Metaplanet Doubles Down: Adds $238.7M in Bitcoin, Amasses 15,555 BTC Treasury

Tokyo-listed Metaplanet just turbocharged its crypto reserves—snapping up another $238.7 million worth of Bitcoin. Their total stash now? A staggering 15,555 BTC.

Why the frenzy? While traditional markets wobble, the firm’s betting big on crypto’s inflation-proof narrative. Hedge funds take notes—this isn’t your grandpa’s ‘diversification’ play.

Bonus jab: Meanwhile, Wall Street still thinks ‘blockchain’ is a type of Peloton accessory.

Key Insights:

- Metaplanet acquired an additional 2,205 BTC for $238.7 million, with total Bitcoin holdings reaching 15,555 BTC.

- Metaplanet shareholders increase amid Bitcoin treasury strategy as it aims to become the 4th largest Bitcoin holder by this year.

- Stock price rebounded over 1% higher but closed 0.45% higher at 1,552 yen on Monday

Metaplanet Inc, aka Asia’s MicroStrategy, has acquired an additional 2,205 BTC for $238.7 million. With the latest purchase, the company has increased its total Bitcoin holdings to 15,555 BTC and approached to flip Riot Platform’s Bitcoin holdings.

At the time of writing, the stock price has rebounded from its recent fall and jumped more than 1.50% to 1,569 yen.

Asia’s MicroStrategy Metaplanet Net Bitcoin Holdings Reaches 15,555 BTC

According to a press release on July 7, Japan-based Metaplanet acquired an additional 2,205 BTC at $108,237 per Bitcoin.

With the latest bitcoin purchase, the company has increased its total Bitcoin holdings to 15,555 BTC, acquired for nearly $1.54 billion at an average price of $99,307 per Bitcoin.

After the latest buy, the company has achieved a BTC yield of 129.4% last quarter and a BTC yield of 416.6% YTD 2025. On a quarter-to-date or QTD basis, its BTC Yield is at 15.1% until now.

In an X post, CEO Simon Gerovich reaffirmed that they WOULD never end up stacking Bitcoin for achieving a high yield with their Bitcoin acquisition strategy.

He celebrated the recent acquisition of an additional 2,205 BTC, continuing to accelerate Bitcoin purchases to generate value for its shareholders.

Metaplanet Advances to Become a Leading Corporate BTC Holder

On June 30, Metaplanet acquired 1,005 BTC for $108.1 million at $107,601 per Bitcoin. The company’s Bitcoin holdings surpassed Galaxy Digital and CleanSpark’s Bitcoin holdings to become the 5th largest corporate Bitcoin holder.

The company also announced the approval of the board to issue the 19th Series of ordinary bonds to EVO FUND last week. Metaplanet decided to proceed with the buyback and cancellation of the 3rd series of bond offerings as they bear interest and are secured by collateral.

Notably, Asia’s MicroStrategy will use the remaining funds to buy more Bitcoin. The firm seeks to claim the 4th position in the top 10 corporate Bitcoin holders list.

Metaplanet recently revised its target to hold 30,000 BTC by 2025. Also, the company plans to hold 100,000 BTC by 2026 and 210,000 BTC by the end of 2027, under the Accelerated 2025-2027 Bitcoin Plan.

Metaplanet Stock Price Rebounds from Slumber

Metaplanet stock faltered after the company announced a plan to raise $5.4 billion to hold at least 210,000 BTC by 2027. However, the recent inflow from shareholders has rebounded the stock price.

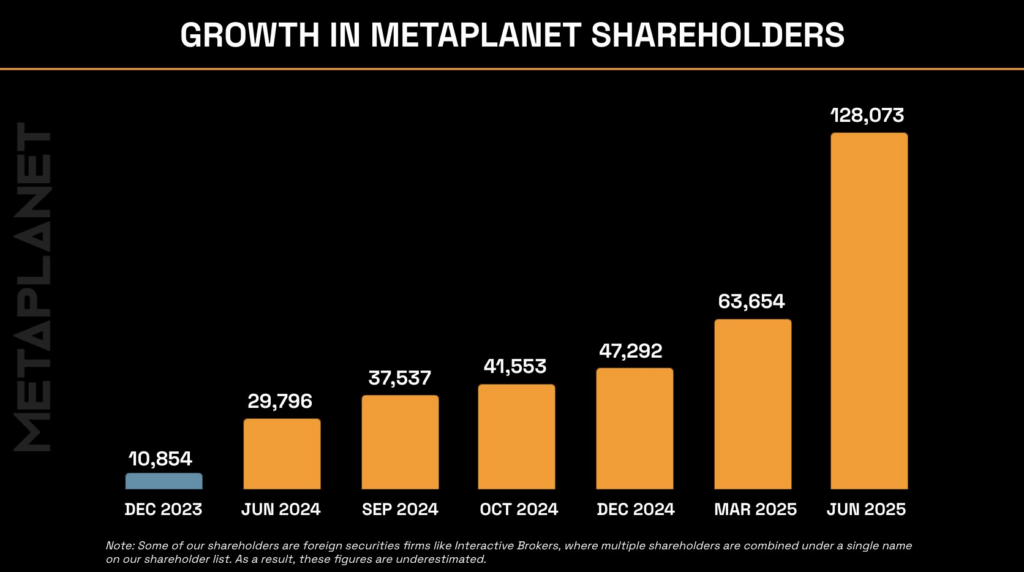

On Thursday, Simon Gerovich said Metaplanet shareholders have doubled in just 3 months to 128,073.

“Thank you to everyone who’s joined us on this journey. We’re deeply grateful for your belief in our mission,” he added.

Metaplanet Inc. (3350.T) stock price closed 0.45% higher at 1,552 yen on Monday. The 24-hour low and high were 1,480 and 1,604 yen.

As per Yahoo Finance, the stock price has rallied nearly 16% in a month and 346% year-to-date.

Bitcoin Price Hints at Making New ATH

BTC price picked up upside momentum again amid massive trading activity as technical indicators turned bullish. Matrixport predicted Bitcoin to hit $116K in July based on historical patterns of on average 9% gains in 7 out of the last 10 years.

In contrast, veteran trader Peter Brandt, 10x Research, and other analysts believe Bitcoin price can hit at least $135K in the coming months a bull flag pattern formation in the daily chart.

At the time of writing, BTC price was trading at $109,001 after paring some gains in the last 24 hours. The 24-hour low and high were $107,847 and $109,731, respectively.

Furthermore, the trading volume increased by 30% in the last 24 hours, indicating a rise in interest among traders.