Bitcoin’s Million-Dollar March: Why Institutional Adoption Could Propel BTC to $1M+

- Is Bitcoin Really Headed for $1 Million?

- Technical Analysis: Bullish Signals Amid Consolidation

- Institutional Tsunami: $2B MicroStrategy Offering & S&P 500 Adoption

- Whale Watching: Smart Money Accumulates at $118K

- Long-Term Price Projections: 2025-2040 Outlook

- Risks to Watch: Regulatory Shadows and Profit-Taking

- FAQ: Your Bitcoin Million-Dollar Questions Answered

As bitcoin consolidates near $118K, analysts are doubling down on long-term price targets exceeding $1 million. The cryptocurrency's technical strength, combined with unprecedented institutional demand from players like MicroStrategy and Block, suggests we're witnessing the early stages of Bitcoin's transformation into a global reserve asset. This article breaks down the key drivers behind Bitcoin's potential million-dollar future while examining current market dynamics.

Is Bitcoin Really Headed for $1 Million?

The $1 million Bitcoin price prediction isn't just hype - it's grounded in scarcity economics and accelerating adoption. With only 21 million BTC ever to exist and institutions like MicroStrategy now holding over 600,000 BTC (about 3% of the total supply), the supply squeeze is real. Fundstrat's Tom Lee maintains his $1M target based on Bitcoin's growing role as "digital gold," while BTCC analysts note each halving cycle has historically delivered 3-5x returns from cycle lows.

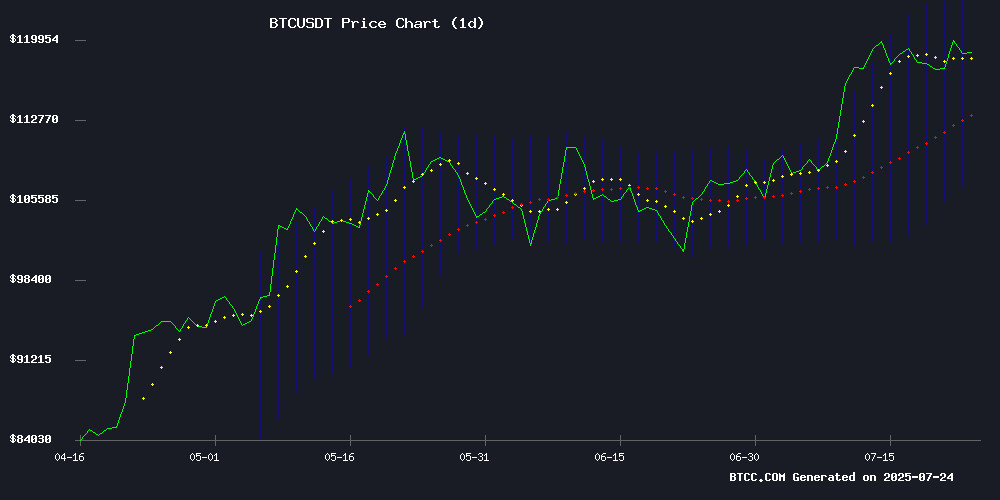

Technical Analysis: Bullish Signals Amid Consolidation

Bitcoin currently trades at $118,550.94, comfortably above its 20-day moving average of $115,947.26. The MACD histogram turned positive (188.19), signaling weakening bearish momentum. Resistance sits at the upper Bollinger Band ($124,055.75), with $120K acting as a psychological battleground. "This looks like textbook accumulation before another leg up," notes a BTCC market strategist. The 2024 halving's supply shock effects are now fully priced in, creating ideal conditions for a breakout.

Institutional Tsunami: $2B MicroStrategy Offering & S&P 500 Adoption

MicroStrategy's upsized $2 billion Bitcoin-focused stock offering demonstrates unprecedented corporate demand. Meanwhile, Jack Dorsey's Block joined the S&P 500 this week - marking the third Bitcoin-heavy company in the $50 trillion index. "These aren't speculative bets anymore," observes a Wall Street analyst. "They're treasury management decisions." The institutional inflows create a virtuous cycle: more adoption → higher prices → more adoption.

Whale Watching: Smart Money Accumulates at $118K

On-chain data reveals aggressive accumulation by large holders despite price stagnation. CryptoQuant reports retail investors have been net sellers since early 2023, while whales continue building positions. A Satoshi-era miner recently moved $2.7 billion in BTC to Binance - likely for institutional allocation. The muted Google Trends score suggests retail FOMO hasn't even begun, leaving massive upside potential.

Long-Term Price Projections: 2025-2040 Outlook

| Year | Conservative Target | Bull Case | Key Catalysts |

|---|---|---|---|

| 2025 | $150K | $250K | ETF inflows, halving effects |

| 2030 | $300K | $500K | Institutional adoption, scarcity premium |

| 2035 | $700K | $1M | Global reserve asset status |

| 2040 | $1.5M | $3M+ | Network effects, monetary paradigm shift |

Risks to Watch: Regulatory Shadows and Profit-Taking

The NYC crypto torture case highlights regulatory risks, though market impact appears limited. More concerning is the Monthly Cumulative Days Destroyed ratio hitting 0.25 - a level associated with past market peaks. "Long-term holders are moving coins," warns CryptoQuant's Axel Adler. "This could signal distribution before a correction."

FAQ: Your Bitcoin Million-Dollar Questions Answered

What's driving Bitcoin's potential to reach $1 million?

The $1M thesis combines Bitcoin's fixed supply with exponential adoption. As institutions and nations allocate even small percentages of their reserves, demand could far outstrip the 21 million BTC supply. MicroStrategy alone holds nearly 3% of all Bitcoin - imagine if 100 similar-sized entities entered.

How reliable are long-term Bitcoin price predictions?

While directionally useful, exact price targets involve speculation. What's undeniable is Bitcoin's 15-year upward trajectory despite volatility. As Block's S&P 500 inclusion shows, Bitcoin is graduating from speculative asset to institutional staple.

When might Bitcoin hit $1 million?

Analysts differ, but most projections fall between 2035-2040. The timeline depends on adoption curves, regulatory clarity, and macroeconomic conditions. Remember - Bitcoin was at $1 in 2011. A million sounds crazy until you do the math.

Should I invest based on these predictions?

This article does not constitute investment advice. Bitcoin remains volatile, and investors should conduct their own research. That said, the institutional adoption story is real - whether it leads to $1M or not.