Ethereum’s Gigagas Era: Justin Drake Unveils 10,000 TPS Vision—Can ETH Outpace Visa?

Ethereum Foundation researcher Justin Drake just dropped a bombshell: The network's next evolution targets a staggering 10,000 transactions per second. Move over, 'ultrasound money'—welcome to the Gigagas era.

Why it matters: If achieved, Ethereum could process transactions at speeds rivaling traditional payment giants (while Wall Street still struggles to settle trades in less than three days).

The tech behind the leap: While Drake kept specifics under wraps, the roadmap likely combines sharding upgrades with Layer 2 superchargers—a one-two punch against blockchain's scalability trilemma.

The cynical take: Banks will 'explore the technology' for five years before launching their own 300 TPS permissioned chain with a 40% failure rate.

The ethereum network is looking to boost its transaction speeds in a fresh attempt at refreshing its appeal as a top blockchain.

Researcher Justin Drake recently revealed a new roadmap for what he termed as a Ethereum’s gigagas era.

According to Drake, the gigagas era means Ethereum will be able to consume 1 gigagas per second which translates to about 10,000 TPS.

An ambitious goal for the Ethereum LAYER 1 considering that it struggled with transaction bottlenecks in the past.

According to the Ethereum researcher, Ethereum will deploy ZK VMs and real-time proving to achieve the ambitious goal. But will the network’s efforts allow it to finally overcome its scalability challenges?

Perhaps more important were the reasons for the push towards 10,000 TPS. The ambitious goal was fueled by the need for Ethereum to be ready for mass adoption considering the recent pro-crypto changes across the world.

A higher TPS WOULD benefit the Ethereum network and aid in retaining a dominant position as one of the top smart contracts blockchains.

Ethereum Reserves on Exchanges on The Rise

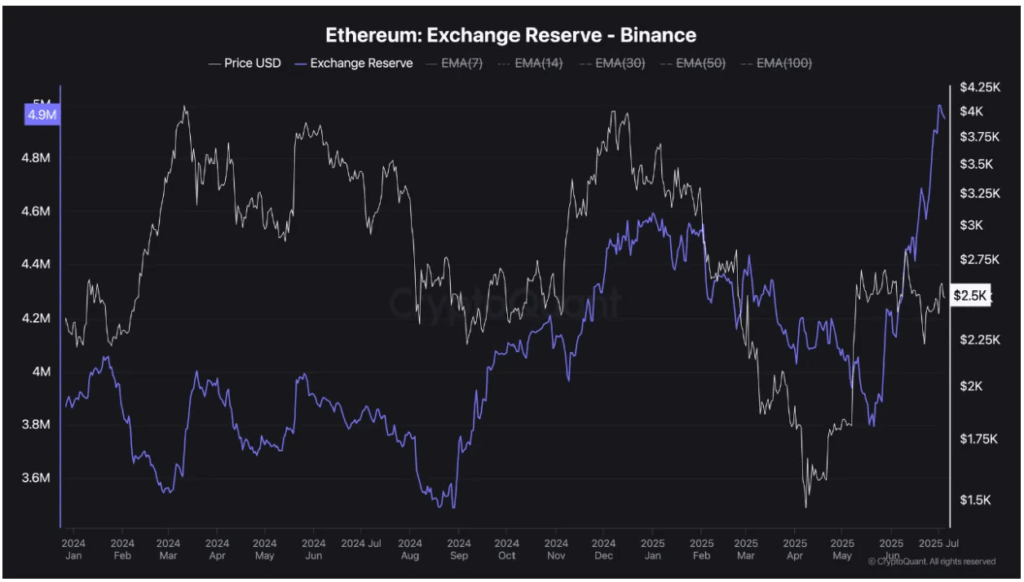

On-chain data recently revealed a massive spike in ETH exchange reserves on Binance. Cryptoquant recorded that Ethereum reserves on Binance surged from around 3.8 million ETH in May, to around 4.9 million ETH so far in July.

