Solana Primed for 52% Surge to $257—If Wall Street Doesn’t Get Spooked

Solana's price chart is flashing bullish signals—but institutional whales hold the keys to this rally.

The $257 target hinges on one fragile variable: continued big-money interest. When hedge funds sneeze, crypto catches pneumonia.

Technical setups suggest breakout potential. Market makers? They suggest volatility ahead. Place your bets—just watch the whale wallets.

Key Insights:

- Public companies like DeFi Growth and Upexi are quietly accumulating millions in SOL, showing long-term confidence in the Solana price.

- Despite rising prices, traders remain cautious, with over $1.64B in short positions suggesting bearish expectations.

- SOL price could rally 52% toward $257, but only if institutional demand holds and short positions unwind.

Solana’s price has stayed mostly stable this week, holding NEAR $168 even as other major coins pushed higher. While some traders may see this as a slowdown, the full picture tells a different story.

SOL price could be preparing for a major move, but only if the big players keep backing it.

From institutional buyers to key trading signals, this article breaks down what’s happening and what it could mean next for the solana price.

Solana Price Is Quietly Being Picked Up by Big Institutions

The latest Solana accumulation trend isn’t led by just whales or retail traders. Some public companies and major firms have been quietly stacking SOL behind the scenes.

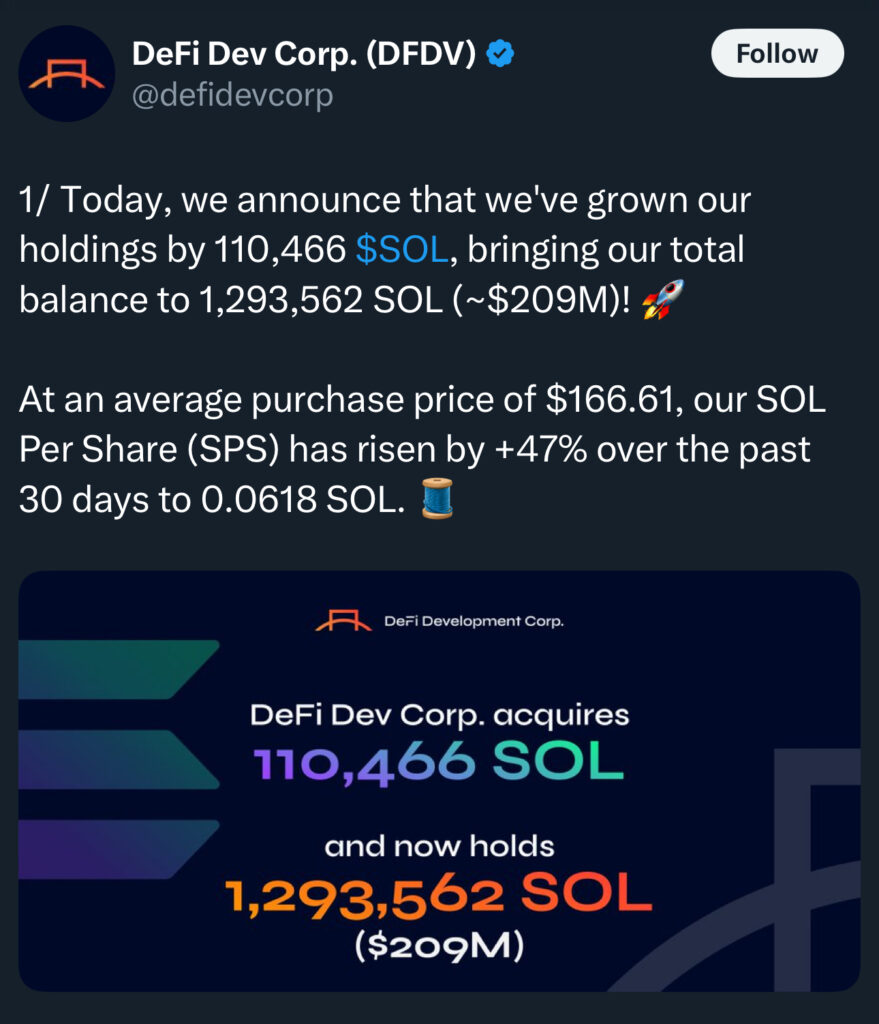

One of the most notable is DeFi Growth, which added more than 110,000 SOL last week alone. They now hold over 1.29 million SOL. That’s not a short-term trade; it’s a serious investment.

This MOVE validates the thought that, like ETH, SOL is also being eyed by the big names. More so, before the altcoin season peaks.

Artelo Biosciences, a public pharma company, is also building out a treasury strategy based entirely around Solana. They’ve become one of the first listed biotech firms to go all-in on a digital asset treasury with SOL at the center.

Another player is Upexi Inc., a consumer brand platform that holds more than $330 million worth of SOL. They’re actively staking it too, showing this is part of their long-term financial planning, not just speculation.

