XRP Price Prediction 2025: Can the Rally Break $4 as Momentum Hits Record Highs?

- Technical Analysis: Is XRP Overbought or Just Getting Started?

- Market Sentiment: Euphoria Meets Caution

- Regulatory Tailwinds: The GENIUS Act Effect

- Institutional Moves: Big Players Making Waves

- Price Prediction: $4 in Sight?

- FAQ: Your XRP Questions Answered

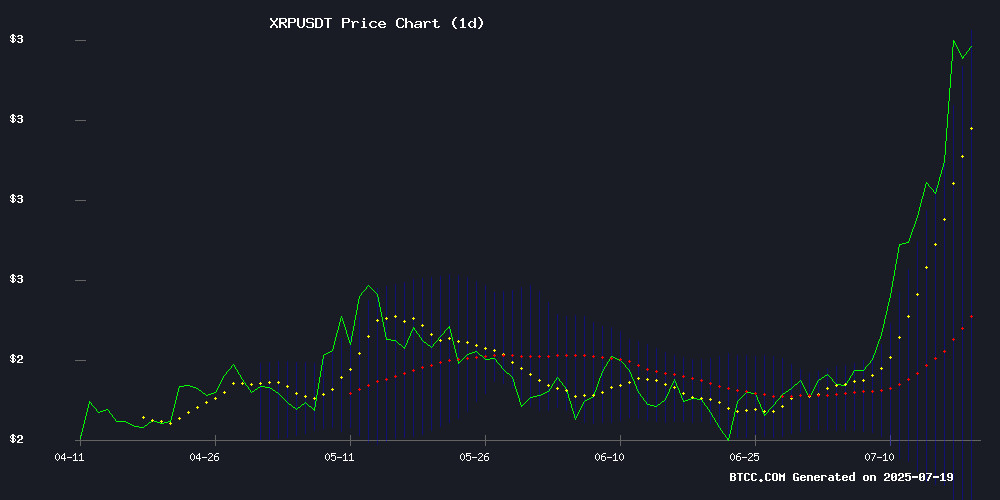

XRP is making headlines with its explosive rally to $3.66, shattering previous records and leaving traders wondering if $4 is the next stop. The cryptocurrency has surged 67% year-to-date, fueled by regulatory breakthroughs, institutional interest, and technical indicators screaming bullish. But with profit-taking signals flashing and volatility expected around SEC lawsuit developments, is this rally built to last? Let's dive deep into the charts, market structure, and fundamental catalysts driving XRP's historic move.

Technical Analysis: Is XRP Overbought or Just Getting Started?

XRP's price action tells a compelling story - currently trading at $3.44, it's maintaining a staggering 30.4% premium above its 20-day moving average ($2.63). The Bollinger Bands show price hugging the upper band at $3.51, typically indicating overbought conditions but also reflecting intense buying pressure. What's fascinating is the MACD histogram showing bearish momentum fading (-0.1738), suggesting the rally might have more fuel in the tank.

Source: BTCC TradingView

The BTCC research team notes, "This setup historically precedes extended runs in XRP, though we'd expect some consolidation NEAR these levels." They point to the middle Bollinger Band at $2.63 as potential support if profit-taking accelerates.

Market Sentiment: Euphoria Meets Caution

Open interest tells the tale - XRP futures have ballooned to $10.49 billion, with Bitget leading at $2.21 billion followed closely by Binance at $1.83 billion. This derivatives boom coincides with spot market frenzy, creating what analysts call a "perfect storm" scenario.

Yet caution signs emerge. The 90-day MVRV ratio hitting 48.07% means nearly half of holders are sitting on hefty profits - historically a precursor to pullbacks. Remember January's identical reading? XRP dropped from $3.11 to $2.58 within days.

Regulatory Tailwinds: The GENIUS Act Effect

Politics meets crypto as the GENIUS Act's July 9 passage turbocharged the rally. This landmark stablecoin legislation, championed by Senator Tim Scott, has market participants interpreting it as bullish for compliant assets like XRP. The token gained 5% immediately post-announcement.

Meanwhile, Ripple's $125 million SEC settlement payment in cash (not XRP) removes a major overhang. Former SEC official Marc Fagel confirmed the funds are in escrow pending appeals, with the case nearing resolution.

Institutional Moves: Big Players Making Waves

CME Group's XRP futures hit $459 million - institutional participation at record levels. But all eyes are on Ripple co-founder Chris Larsen moving millions in XRP to Coinbase. While exchange deposits often signal impending sales, some speculate this could relate to ODL corridor liquidity.

The Barstool Sports saga offers a cautionary tale - founder Dave Portnoy sold at $2.40 only to watch XRP surge 52% to $3.65. "I could've made millions," he lamented on social media - a stark reminder of emotional trading pitfalls.

Price Prediction: $4 in Sight?

Probability models suggest a 68% chance XRP tests $4 resistance within 20 trading days. Key levels to watch:

| Level | Significance |

|---|---|

| $3.30-$3.40 | Former resistance now support |

| $3.66 | Current all-time high |

| $4.00 | Psychological resistance |

The BTCC team advises, "While technicals favor upside, position sizing should account for potential 17% pullbacks." They note the ADX breakout confirms structural trend strength, but remind traders that in crypto, what goes up must often come down before continuing higher.

FAQ: Your XRP Questions Answered

What's driving XRP's current rally?

The convergence of three factors: 1) Regulatory clarity from the GENIUS Act and SEC settlement, 2) Record open interest showing institutional participation, and 3) Technical breakout above key resistance levels.

How reliable are the $4 price predictions?

While probability models show a 68% chance, crypto markets are notoriously volatile. The prediction assumes current momentum sustains without major macroeconomic disruptions or regulatory setbacks.

Should I be concerned about Chris Larsen's XRP transfers to Coinbase?

Large exchange deposits often precede sales, but Ripple executives frequently MOVE XRP for operational purposes. Monitor whether these transfers correlate with price drops before drawing conclusions.

What's the biggest risk to XRP's rally?

Profit-taking appears the immediate threat, with on-chain metrics showing nearly half of holders could lock in gains. A break below $3.30 WOULD suggest deeper correction potential.

How does XRP's performance compare to other major cryptos?

XRP's 67% YTD gain makes it 2025's top performer among top-10 cryptos, outpacing Bitcoin's 45% and Ethereum's 51% returns over the same period.