Bitcoin (BTC USD) Price Plunge: How Low Will It Go?

Bitcoin's nosedive has traders scrambling—is this a buying opportunity or the start of a deeper crash?

Whales are circling, retail is panicking, and your portfolio just got a whole lot redder. Here's what's really moving the market.

Meanwhile, Wall Street's 'experts' are still trying to time the bottom—just like they did at the last ATH.

Bitcoin (BTC USD) price has recorded a significant retreat today, losing more than 2% and hovering NEAR the $116k level.

The latest dip comes amid a massive selloff by market participants, with many leaning towards a profit-booking strategy after the robust rally.

Notably, this has also fueled speculations that BTC could lose more in the near future. Amid this, market pundits have shared mixed insights, predicting a further decline in the flagship crypto’s price.

However, despite the gloomy predictions, experts remain bullish on the future trajectory of the crypto.

In other words, BTC may face more rejection before witnessing a strong rebound in the coming days.

Besides, the institutional interest, which appeared to have faded this last week, is also bouncing back. Considering all these aspects, the future of Bitcoin price looks promising.

So, here we explore some of the potential reasons behind the recent dip in BTC and where the crypto might be heading next.

Why is Bitcoin (BTC USD) Price Falling Today?

Bitcoin (BTC USD) price has slipped more than 2% today and fallen to to about $15,384 in the last 24 hours.

However, it recorded some recovery and traded at $116,560 at the time of writing, with its trading volume soaring over 38% to $103.7 billion.

However, the BTC/USDT chart shows a 8.42% gain over the last 30 days, albeit with the recent retreat. But the weekly performance showed a 0.60% drop from a high of around $120k.

Meanwhile, despite the recent plunge, derivatives data suggest otherwise. BTC Futures Open Interest (OI) ROSE around 6% from yesterday to $88.23 billion.

However, it’s worth noting that the OI on the CME exchange slipped around 3% during writing.

Notably, the latest plunge could be due to the waning risk-bet appetite of investors. In addition, a massive selloff by institutions might have also weighed on the investors’ sentiment.

Institutional Interest Weakens, But Latest Data Gives Relief

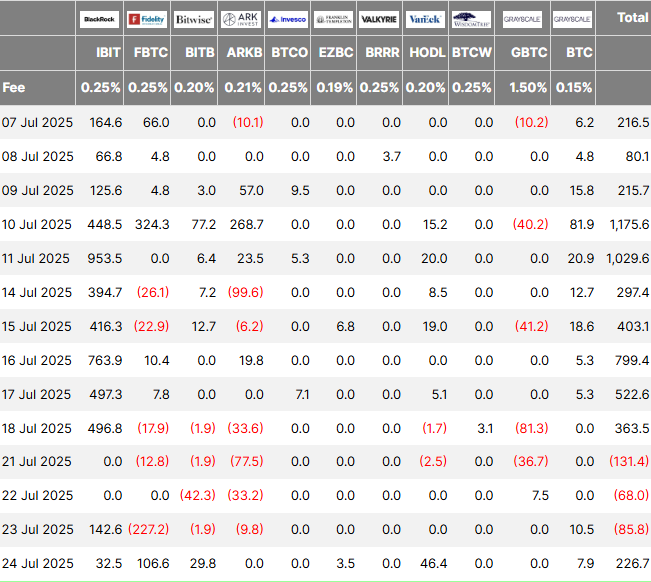

The institutional interest in Bitcoin (BTC USD) appears to have faded since the week’s start, as evidenced by the US Spot Bitcoin ETF fund flow figures.

The US Spot BTC inflow recorded outflow for three straight days through July 23, breaking its 12-day inflow streak.

From July 21 to 23, the overall outflow totaled $285.2 million, with Fidelity’s FBTC contributing the highest outflux of $240 million.

This robust outflow has sparked investors’ concerns, with many evaluating the risk of waning institutional interest.

However, on Thursday, July 24, the investment instrument reversed track with a significant inflow of $226.7 million. It’s worth noting that FBTC has contributed the most with $106.6 million influx on Thursday.

This appears to have provided some relief to investors, aiding in the recovery of the Bitcoin price. If the positive momentum holds, the crypto might continue to wipe off its recent losses in the near future.

Investors Shifting Focus to Altcoin

Another potential reason behind the recent pullback for Bitcoin (BTC USD) could be the shifting investors’ focus towards altcoins.

The altcoins have recorded a massive drop on July 24, which might have made them more attractive to investors.

Having said that, the investors might have leaned towards the lower-price BTC peers. Notably, the theory is further evidenced by the recent rally of over 2% in ethereum price.

In addition, the BTC dominance also fell by around 4% today, while the ETH dominance soared around 3%.

$3.5 Billion Bitcoin Dump Fuels Speculation

The recent dip in bitcoin price also comes amid a heavy selloff by a corporation, which has sparked discussions among traders.

For context, a renowned corporation, Galaxy Digital, is on a BTC selling spree, which has dampened traders’ sentiment.

The leading on-chain transaction tracking platform, Lookonchain, reported the selloff.

According to a recent X post, Galaxy Digital transferred nearly 30,000 BTC, worth $3.5 billion, to exchanges, where most of it was sold.

Following the Bitcoin sale, the corporation withdrew $1.15 billion in USDT from exchanges. Despite the large-scale divestment, Galaxy Digital still holds 18,504 BTC, worth around $2.14 billion.

However, traders are growing concerned that if the corporation continues its selling spree, it could trigger another dip in Bitcoin price.

Analysts Predict Further Bitcoin (BTC USD) Price Dip, But There’s a Catch

Amid the ongoing dip in BTC price, analysts have hinted at a further dip ahead.

For context, in a recent X post, expert Michael van de Poppe said that if BTC loses the $114k support, it could witness a further dip to the $110k-$112k range.

Echoing a similar sentiment, analyst MMCrypto also said that Bitcoin price could drop to $112.374.

While these predictions have sparked discussions, the analysts appear to have remained bullish on the future trajectory of the coin.

For context, van de Poppe noted that a retreat to $112k WOULD be a “brilliant area to accumulate.”

In other words, the dip could allow more traders to enter the market, potentially lifting the BTC price higher.

In addition, the expert also said that if Bitcoin (btc usd) price could hold the $115.6k support, it could continue its run to the north.