All of these moves point to one thing: Solana is no longer just a trader’s favorite. It’s being taken seriously by institutions, and it’s becoming part of corporate balance sheets.

Retail Traders Are Still Hesitant

Even though institutions are buying, the retail crowd seems unsure. One way to track this is through spot netflows, which show how much SOL is moving in and out of exchanges.

Over the last few weeks, Solana saw more outflows than inflows. That means more people are selling than buying on exchanges, suggesting some traders are still taking profits or waiting on the sidelines.

However, this week, the metric has instantly turned green or net positive, showing profit-taking.

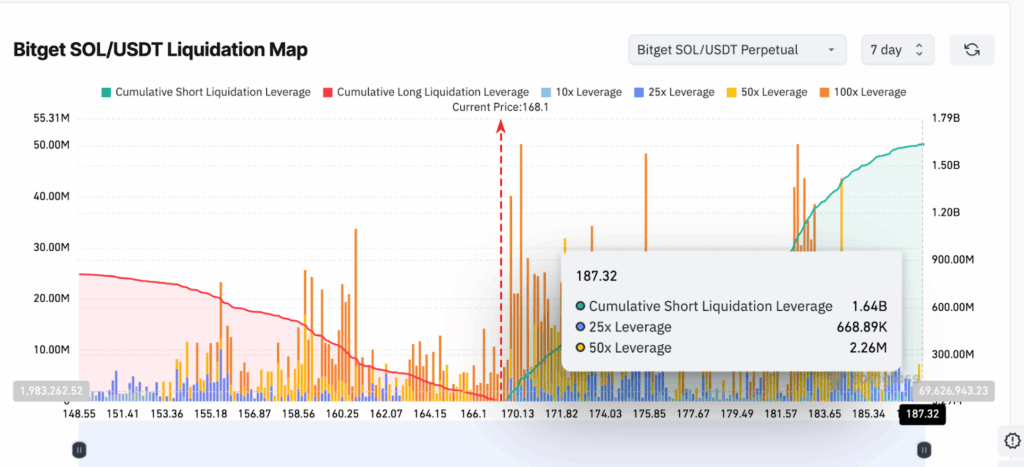

At the same time, the liquidation map for SOL/USDT on Bitget shows heavy short positioning.

Shorts are stacked around the $170 to $187 range, with about $1.64 billion in short leverage compared to only $810 million on the long side. This tells us most leveraged traders expect the SOL price to drop from here.

But if price moves above those short levels, it could trigger a wave of liquidations, causing a quick push up. That’s a key zone to watch.

Solana Price Prediction: A 52% Rally Is on the Table

As of writing, the Solana price was hovering around $168. Based on the Fibonacci extension levels, the next big resistance levels sit at $194, $218, and then $257.

If SOL price can push past these zones, it could deliver up to a 52% rally from the current level.

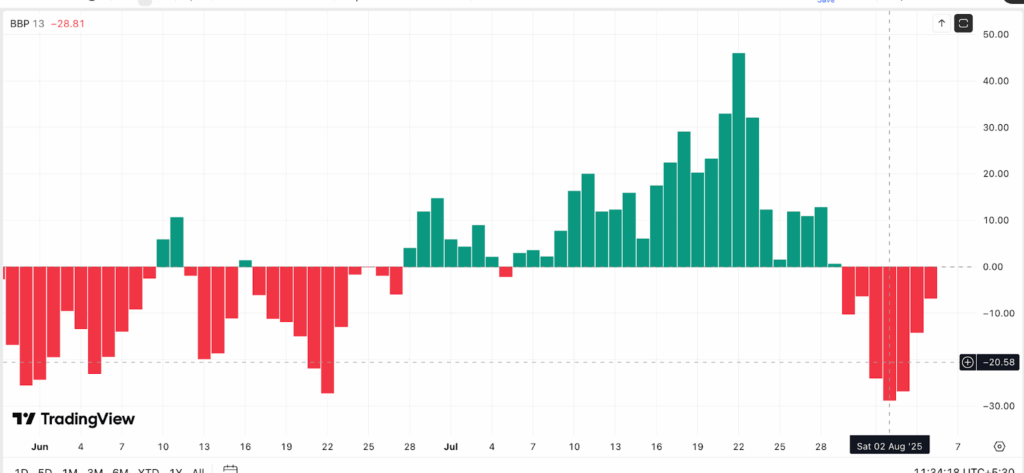

The bull-bear power indicator, which measures who’s stronger in the market, still shows the bears are in control, but the gap is narrowing.

That means the buying momentum is slowly returning, even though it hasn’t taken over yet. But then, bulls need to make a clean return for SOL to reclaim the $200 level.

For this rally to happen, institutional buying must continue, and retail traders need to stop betting against the move. Without both sides aligning, the solana price could stay stuck around current levels.