XRP Price Prediction 2025: Will It Break Out or Breakdown Amid Whale Movements?

- What's the Current Technical Picture for XRP?

- Why Are Whale Wallets Disappearing While Network Activity Grows?

- What Are the Key Levels to Watch?

- How Might Institutional Activity Impact XRP?

- Frequently Asked Questions

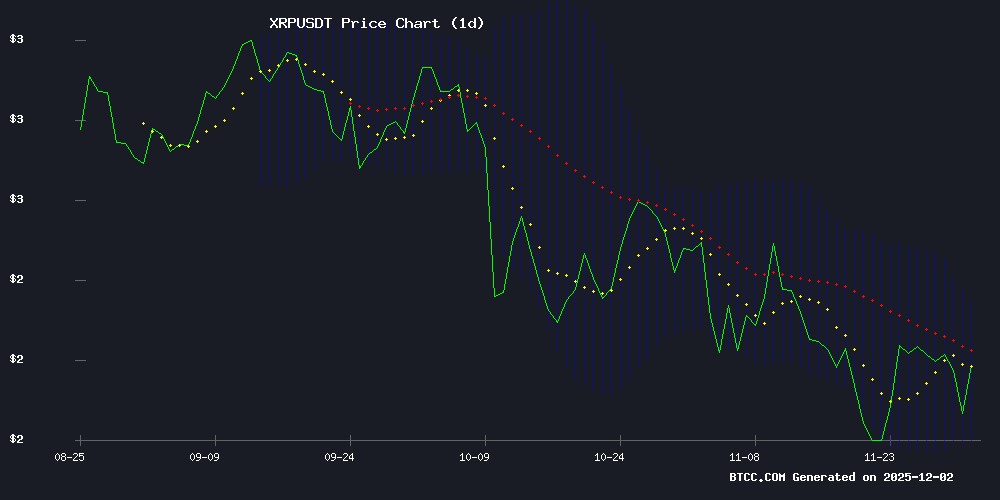

As of December 2, 2025, XRP sits at a critical juncture - trading at 2.0307 USDT below its 20-day moving average while showing conflicting signals between technical indicators and on-chain activity. Whale wallets have seen a dramatic 20.6% reduction since September, yet network payments are surging to record levels. This creates a fascinating tension between bearish technicals and bullish fundamentals that could determine XRP's trajectory through year-end.

What's the Current Technical Picture for XRP?

XRP currently trades at 2.0307 USDT, caught between key technical levels that traders are watching closely. The 20-day moving average at 2.1455 USDT acts as immediate resistance, while the lower Bollinger Band NEAR 1.9371 provides support. The MACD indicator shows a bearish crossover with the signal line (0.1033) above the MACD line (0.0846), typically suggesting downward momentum.

"What's interesting here is how price is respecting these technical boundaries," notes the BTCC research team. "We're seeing classic consolidation patterns that often precede significant moves." Trading volume has doubled to $4 billion recently, indicating growing interest at these levels.

Why Are Whale Wallets Disappearing While Network Activity Grows?

The on-chain data tells a paradoxical story. While the number of wallets holding 100M+ XRP has dropped 20.6% in eight weeks (from 2,700 to below 2,000), the remaining whales now hold a staggering 48B XRP - levels not seen since 2018. This suggests intense supply consolidation among larger players.

Meanwhile, the XRP Ledger processed over 1.05 million payments in a single day recently - a 15% overnight spike. Even more intriguing are the 40,000+ "AccountSet" transactions that suggest institutional wallet configurations. "It's like watching two different movies simultaneously," quips one analyst. "Whales exiting stage left while institutions appear to be entering stage right."

What Are the Key Levels to Watch?

The technical setup presents clear lines in the sand:

| Level | Price (USDT) | Significance |

|---|---|---|

| Current Price | 2.0307 | Base Level |

| Lower Bollinger Band | ~1.9371 | Near-term Support |

| 20-Day Moving Average | 2.1455 | Key Resistance/Trend Indicator |

| Upper Bollinger Band | ~2.3539 | Next Major Resistance |

A break above the 20-day MA could open the path to 2.35 USDT, while losing 1.90 support might trigger a slide toward 1.65. The wild card? Whether institutional activity translates into buying pressure that overcomes whale distribution.

How Might Institutional Activity Impact XRP?

The surge in ledger activity, particularly the AccountSet transactions, hints at serious players preparing infrastructure. These transactions typically involve multi-signature setups and compliance metadata - hallmarks of institutional operations rather than retail trading.

This comes amid speculation about XRP-related ETF developments in the U.S. market. While nothing is confirmed, the timing of this ledger activity is... curious, to say the least. If institutions are indeed building positions, we might see the current consolidation resolve upward despite the bearish technicals.

Frequently Asked Questions

Is XRP a good buy in December 2025?

The current technical setup suggests caution in the near term, with XRP needing to reclaim its 20-day MA at 2.1455 USDT to signal potential upside. However, the strong network fundamentals and possible institutional interest provide long-term bullish arguments.

Why are XRP whales selling?

The 20.6% reduction in large wallets likely represents profit-taking after XRP's November peak near $2.85. Some whales may be rotating into other assets, while others could be consolidating holdings into fewer wallets - the data shows remaining whales actually increased their aggregate holdings.

What would make XRP price go up?

Key factors WOULD be: 1) A technical breakout above 2.1455 resistance, 2) Stabilization in whale supply dynamics, 3) Continued growth in ledger utility, and 4) Positive developments regarding institutional adoption or ETF approvals.

How low could XRP price go?

If XRP loses the 1.90 support level, the next major support sits around 1.65 USDT. However, the strong network activity and potential institutional interest may provide a floor above these levels.