The surge pushed ETH exchange reserves on Binance to their highest levels in more than 18 months.

Some analysts interpreted this MOVE a sign of sell pressure and it coincided with outflows from the Ethereum Foundation’s addresses.

Recent reports revealed that the Ethereum Foundation has been moving ETH from its accounts. The foundation moved roughly 1000 ETH from its wallet, marking the 21st outflow observed since April.

Despite the surging exchange reserves, the aggregate demand for ETH across the crypto market remained relatively strong.

The cryptocurrency managed to balance out the sell pressure with the demand in the last few months.

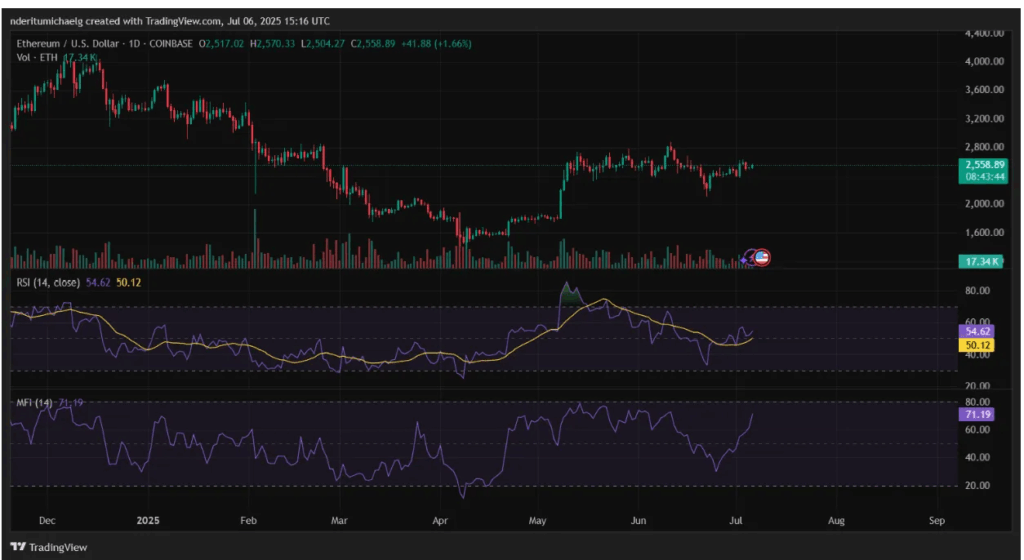

As a result, ETH moved within a narrow range and maintained its position close to the $2,500 price level.

It exchanged hands at $2,557 at press time, after gaining by over 14% from its lowest price point in June.

ETH Whales Contribute to Sell Pressure on Binance

While the situation highlighted a strong focus on long-term holding among a faction of ETH traders, it also underscored the presence of sell pressure.

The tug of war between the bulls and the bears will eventually give way to one side and this warrants a look at some of the key drivers of price movements.

Recent whale activity signaled efforts at triggering a pattern break. Large orderbook statistics revealed that whales dumped over $19 million worth of ETH on Binance in the last 2 days which would traditionally indicate a potential bearish move ahead.

However, whales also executed about $3.25 billion worth of ETH Binance derivatives on the Binance perpetual market. Shorts on the OKX exchange perpetual market surged above $906 million.

Whale activity formed what looked like a market manipulation scenario. The spot sale could potentially spoof investors into anticipating sell pressure while an unexpected upside would allow Binance whales to reap substantial profits.

In addition, the large derivatives positions signaled expectations of profits from small price moves. Ethereum (ETH) was up by about 1.7% in the last 24 hours at the time of observation despite the whale outflows in the spot segment.

Money FLOW remained positive despite the recent signs of whale sell pressure. Despite these observations, ETH previously demonstrated a strong accumulation pattern which could potentially tilt outcomes in favor of the bulls if strong demand makes a comeback.