000 might set the stage for the next upward wave.

Van de Poppe suggested that if Bitcoin stabilized at that range, altcoins could also see stronger performance during the next leg higher.

The focus on these levels came as trading volumes showed signs of caution. Notably, short-term gains did not change the broader pattern of hesitation.

Analysts said the next impulse WOULD likely depend on whether it held above the support zone and tested the upper limit again.

September’s Mixed History and What Lies Ahead

September had always boasted a mixed history for BTC. In 2015, the coin gained 2.52%, and in 2016, it added 5.94%.

From 2017 to 2022, however, the months mostly ended in losses. Bitcoin fell 7.72% in 2017, 5.77% in 2018, 14% in 2019, 7.96% in 2020, 7.30% in 2021, and 3.10% in 2022.

A change came in 2023 when Bitcoin closed the month up 3.99%. The positive trend continued in 2024 with a 7.11% increase.

These results gave traders reason to hope September might not always be negative for Bitcoin.

Still, many stressed that the outcome this year would depend on how investors approach the $112,000 resistance and the $103,000 support.

Amid the push for BTC, Eric TRUMP drew market attention when he said Bitcoin could one day reach $1 million.

He commented only days after suggesting a shorter-term target of $175,000.

While some called his forecast too bold, others pointed to earlier Bitcoin cycles where moves once thought unlikely later took place.

His remarks pushed the debate about BTC beyond finance into political circles as well.

With gold still holding the upper hand and Bitcoin trading just above $108,000, the focus turned to September.

McGlone and van de Poppe agreed that the coming weeks would be important in showing whether Bitcoin could recover momentum or if gold would continue to stay ahead.