Ethereum Price Prediction 2025: Can ETH Smash Through the $4,000 Ceiling?

- ETH Technical Analysis: The Bull Case

- Institutional Demand Heats Up

- ETF Inflows Break Records

- Market Structure Supports Further Gains

- The $4,000 Question

- Potential Roadblocks

- Frequently Asked Questions

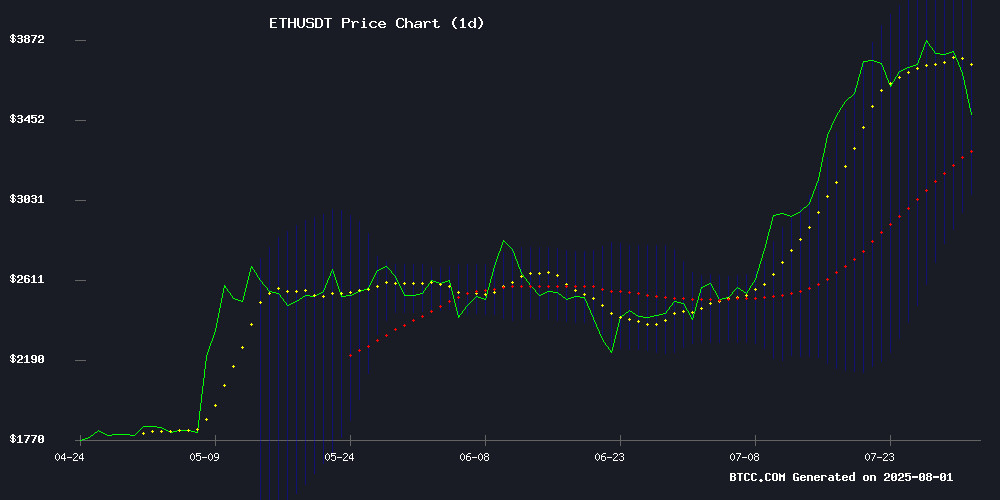

Ethereum (ETH) is showing all the signs of a major breakout as we head into August 2025. Currently trading at $3,630.91, the second-largest cryptocurrency by market cap has gained an impressive 56% in July alone - its best monthly performance since 2022. With institutional demand surging, technical indicators flashing green, and ETF inflows hitting record levels, many analysts believe the $4,000 barrier could be ETH's next stop. But will it hold? Let's dive into the data.

ETH Technical Analysis: The Bull Case

According to TradingView data, Ethereum's price action paints a bullish picture. The cryptocurrency is currently trading above its 20-day moving average ($3,589.07), which typically signals upward momentum. The MACD indicator shows a positive crossover with the histogram at +111.06 - another strong buy signal for traders.

Source: BTCC trading platform

Bollinger Bands analysis reveals ETH is hovering NEAR the middle band, with plenty of room to test the upper resistance at $4,107.85. "The technical setup suggests we could see ETH test $4,000 in the coming weeks," notes a BTCC market analyst. "The key will be whether it can sustain above $3,700 first."

Institutional Demand Heats Up

The institutional story for ethereum has become increasingly compelling in 2025:

| Institution | ETH Holdings | Recent Activity |

|---|---|---|

| The Ether Machine | 334,757 ETH | $56.9M purchase in July |

| BlackRock | 2.5% of supply | $375M added this week |

| FTX/Alameda | 20,736 ETH | Recently staked |

Corporate treasuries now hold over $10 billion worth of ETH - about 2.27% of total supply. This represents a seismic shift in institutional crypto strategy compared to just a year ago.

ETF Inflows Break Records

U.S.-listed spot Ethereum ETFs have attracted $5.4 billion in net inflows - their best streak since launch. This flood of institutional money has been a key driver of ETH's 56% monthly gain.

"We're seeing similar patterns to the 1990s tech boom," observes Bloomberg's Eric Balchunas. "The ETF approvals opened the floodgates for traditional finance money to Flow into crypto."

Market Structure Supports Further Gains

Several on-chain metrics suggest ETH's rally might have legs:

- Low funding rates (unlike the overheated derivatives activity seen in Q1 2024)

- Whales acquired 220,000 ETH ($850M) in just 48 hours

- NFT sales surged to $574M in July despite fewer unique buyers

This combination of strong fundamentals and technicals creates what analysts call a "perfect setup" for continued appreciation.

The $4,000 Question

Can ETH break through the psychologically important $4,000 level? Here are the key factors:

| Indicator | Current Value | Implications |

|---|---|---|

| Price vs 20MA | $3,630.91 > $3,589.07 | Bullish |

| MACD Histogram | +111.06 | Bullish |

| Bollinger %B | 0.5 (neutral) | Room to upper band |

With technicals aligned and institutional demand accelerating, ETH has about 10.2% upside potential to $4,000 if it can break through the $3,700 resistance level.

Potential Roadblocks

Not everything is smooth sailing for ETH:

- The $4,500 level has historically acted as strong resistance

- Nearly half of active addresses are in profit, which could lead to selling pressure

- The crypto market is entering a historically quieter seasonal period

As always in crypto, volatility is virtually guaranteed. While the setup looks bullish, traders should brace for potential pullbacks along the way.

Frequently Asked Questions

What's driving Ethereum's price surge in 2025?

The combination of spot ETF approvals, institutional accumulation, and improving technicals has created perfect conditions for ETH's rally. The cryptocurrency has benefited from both speculative fervor and genuine adoption.

How likely is ETH to reach $4,000?

With current momentum and market structure, many analysts see $4,000 as a probable near-term target. The key level to watch is $3,700 - if ETH can sustain above that, $4,000 becomes much more likely.

Are institutions really buying ETH?

Absolutely. Public companies now hold over $10 billion in ETH, with entities like The Ether Machine, BlackRock, and Bitmine leading the charge. This represents a major shift from just a year ago when institutional ETH holdings were minimal.

What are the risks to ETH's price?

Potential roadblocks include profit-taking at key resistance levels, seasonal market slowdowns, and macroeconomic factors like interest rate decisions. The $4,500 level has historically been particularly tough resistance.

Is now a good time to buy ETH?

This article does not constitute investment advice. That said, the technical and fundamental setup appears favorable, though as with any investment, there are no guarantees in crypto markets.