SUI Coin Primed for $9 Surge—Here’s the Trigger

Move over, meme coins—SUI’s got a real shot at a breakout.

The $9 Catalyst No One’s Talking About

Forget vague hype. SUI’s path to $9 hinges on one make-or-break factor: sustained whale accumulation paired with a Bitcoin rally past its 2025 resistance. No magic, just cold, hard liquidity.

Why Traders Are Quietly Stacking SUI

Smart money’s betting on SUI’s tech stack (that Move language efficiency) finally getting its day. But let’s be real—most ‘investors’ won’t notice until CNBC runs a panic headline.

The Fine Print

This isn’t financial advice—just a reminder that in crypto, price targets are 50% math, 50% collective delusion. Trade accordingly.

SUI crypto price showed strength after breaking out of a long-standing triangle pattern. With on-chain analysis and predictions, this bullish continuation action has paved the way for a potential rally to the $7-$9 target.

Meanwhile, with trading volume soaring and resistance levels flipping into support, sui price appears to be entering a new phase of upside momentum.

SUI Price Breaks Triangle, Sets $7 Target

SUI price has officially broken out of its descending triangle, triggering a bullish continuation structure.

Analyst Ali said that the breakout outside of this long-term trend pattern indicated a price target of 7 using Fibonacci extensions.

His updated 3-day chart showed SUI price trading around $3.95 after pushing above the triangle resistance near $3.90.

This consolidation triangle accumulation, occurring between January and July, squeezed the price movement between $2.25 and $3.90.

After repeated rejections at the descending resistance, sui price finally broke above with strong candle closes and higher lows.

According to the analysts, the next resistance is the 0.786 Fibonacci retracement point of $4.20. Upon clearing that, Fibonacci extensions hint at targets of $5.36, $7.30, and $8.58.

The present configuration duplicated classic continuation patterns, where the breakout above long-term compression zones leads to expansion phase. However, holding above $3.90 remained key for trend continuation.

Buyers Absorb Dip Near $3.56 and Reclaim $3.90

SUI crypto recent price action has supported the bullish predictions. According to Nastia Vox, SUI price briefly dipped to test the $3.56 support, but buyers stepped in with force and pushed the price back toward $3.70.

This rebound with rising volume indicated that the bulls are now keen on defending the breakout region.

The MOVE under $3.60, followed by instant upward pressure, is typical of a liquidity sweep to clear weak hands before continuation.

Since then, SUI price has not only reclaimed the $3.80 level and is now attempting to FORM higher lows above the breakout trendline.

If this structure holds, it sets the stage for another leg higher toward $4.80 and beyond. At the time of writing, the intraday bounce of 4.3% saw SUI coin go as high as $3.8

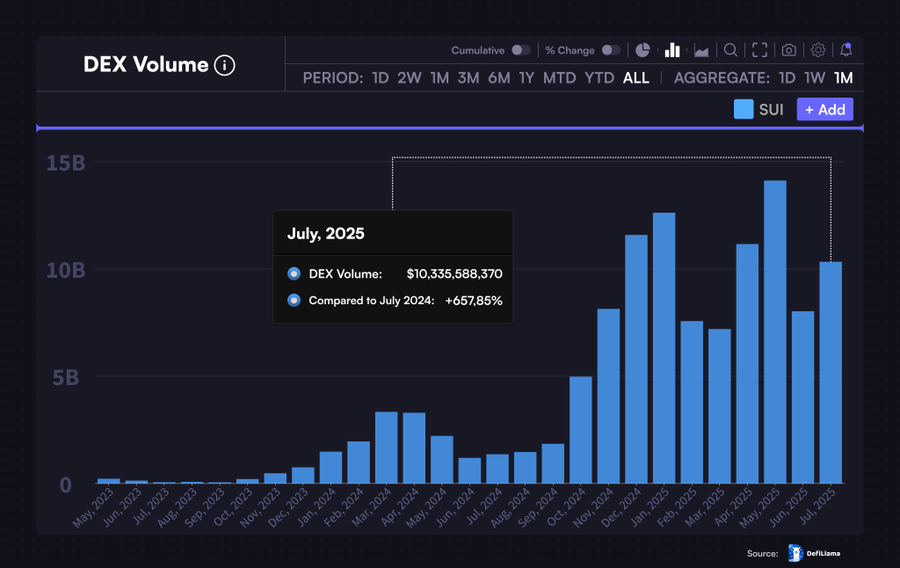

SUI DEX Volume Soars to $10 Billion in July

More so, fundamental on-chain data backs the technical setup. According to ToreroRomero, SUI decentralized exchange (DEX) volume surpassed $10.3 Billion in July 2025.

This was a huge 657.85% rise in July 2024, indicating exponential growth in user engagement and liquidity.

Such volume growth suggested broader adoption of the SUI network’s DeFi ecosystem. These are not speculative flows, as high DEX activity indicated that users are actively using the chain.

As liquidity deepens, SUI becomes more resilient to volatility and better positioned to attract large-cap traders.

Hence, SUI crypto breakout is also supported by increasing network demand. The convergence of the price with the on-chain growth provided a stronger case for the sustained rally.

Analyst Sees Upside Toward $9 if Momentum Sustains

In the meantime, analyst Mr. APE presented a bullish side of the matter, anticipating that the setup may move to $7.50-$9.00 before the end of Q4.

He pointed out that the triangle breakout was typical of continuation patterns consisting of a consolidation phase, the breakout, an increase in volume, and reversal resistance.

He noted that the $3.45 resistance, which had previously rejected several uptrends, was eventually overcome after seeing buying strength.

That was a technical move that eliminated weak hands on the CETUS hack and left a strong foundation of long-term holders.

Mr. APE looks at this as a zone where the smart money can go in, as sell-side pressure has been diminished.

The pattern resembled past rallies where clear breakouts resulted in multi-week expansions.

His chart indicated a possible technical path to 107.5% measured move of the breakout base and a short-term technical projection of levels of $7.80-$9.00.