PYTH Coin 2025-2026 Bull Run: Explosive Growth Drivers and Market Outlook

Oracle network PYTH defies crypto winter with institutional adoption surge—price targets suggest 3-5x gains ahead.

Data Feeds Revolutionize DeFi

PYTH's real-world data oracles finally deliver what TradFi players demand: institutional-grade reliability. Major protocols now integrate PYTH feeds at triple 2024 rates—because nobody trusts meme-driven price data when real money's on the line.

Market Cycle Convergence

Historical patterns align perfectly with 2025-2026 projections. Previous bull runs saw oracle tokens outperform majors by 200-400%. PYTH's current infrastructure scaling suggests it'll eat competitors' lunch while VCs pretend they believed in utility all along.

Adoption Metrics Don't Lie

Active addresses up 78% quarter-over-quarter. Total value secured crosses $5B as blue-chips finally ditch centralized data feeds. Because nothing says 'financial revolution' like saving 30% on oracle costs while hedge funds still pay Bloomberg terminals six figures.

Regulatory Tailwinds

Clearer frameworks emerging for decentralized data providers—regulators oddly prefer verifiable on-chain proofs over 'trust me bro' Excel models. PYTH's transparency advantage becomes its killer feature as compliance officers discover blockchain.

Price Outlook: Conservative to Moon

Base case: 2-3x from current levels as ecosystem matures. Bull case: 5-8x if crypto fully recovers and PYTH captures 40%+ oracle market share. Because in crypto, fundamentals eventually matter—right after the degens get bored of dog tokens.

Its been an interesting week for the market and more so for Pyth Network and its native coin.

The U.S. announced earlier this week that it will publish economic data on-chain and that it had selected PYTH as the network bring those plans into fruition.

The announcement triggered a positive market reaction which cast the spotlight onto PYTH coin.

The cryptocurrency experienced its biggest single-day price surge on Thursday, during which it rallied by over 100%.

PYTH coin previously struggled to secure enough bullish momentum to escape its historic low range.

The U.S government’s plans to migrate its economic data on-chain through PYTH was the cryptocurrency’s biggest catalyst event so far.

PYTH Coin Volume Surges to Historic Levels but is it Sustainable?

The PYTH coin rally was made it clear that the recent announcement made it more popular. However, the scale of that attention was even more impressive in terms of volume.

According to DeFiLlama, PYTH tone volume jumped from$23.36 million on Wednesday, to $1.42 billion on Thursday. A 6,000% plus gain within a 24-hour period.

Things were even more exciting on the derivatives side of things where volumes surged above $3 billion. PYTH open interest surged from $40 million on Wednesday, to $194 million.

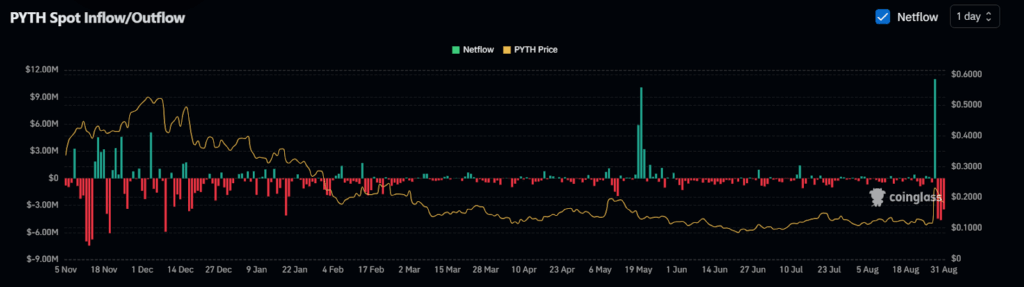

PYTH coin price’s robust upside also pushed it into overbought territory which also raised bearish expectations. This was evident by the spike in negative funding rates.

This was also backed by just over $12million worth of spot outflows during the weekend, which reflected a short term profit-taking wave.

The spot outflows were more than the inflows observed on Thursday but price still retained some of its recent gains.

The lower outflows compared to recent outflows indicated that a significant amount of holders did not sell. Perhaps an indication of more bullish expectations.

Price also demonstrated some buying pressure, leading to a slight recovery from the day’s low at $0.19 to its $0.25 press time price tag.

This outcome led to about $11 million in short liquidations which contrasted to roughly $7 million in long liquidations.

Will PYTH Coin Maintain its Recent Bullish Momentum?

The U.S department of Commerce will use Pyth network and this marked a major adoption MOVE for the network.

It not only underscored a new wave of government utility but it also put the network on the map.

The development could potentially set the pace for more network adoption down the road. This could be a net positive for PYTH coin in the short term but not necessarily in the long term.

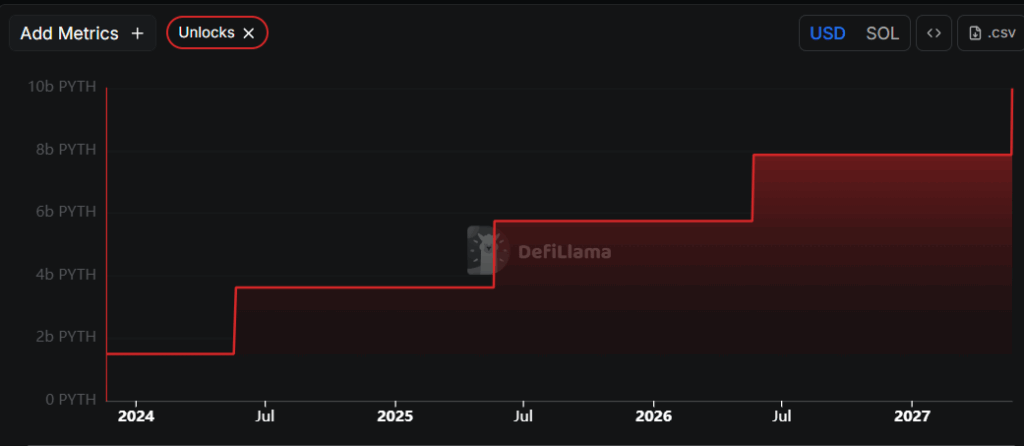

Recent demand may aid price excitement in the short term but its supply is set to increase significantly over the next two years.

Its latest unlock in May pushed the circulating supply up from 3.62 billion to 5.74 billion coins.

The network has been conducting unlocks in May every year. This means the cryptocurrency has about 9 months before the next unlock event, after which the supply will balloon to 7.87 billion coins.

PYTH coin bulls could take advantage during the 9 months but the rising circulating supply meant that it was also at risk of price dilution.

Nevertheless, the impact of that price dilution might be understated if the cryptocurrency’s market cap achieves a higher growth rate.