Bitcoin Price Forecast 2025-2040: Expert Predictions & Market Drivers

- Current Bitcoin Market Snapshot

- Technical Analysis: Bullish Signals vs. Resistance Levels

- Institutional Activity: The $9 Billion Whale Move

- Wall Street's Growing Bitcoin Appetite

- Nation-State Adoption: El Salvador's Bitcoin Strategy

- Corporate Bitcoin Adoption Expands Globally

- Long-Term Bitcoin Price Forecasts: 2025-2040

- Retirement Planning with Bitcoin?

- Key Risks to Watch

- Bitcoin Price Prediction FAQs

As bitcoin continues its volatile journey, analysts are looking beyond short-term fluctuations to predict where BTC might be headed over the next 15+ years. This comprehensive analysis examines current technical indicators, institutional activity, and macroeconomic factors shaping Bitcoin's potential trajectory through 2040. We'll explore expert price targets from $135K (2025) to $3M (2040), while analyzing key market-moving events like Galaxy Digital's $9B transaction and Citigroup's bullish projections. Whether you're a long-term holder or active trader, understanding these fundamental drivers could prove invaluable for navigating Bitcoin's next chapters.

Current Bitcoin Market Snapshot

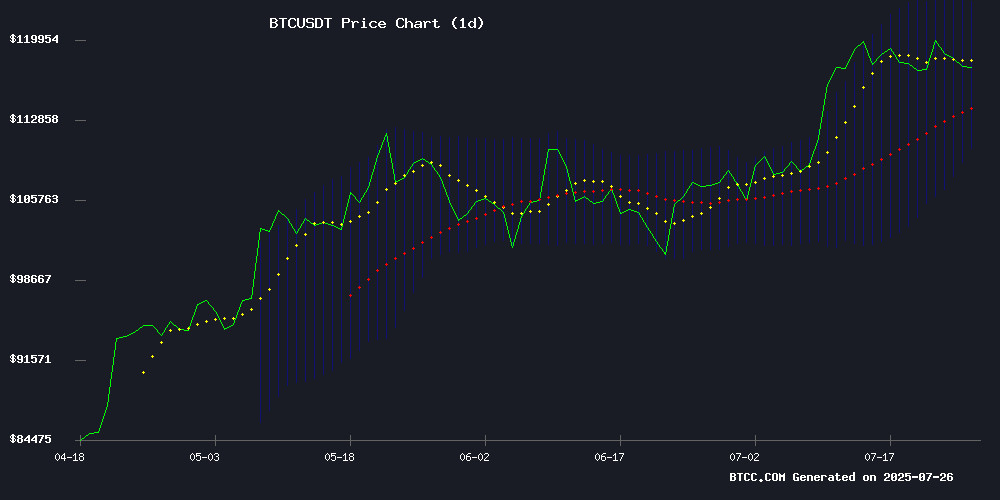

As of July 2025, Bitcoin trades at $118,148.53, showing resilience after testing support near $117,000. The cryptocurrency remains 6.1% below its all-time high of $123,000 set earlier this month, with technical indicators suggesting potential for both continuation and correction scenarios.

Source: BTCC Trading Platform

Technical Analysis: Bullish Signals vs. Resistance Levels

The BTCC research team notes several encouraging technical factors:

- Price remains above the 20-day MA ($116,854.80)

- MACD shows positive divergence (histogram at 1401.7568)

- Bollinger Bands suggest resistance near $123,386.55

However, recent exchange inflows totaling 32,000 BTC on July 17 created temporary sell pressure, demonstrating how large movements can impact short-term price action. The market absorbed this supply relatively quickly, with subsequent outflows suggesting accumulation by long-term holders.

Institutional Activity: The $9 Billion Whale Move

Galaxy Digital's historic 80,000 BTC transaction (worth ~$9B) dominated July's institutional news flow. This transfer from wallets tied to the defunct MyBitcoin service represents one of the largest single Bitcoin movements in history. Interestingly, the market absorbed this supply with minimal disruption - BTC dipped briefly to $114.7k before recovering to $117.5k within 24 hours.

Pseudonymous analyst Mononaunt highlighted Galaxy's on-chain transparency, noting: "If the press release isn't on-chain, did it even really happen?" This institutional-scale transaction demonstrates how early Bitcoin adopters are now managing generational wealth through professional channels.

Wall Street's Growing Bitcoin Appetite

Citigroup's recent projections have stirred market excitement with three scenarios:

| Scenario | 2025 Target | Key Drivers |

|---|---|---|

| Bear Case | $64,000 | Regulatory setbacks, reduced ETF flows |

| Base Case | $135,000 | Current adoption trends continuing |

| Bull Case | $199,000 | Accelerated institutional adoption |

The bank's analysis suggests ETF flows now account for over 40% of Bitcoin's price movements, with $54.66 billion absorbed by US-based funds since January 2025. Their models indicate every $1 billion in ETF inflows could add $4 to Bitcoin's price.

