Altcoin Season 2025: The Crypto Rally You Can’t Afford to Miss

Bitcoin's boring. Ethereum's institutional. The real action? Altcoins are primed for a violent breakout—here's why.

### The Altcoin Pump Playbook

When BTC dominance dips below 45% (like it did last week), capital floods into smaller caps faster than a hedge fund dumping toxic NFTs. Historical cycles suggest we're 3-6 weeks from peak alt mania.

### Four Telltale Signs

1. Meme coins outperforming blue-chips (again) 2. Binance listing 3 obscure tokens weekly 3. Your Uber driver asks about 'that Solana killer' 4. Tether printer goes brrr into DeFi pools

### The Cynical Trade

Smart money's already rotating profits from Bitcoin into high-beta alts—just like they did before the 2021 crash. Retail always arrives late to the party... and pays for the cleanup.

Key Insights:

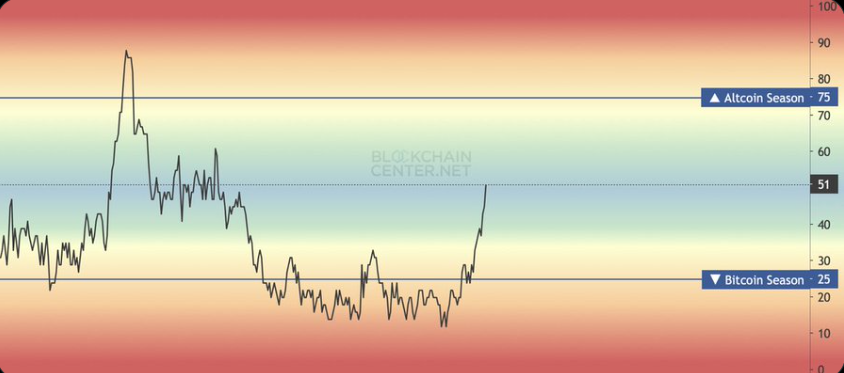

- Altcoin season Index has risen to 51, signaling a transition from Bitcoin dominance to altcoin momentum.

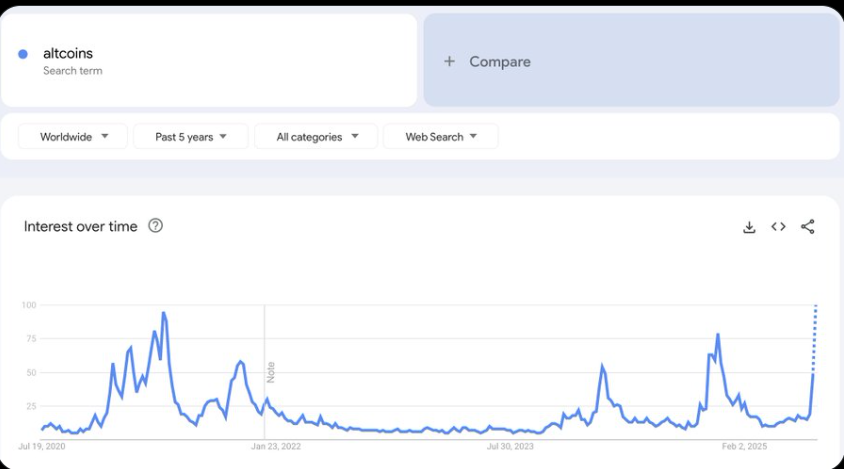

- Google searches for “altcoins” just hit a 4-year high, indicating rising retail interest in the crypto market.

- $TOTAL2 has broken out of a bullish channel, echoing past altseasons and signaling strong altcoin momentum.

A new wave of market indicators suggested that altcoins could be entering a surging phase. From chart breakouts to rising search interest and capital flow shifts, several data points signaled a possible rotation away from Bitcoin dominance with altseason starting soon.

Altseason Index Breaks 50 for the First Time in Months

The Altseason Index, a tool that measures whether altcoins are outperforming Bitcoin, recently climbed to 51.

It marked the first time it had traded above 50 in several months. It was a change of direction in the market whereby altcoins started gaining relative strength over Bitcoin.

The Altseason index utilized performance data from the top 50 altcoins and compared their returns against those of bitcoin over a 90-day period.

Crossing above the midpoint on this index indicated that more than half of these altcoins were outperforming Bitcoin. Historically, this has occurred during the early stages of the altcoin market growth.

While a confirmed altcoin season is generally recognized when the index exceeds 75, the movement past 50 is a transitional signal.

The latest structure resembled previous phases where altcoins reflected broader participation from both retail and institutional segments.

Google Search Trends Suggest Return of Retail Interest

More so, according to a recent update shared by market analyst Lark Davis, Google searches for the term “altcoins” have reached their highest level in four years.

The search data, based on worldwide queries over a five-year range, showed a steep increase in the last few days. This development was a renewed wave of interest in an altcoin season.

Notably, past surges in this search term have coincided with large crypto market bull runs, such as in 2017 and 2021.

The high search traffic revival showed further retail awareness and participation. This pattern may unfold with market volume, specifically low and mid-cap tokens that usually turn into speculative retail plays.

Capital Flows Shifting From Bitcoin to Altcoins

Moreover, whale tracking platforms and analyst commentary indicated that capital was rotating out of Bitcoin and into Ethereum.

This movement tends to happen in market cycles as traders seek to maximize returns by moving off the largest crypto asset to its successor. In these rotations, ethereum is usually the target of the first run.

Following this initial shift, historical patterns suggest that funds often move from Ethereum to a wider range of altcoins.

This cascading FLOW usually fuels rising prices across decentralized finance (DeFi), infrastructure, and meme tokens.

Analysts pointed to rising transaction volume and on-chain activity on Ethereum as early signals of this ongoing reallocation. If this trend continues, it may contribute to broader gains across the altcoin sector.

TOTAL2 Chart Breakout Mirrors Previous Altseasons

The TOTAL2 chart, which depicts the total defined market capitalization of cryptocurrencies other than Bitcoin, has just exited a bullish ascending channel.

Analyst crypto Yoddha noted that this breakout was similar to the previous patterns observed in notable altcoin rallies.

Similar patterns formed on the TOTAL2 chart in December 2017 and December 2021, when there was a peak in altcoin season.

Additionally, the breakout suggested the potential development of an uptrend in the altcoin market.

The chart pattern indicated consolidation followed by a breakout, a characteristic of cyclical bull markets.

Notably, the breakout zone also coincided with advancing price action on various large-cap altcoins. This means that it is a sector-wide move, not isolated gains.