🚀 Top 3 Crypto Stocks Primed to Explode as Q3 Altcoin Season Heats Up

Wall Street's sniffing around altcoins again—and these crypto-correlated stocks could ride the wave. Here's what's brewing behind the Q3 hype.

1. The Exchange Play: Betting on the House

When altcoins run, trading volumes explode. The big platforms rake in fees whether Bitcoin's pumping or Dogecoin's mooning. One exchange stock's quietly stacking regulatory wins—just in time for the frenzy.

2. The Miner Gambit: Beyond Bitcoin

Top miners now diversify into altcoin infrastructure. Their energy deals and rigs position them as picks-and-shovels plays for Ethereum, Solana, and other layer-1 networks prepping major upgrades.

3. The Dark Horse: Institutional Gateways

That obscure fintech with the SEC-friendly altcoin custody solution? Suddenly looking less like compliance theater and more like a backdoor for TradFi money chasing the next meme coin miracle.

Remember: In crypto seasons, the real profits often flow to those selling the shovels—or in this case, the stock tickers that let you pretend this is all 'investing.'

Key Insights:

- Crypto stocks of Circle, Coinbase, and Robinhood are positioned for a positive rally in Q3 2025.

- CRCL, COIN, and HOOD are all up in Pre-market trading in readiness for a bullish week ahead.

- Investors eye a potential Q3 2025 altcoin season, fuelled by historical patterns with crypto stock ties.

Over the years, crypto stock and associated currencies have solidified their position as a significant asset class. The market continues to attract interest from both individual and institutional investors.

The current bull run in the market is further fueling investor interest in stocks associated with crypto-based firms. cryptocurrency stocks allow investors to benefit from both the traditional stock and crypto prices.

As market participants turn their attention to Q3, here are three top crypto stocks to look out for:

Circle Internet Group (CRCL)

Despite a mild correction, Circle CRCL remains a top performer among other crypto stocks. According to data from TradingView, the CRCL stock was priced at $187.33, up 0.92% in pre-market trading.

Circle (CRCL) began trading on the New York Stock Exchange (NYSE) on June 5, 2025, following its Initial Public Offering (IPO). The stock opened at $69, surged to $103.75 intraday, and closed at $83.23.

Circle stock jumped 800% in just 18 days to trade at $279. Circle CRCL has rallied approximately 550% since the initial public offering. This rapid increase indicated strong demand and effective positioning.

As of July 14, 2025, the stock had a market capitalization of $42.64 Billion at the time of filing this story. Circle is the issuer of USDC, the second-largest stablecoin by market cap, $63 Billion (press time).

Beyond stablecoin settlements, Circle has a partner network of over 500. Additionally, the US Senate passed the GENIUS Act with a 68–30 vote on June 17.

This legislation creates the first federal framework for dollar‑pegged stablecoins, further boosting CRCL’s outlook.

Using a 10-year discounted cash FLOW model, Bernstein analysts forecasted a $230 target for Circle stock.

Coinbase Global Inc (COIN)

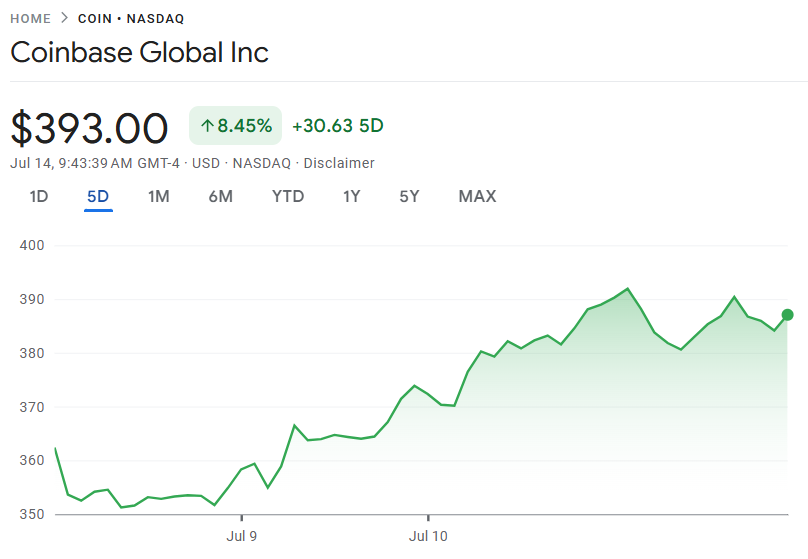

Coinbase (COIN) is another promising stock to watch in the third quarter of 2025. COIN has rallied in pre-market trading on July 14, 2025, according to Google Finance data.

The stock is currently traded at $387.06, reflecting a 55% increase year-to-date. As of writing, COIN was trading at $393 atop 5-day rally of 8.45%.

The Coinbase stock debuted at $381 on the Nasdaq Global Select Market on April 14, 2021. Price dropped below $50 in 2022, but it bounced back in 2023, 2024, and 2025.

The rally is supported by the growing popularity of Bitcoin Exchange-Traded Funds (ETFs) and the fourth Bitcoin halving.

Analysts are optimistic about the future outlook of COIN. Popular market analyst Ali Martinez recently predicted a $2,000 target for COIN, citing a rare bullish pattern on the COIN chart.

Moreover, COIN recently ROSE as high as $388.96, despite Ark Invest selling 16,627 units of its Coinbase stock.

Separately, the Czech National Bank has recently announced the acquisition of $18 Million worth of Coinbase shares during the second quarter of 2025.

Robinhood Markets Inc (HOOD)

Robinhood Markets, Inc. (HOOD) is the third crypto-related stock to consider in Q3 2025. HOOD opened at $98.34 on July 14, 2025, with a market capitalization of $86.78 Billion.

As of writing, it was up 4.05% in the last 5 days to $99.36.

Robinhood Markets has a fifty-two-week low of $13.98 and a fifty-two-week high of $101.50. HOOD surged over 163% year-to-date and 310.7% within the past year.

Analysts noted a strong rising trend, with some predicting a 117% rise in the next three months.

In a research note on Tuesday, July 1, KeyCorp boosted its price objective on HOOD shares from $60 to $110. The bank-based financial services company gave the HOOD stock an “overweight” rating.

In its last quarterly earnings released on April 30, Robinhood reported $0.37 earnings per share (EPS) for the quarter. This figure comes short of analysts’ consensus estimates of $0.41.

However, the firm reported revenue of $927.00 Million for the quarter, higher than the consensus estimate of $917.12 Million.

Beyond Crypto Stocks: Is an Altcoin Season in View in Q3?

Historically, the altcoin season follows Bitcoin’s strong rallies and subsequent consolidation.

According to CoinMarketCap data, bitcoin has hit a new all-time high of $123,000, driven by positive market sentiments.

This rally creates an opportunity for prices to consolidate, giving room for altcoins to shine.

Ethereum (ETH) often leads altcoin rallies, as its performance against Bitcoin signals broader altcoin market strength.

In the past 24 hours, ETH has surged over 2.7% to $3,046. Blockchains like Solana (SOL) and Avalanche have also benefited from the recent BTC rally.

Additionally, altcoins like Aave (AAVE) and Toncoin (TON) are seeing renewed interest due to their scalability and DeFi innovations.