Nation-State Adoption: El Salvador's Bitcoin Strategy

El Salvador continues making headlines with its Bitcoin strategy, though not without controversy. The country's recent purchase of 8 BTC (worth ~$948,392) directly contradicted IMF claims about its accumulation strategy. This brings El Salvador's publicly reported holdings to 6,248 BTC (~$740 million).

However, education advocate John Dennehy notes declining public engagement: "Bitcoin is no longer legal tender in practice," highlighting the gap between government treasury strategy and everyday adoption. The IMF dispute underscores growing tensions between Bitcoin-friendly policies and traditional financial institutions.

Corporate Bitcoin Adoption Expands Globally

The Smarter Web Company's recent 225 BTC purchase ($118,076 per coin) demonstrates how corporate Bitcoin adoption is spreading beyond US markets. The London-listed firm now holds 1,825 BTC (~$216 million), reporting a staggering 43,787% YTD yield on its treasury strategy.

This "laddered accumulation" approach since April 2025 shows how companies are implementing disciplined Bitcoin exposure strategies rather than speculative trading - a significant evolution from early corporate adoption patterns.

Long-Term Bitcoin Price Forecasts: 2025-2040

Based on current technicals, adoption trends, and macroeconomic factors, here are potential bitcoin price ranges:

| Year | Price Range | Key Drivers |

|---|---|---|

| 2025 | $135K - $200K | ETF inflows, institutional adoption, halving effects |

| 2030 | $300K - $500K | Global regulatory clarity, scalability solutions |

| 2035 | $750K - $1M+ | Mass adoption as reserve asset |

| 2040 | $1.5M - $3M | Network maturity, global monetary standard potential |

These projections assume continued technological development, favorable regulatory environments, and increasing scarcity as the 21 million BTC cap approaches. However, macroeconomic conditions (like IMF policies) and technological breakthroughs (like LAYER 2 solutions) could significantly impact these trajectories.

Retirement Planning with Bitcoin?

An intriguing research model by 'Smitty' suggests that by 2035, less than 1 BTC may suffice for retirement in most countries. The analysis factors in:

- National average incomes

- 7% annual inflation adjustments

- Retirement age variables

- Bitcoin's power law trajectory

For wealthier nations, the requirement rises to 1-10 BTC. By 2045, the model predicts sub-1 BTC thresholds for nearly all nations except a few high-income regions. While speculative, this research highlights Bitcoin's potential as an asymmetric hedge against inflationary fiat systems.

Key Risks to Watch

Despite bullish projections, several factors could derail Bitcoin's upward trajectory:

- Exchange Volatility: Large movements (like July's 32,000 BTC inflow) can create short-term price pressure

- Regulatory Actions: IMF disputes and potential restrictions on nation-state adoption

- Macroeconomic Shifts: Changes in risk appetite or liquidity conditions

- Technological Risks: Security vulnerabilities or scalability challenges

As always in crypto markets, volatility remains the only certainty. The coming months will be particularly telling as Bitcoin tests key resistance levels while institutional adoption continues apace.

Bitcoin Price Prediction FAQs

What is Bitcoin's price prediction for 2025?

Analysts project Bitcoin could reach between $135,000 and $200,000 by December 2025, driven primarily by ETF inflows, institutional adoption, and post-halving supply dynamics. Citigroup's base case sits at $135,000, with a bull case of $199,000 if adoption accelerates beyond current trends.

How high can Bitcoin go by 2040?

Long-term models suggest Bitcoin could reach $1.5 million to $3 million by 2040 if it achieves status as a global reserve asset. These projections factor in network maturity, complete monetization of the 21 million supply cap, and continued fiat currency debasement trends.

What was Galaxy Digital's $9B Bitcoin transaction?

In July 2025, Galaxy Digital facilitated the movement of 80,000 BTC (worth ~$9B) from wallets tied to the defunct MyBitcoin service. This estate planning transaction for a Satoshi-era investor represents one of the largest single Bitcoin movements in history, demonstrating institutional-scale management of generational crypto wealth.

How are Bitcoin ETFs affecting the price?

US-based spot Bitcoin ETFs have absorbed $54.66 billion worth of BTC since January 2025, accounting for over 40% of price movements according to Citigroup. Their flow-to-price model suggests every $1 billion in inflows adds approximately $4 to Bitcoin's price, creating substantial upward pressure as institutional participation grows.

Is El Salvador still buying Bitcoin?

Despite IMF claims to the contrary, El Salvador's Bitcoin Office confirmed a new purchase of 8 BTC on July 24, 2025, bringing total reported holdings to 6,248 BTC (~$740 million). However, observers note declining public engagement with Bitcoin as legal tender, creating a disconnect between the government's treasury strategy and everyday usage.