XRP Price Prediction 2025: Will It Hit $5 Despite Market Turbulence?

- What Do Technical Indicators Reveal About XRP's Current Position?

- How Might Regulatory Developments Impact XRP's Price?

- What Are the Key Price Levels to Watch?

- Could Technological Developments Drive Adoption?

- What Do Market Sentiment Indicators Suggest?

- XRP Price Prediction: The Path to $5

- Frequently Asked Questions

As we approach Q4 2025, XRP stands at a critical juncture. Trading at $2.79 with bullish technical indicators but facing market volatility, the cryptocurrency presents both opportunities and risks. This analysis examines XRP's potential path to $5, considering technical factors, regulatory developments, and market sentiment. We'll explore key support and resistance levels, analyze recent partnerships, and assess the impact of upcoming ETF decisions. Data from TradingView and CoinMarketCap reveals intriguing patterns that could determine XRP's trajectory in the coming months.

What Do Technical Indicators Reveal About XRP's Current Position?

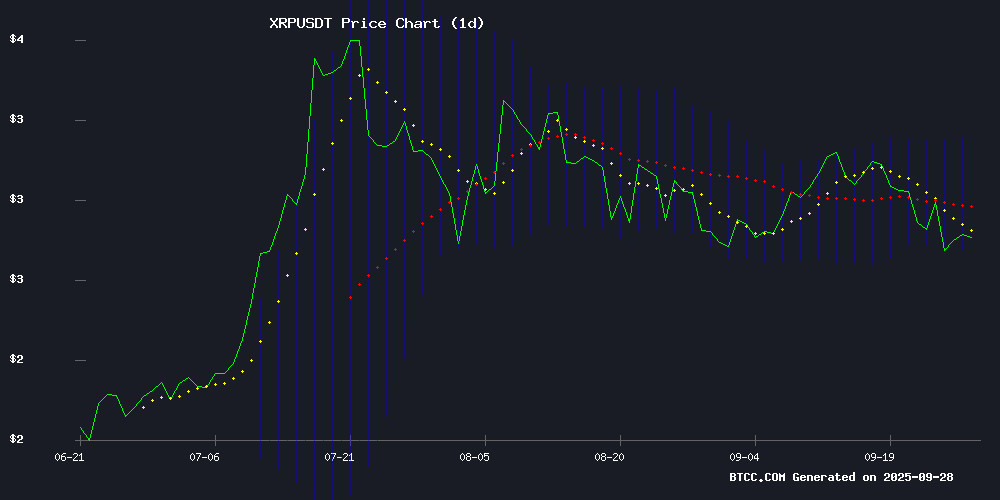

XRP's technical setup presents a fascinating picture as of September 2025. The cryptocurrency is currently trading slightly below its 20-day moving average ($2.95), which typically signals near-term consolidation. However, the MACD indicator shows bullish momentum with a positive reading of 0.0704, suggesting potential upward movement. The Bollinger Bands indicate the price is hovering NEAR the lower band at $2.73, potentially signaling an oversold condition that historically precedes rebounds.

Source: BTCC trading platform

Market technician Bobby A has identified a multi-month bullish flag pattern forming on XRP charts, with key support zones at $1.9 and $2.89 successfully defended during recent market turbulence. The consolidation above historical resistance levels suggests accumulation of energy for a potential major move. According to TradingView data, XRP's market capitalization has held above its 2018 peak for over 300 consecutive days - an unusually strong base formation in cryptocurrency markets.

How Might Regulatory Developments Impact XRP's Price?

The regulatory landscape for XRP has improved significantly since the resolution of Ripple's SEC lawsuit in May 2025. The $50 million settlement removed a major overhang that had weighed on the cryptocurrency for years. Currently, all eyes are on potential XRP ETF approvals, with several major financial institutions including Franklin Templeton considering applications.

The BTCC research team notes: "October 2025 could prove pivotal for XRP, with multiple ETF decisions expected. Institutional adoption through approved funds could dramatically improve liquidity and market depth." Historical data from CoinMarketCap shows that similar ETF approvals for other cryptocurrencies have typically preceded significant price appreciation.

What Are the Key Price Levels to Watch?

Technical analysts have identified several critical price zones that could determine XRP's near-term direction:

| Level | Significance |

|---|---|

| $2.70-$2.75 | Current support cluster (tested 4 times since July) |

| $2.50 | Strong historical support with on-chain buy wall |

| $2.97 | 50-day SMA resistance |

| $3.25 | Breakout trigger level |

| $3.65 | July 2025 peak |

CasiTrades, a prominent crypto analyst, suggests XRP may need to test $2.715 before initiating its next upward wave. The Relative Strength Index currently at 40 reflects persistent selling pressure that may require further downside to exhaust the correction phase.

Could Technological Developments Drive Adoption?

Recent partnerships are enhancing XRP's utility case. The collaboration between ZNS Connect and Layer3 to develop decentralized identity solutions on the XRP Ledger represents a significant technological advancement. These .XRPL domains serve as human-readable, interoperable identifiers that could simplify blockchain interactions for mainstream users.

Industry observers note that such infrastructure developments, while less flashy than price movements, create fundamental value that supports long-term price appreciation. The gamified adoption system implemented by Layer3 could particularly accelerate user acquisition in the Web3 space.

What Do Market Sentiment Indicators Suggest?

Despite recent price consolidation, several sentiment indicators remain positive for XRP:

- 380% price appreciation over the past year

- Sustained trading volume above 2018 peaks

- Growing institutional interest (REX/Osprey XRPR ETF has drawn $38 million)

- Resilience during broader market downturns

Sistine Research highlights that XRP is experiencing its weakest liquidity compression since late 2024 - a condition that has historically preceded significant price moves in either direction.

XRP Price Prediction: The Path to $5

Considering all factors, XRP's path to $5 WOULD likely require:

- Successful defense of the $2.70 support level

- Breakthrough above $3.25 resistance

- Positive ETF decisions in October

- Continued adoption of XRPL-based solutions

- Favorable macroeconomic conditions

The BTCC analysis team suggests: "While $5 represents ambitious upside from current levels, the combination of technical positioning, regulatory clarity, and institutional interest creates a plausible path. However, investors should remain cautious of market volatility and maintain appropriate risk management."

This article does not constitute investment advice.

Frequently Asked Questions

What is the current XRP price prediction for 2025?

As of September 2025, analysts suggest XRP could potentially reach $5 if current bullish factors align, though market volatility remains a significant consideration. The cryptocurrency would need to break through several resistance levels and benefit from positive regulatory developments.

Is now a good time to buy XRP?

With XRP trading near key support levels and showing oversold technical indicators, some analysts see current prices as an accumulation opportunity. However, investors should always conduct their own research and consider their risk tolerance before making any investment decisions.

How might ETF decisions affect XRP's price?

Historical data suggests that positive ETF decisions typically lead to increased institutional participation, improved liquidity, and price appreciation. Several major financial institutions are expected to announce XRP ETF decisions in October 2025, which could serve as significant catalysts.

What makes XRP different from other cryptocurrencies?

XRP distinguishes itself through its focus on cross-border payments, regulatory clarity following its SEC settlement, and growing ecosystem of utility applications like the recent decentralized identity solutions developed on the XRP Ledger.

What are the main risks to XRP's price growth?

Key risks include broader market downturns, unfavorable regulatory developments, failure to break through technical resistance levels, and potential delays in institutional adoption through vehicles like ETFs.