Wall Street’s Ethereum Obsession: 5 Reasons It’s the Ultimate Reserve Asset in 2025

Move over, gold—Wall Street’s new shiny toy is Ethereum. Institutional investors are piling into ETH like it’s the last lifeboat off the Titanic (and let’s be honest, their traditional portfolios might need one). Here’s why the smart money’s betting big.

1.

Programmable Yield in a Zero-Rate World

Bonds? Barely breathing. ETH staking? Printing 5%+ while TradFi snoozes. The Fed’s stuck in neutral—Wall Street’s bypassing them entirely.

2.

The Deflationary Endgame

Post-Merge, ETH’s supply shrinks faster than a hedge fund’s patience during a bear market. Scarcity narrative meets hard-coded economics.

3.

Institutional-Grade DeFi Rails

BlackRock didn’t file for an ETH ETF because they like memes. The infrastructure’s now there—regulated custody, CME futures, the whole circus.

4.

The Bitcoin Hedge Play

Gold 2.0 was yesterday. Today’s macro whales want asymmetric upside with less volatility. ETH’s beta to BTC? Just spicy enough.

5.

Network Effects You Can’t Fake

A million devs building real things beats a PowerPoint about ‘digital gold’ any day. Even JP Morgan’s blockchain team admits it.

Of course, this all assumes Wall Street finally understood the whitepaper. Place your bets—the suits are late to the party, but they’re bringing the champagne.

Wall Street has shown growing interest in ethereum (ETH) as a reserve asset due to its key role in blockchain infrastructure and crypto market.

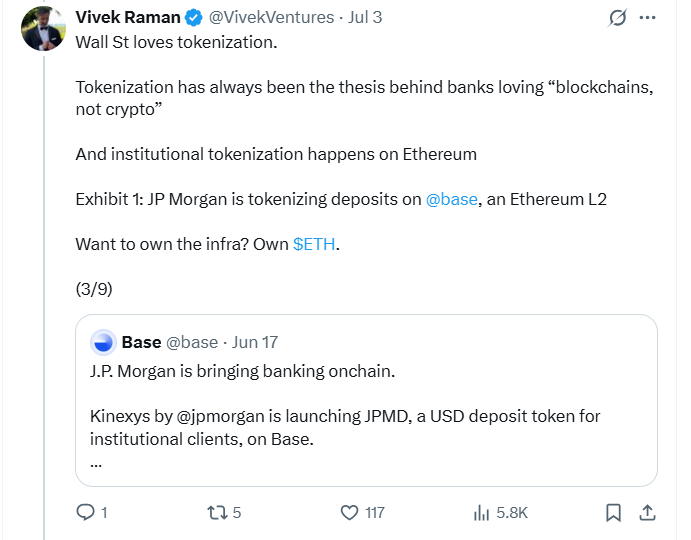

Notably, crypto researcher Vivek Raman highlighted stablecoins and tokenization as contributing factors.

Ethereum (ETH) Infrastructure Role Draws Institutional Interest

Ethereum emerged as a top reserve asset for Wall Street due to its function in the infrastructure push in the crypto ecosystem.

Vivek Raman, a well-known figure in the crypto market, outlined this in a widely circulated thread on X.

First, he explained that Ethereum powers much of today’s decentralized finance (DeFi) and serves as the base layer for tokenization and stablecoins.

Raman stated that Wall Street had a history of investing in infrastructure that stood the test of time. This is the second solid reason the coin is currently attractive.

In previous eras, this included railroads and telecommunications. Today, Ethereum provides a digital version of such infrastructure, often referred to as “digital oil.”

Due to its foundational role, institutional investors are treating Ethereum as a long-term strategic asset.

Ethereum’s LAYER 2 networks played a critical part in this development.

For example, JPMorgan utilized Base, an Ethereum Layer 2, to develop Kinexys, a platform for tokenized deposits.

Meanwhile, Robinhood tokenized stocks using Arbitrum, another Ethereum Layer 2.

According to Raman, institutions were not just interested in cryptocurrencies but in the platforms that powered financial innovation.

Owning Ethereum, he explained, meant owning a portion of the infrastructure behind these services.

This outlook aligned with how traditional markets valued companies or systems enabling large-scale activity.

Tokenization and Stablecoins Strengthen Ethereum’s Case

The Tokenization of real-world assets was another reason Wall Street turned its focus to Ethereum.

Raman noted that financial firms preferred the idea of using blockchain for asset representation.

They do this without necessarily embracing crypto market speculation. Ethereum provided the most active environment for such tokenization projects.

Raman pointed out that major players, such as JPMorgan, had already deployed tokenization on Ethereum’s networks.

These efforts made Ethereum a logical infrastructure choice for more institutions exploring similar strategies.

Stablecoins are another reason Wall Street is banking on Ethereum. These tokens generally support Ethereum’s reserve asset status.

According to crypto market insights, the stablecoin market has reached $250 billion and could scale to $2 trillion.

It is worth mentioning that most of these digital assets were issued on Ethereum.

Firms like Circle, which issued the USDC stablecoin, had already received equity investment from traditional financial institutions.

Raman explained that Ethereum could be the next logical step in these institutions’ crypto exposure.

Analyst Tom Lee had suggested that banks might begin buying Ethereum to ensure operational stability for their stablecoin holdings.

Crypto Market Momentum and Narrative Shift Influence Strategy

Raman identified market catalysts that could explain rising Ethereum investments.

He mentioned companies like SharpLink Gaming and BitMine Immersion Technologies, both of which attracted new inflows into Ethereum (ETH)-related assets.

These firms operated with the involvement of high-profile individuals, including Joseph Lubin and Tom Lee.

Wall Street often responded to positive price catalysts and emerging narratives.

Ethereum’s increased association with stablecoin growth and financial infrastructure attracted this kind of attention.

Lastly, Raman named the potential of Ethereum playing the role of the next Bitcoin as a key attraction point for the asset.

It is essential to add that many investors had missed the major price surge in Bitcoin’s early years.

Ethereum’s sideways performance over five years, he suggested, resembled other pre-breakout market movements.

According to the thread, Ethereum could undergo repricing if its use cases continued to grow.

Its position in tokenization, stablecoins, and DeFi WOULD be key to that shift.

If anything, Wall Street’s current interest in Ethereum (ETH) reflected long-term strategic thinking.

Raman’s analysis identified infrastructure, tokenization, and market activity as the primary reasons. Ethereum’s role in blockchain finance appeared set to expand further.