XRP Primed for $6 Surge as Ripple Smashes Critical Milestone

Ripple's latest breakthrough sends XRP bulls into overdrive—price eyes a seismic $6 breakout.

Ripple's infrastructure hits escape velocity

The payments giant just flipped a key adoption switch that could turbocharge XRP's liquidity. No specifics yet, but the market's already pricing in the domino effect.

Technical setup screams accumulation

Charts show XRP coiled tighter than a Wall Street trader's stop-loss trigger finger. That $6 target? Not a moonboy fantasy—it's the measured move from this consolidation pattern.

Regulatory clouds part (for now)

With the SEC lawsuit in the rearview, institutional money's finally warming to XRP's cross-border utility. Funny how compliance works when you're not getting sued.

Bottom line: This isn't 2017's meme-fueled pump. Real adoption meets technical perfection—just don't tell the Bitcoin maxis.

Key Insights:

- XRP price broke out of a symmetrical triangle pattern, targeting $6.

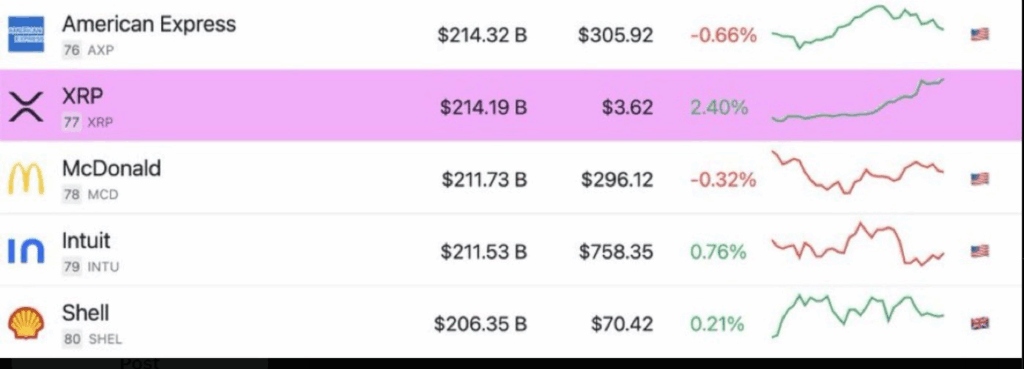

- XRP’s market cap hit $215.5B, surpassing McDonald’s, ranking it as the 83rd largest mainstream asset globally.

- XRP investment products saw $36M in weekly inflows as digital asset fund flows hit a record $4.39B.

XRP price is approaching a major technical breakout as its market capitalization crossed $215.5 Billion.

This Ripple news saw the top altcoin market cap surpass that of McDonald’s and position it as the 83rd largest mainstream asset globally.

The cryptocurrency was trading near $3.60 after gaining over 65% over the past week. This is backed by powerful institutional buying and a broken move out of a symmetrical triangle resistance.

The strength and bullish structure of the XRP market have made analysts set a price target of up to $6 short term.

XRP Price Triangle Breakout Setup Points to $6 Target

In the latest crypto news, xrp price has escaped a multi-month symmetrical triangle. The chart, shared by analyst Ali Martinez, showed a confirmed breakout above the triangle’s upper trendline. The breakout occurred after XRP crossed the $2.80 resistance level in early July.

Since the breakout, XRP price has climbed above multiple Fibonacci retracement levels. The price moved above $3.00 and surpassed the 1.0 Fibonacci level at $3.40.

Analysts often view this level as a key signal of a trend continuation. Martinez marked the 1.618 Fibonacci extension at just under $6, making it a critical near-term target.

XRP price pattern formed between January and July 2025. The triangle compressed price action with lower highs and higher lows.

A breakout is regarded as a closure of consolidation and the beginning of a new bullish direction. The increased trading volume also confirmed momentum during the breakout.

XRP was trading at about $3.56 at press time, an increase of around 0.1% within the past 24 hours.

The top altcoin is holding above the $3.50 resistance zone, with trading volume surging over 26% in the last 24 hours. If the altcoin holds, the next Fibonacci levels NEAR $4.40 and $5.00 remain potential targets.

XRP Market Capitalization Surpasses McDonald’s

XRP had just clocked a market capitalization of $215.5 Billion. This valuation puts XRP ahead of McDonald’s and ranks it as the 83rd largest mainstream asset.

The development came as altseason indicators crossed above 50 for the first time since December, signalling a shift in market focus. Bitcoin’s dominance also declined, while Ethereum’s share of the market continued to rise.

According to recent crypto news, Altcoin Season 3.0 is coming as Bitcoin dominance breaks below key support levels.

The RSI on altcoin charts has rebounded from a multi-year trendline, mirroring past cycles from 2015, 2019, and 2023. With this momentum, XRP price is now among the top gainers in 2025.

Institutional Inflows and Futures Data Support XRP Price Rise

Last week, XRP products showed an inflow of $36 Million. CoinShares reported this following $104 Million of outflows last week.

The correction was influenced by the increase in institutional interest and an outlook of Optimism regarding the regulatory situation of Ripple.

Total digital asset fund inflows reached $4.39 Billion, setting a record for weekly inflows. XRP’s contribution places it among the top three inflow gainers after ethereum and Bitcoin.

XRP’s year-to-date net inflows now stand at $267 Million. Assets under management in XRP products average above $2 Billion.

Data provided by CoinGlass also supported the trend. XRP futures open interest went up to 10.81 Billion, an increase from the low of $3.54 Billion in June.

The rise indicated that traders are entering into new positions and anticipating additional changes in the price.

In the meantime, XRP price is approaching its all-time high of $3.84 recorded during the previous cycle.

Analysts are keen because the current price is getting close to this resistance level. Once XRP price breaks above $3.66, it can verify the next phase of the rally, probably to the $6 level.