XRP Price Prediction 2025: Can It Break Through $3 Despite Market Uncertainty?

- What Does Technical Analysis Reveal About XRP's Current Position?

- How Is Market Sentiment Impacting XRP's Price Movement?

- What Are the Key Factors That Could Drive XRP to $3?

- What Are the Technical Price Targets for XRP?

- What Are the Risks Preventing XRP from Reaching $3?

- Expert Predictions: Will XRP Hit $3 Soon?

- XRP Price Prediction FAQs

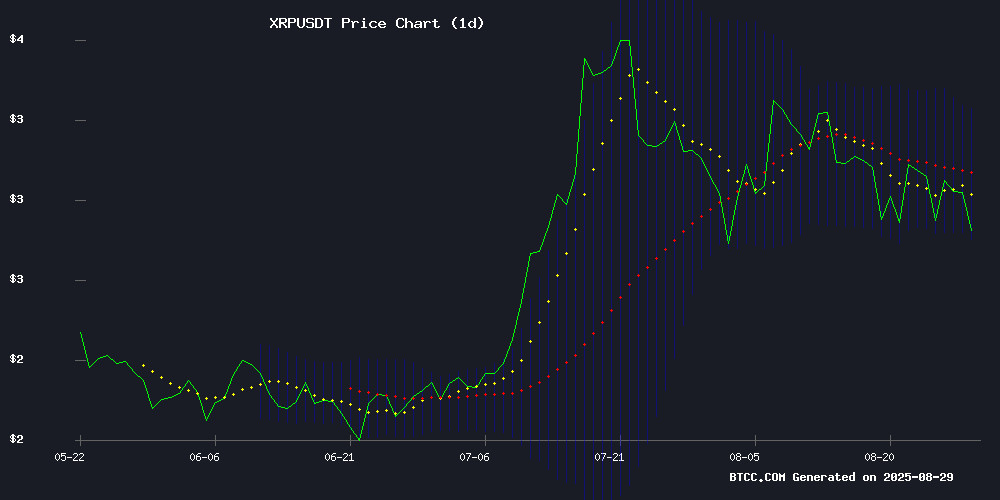

As we approach the end of August 2025, XRP finds itself at a critical juncture. Currently trading at $2.79, the digital asset shows conflicting technical signals - bearish pressure from its position below the 20-day moving average ($3.03) but positive momentum from MACD indicators. The coming weeks could determine whether XRP can overcome resistance and reach the psychologically important $3 mark, with potential catalysts including institutional adoption at Ripple Swell 2025 and pending SEC decisions on 15 XRP ETF applications. However, weak retail demand and capital outflows present significant headwinds that could delay this move.

What Does Technical Analysis Reveal About XRP's Current Position?

XRP's technical setup presents a fascinating tug-of-war between bearish and bullish signals. The price currently sits at $2.79, notably below its 20-day moving average of $3.03 - typically a bearish indicator suggesting short-term downward pressure. However, the MACD tells a different story, showing a positive crossover with the signal line at 0.1023 and histogram at 0.0388, which technical analysts interpret as underlying strength.

Bollinger Bands place XRP NEAR its lower band at $2.78, potentially acting as support. "The technical setup shows mixed signals with the price struggling to break above the 20-day MA, but the MACD suggests underlying strength that could support a move toward $3 if buying pressure increases," notes the BTCC research team.

Source: BTCC TradingView data

How Is Market Sentiment Impacting XRP's Price Movement?

The news Flow around XRP presents a classic case of "good news, bad news." On the positive side, Ripple's upcoming Swell 2025 conference (November 4-5 in New York) promises to showcase significant institutional developments, including partnerships with traditional finance giants like BlackRock and Citi. This contrasts sharply with concerning reports of waning retail interest and capital outflows from the asset.

Futures markets reflect this pessimism, with open interest declining and liquidations accelerating amid recent price drops. On-chain metrics reveal active addresses on the XRP Ledger have collapsed to 24,000 from 50,000 in mid-July - not exactly a vote of confidence from the network's users.

What Are the Key Factors That Could Drive XRP to $3?

1. Ripple Swell 2025: Institutional Adoption Catalyst

Scheduled for November, this high-profile event will feature Ripple's leadership alongside executives from traditional finance heavyweights. The focus on tokenization, payments, and regulatory advancements could provide the institutional validation XRP needs to break through resistance levels.

2. Flare Network's XRP DeFi Solutions

Flare Network has onboarded its second corporate client (Everything Blockchain) for its XRP DeFi treasury framework, following VivoPower International's $100 million commitment. These developments address XRP's historical lack of yield opportunities, potentially making it more attractive to institutional holders.

3. Potential XRP ETF Approvals

With 15 XRP ETF applications before the SEC and deadlines looming in October, regulatory decisions could be game-changers. Historical precedent shows ETF approvals typically catalyze significant capital inflows into crypto assets.

4. Ripple's Strategic Expansion in Payments

Ripple's investment in Singapore-based Tazapay (processing $10B annually) signals serious intent to compete with SWIFT in cross-border payments. As crypto analyst Stern Drew notes, this represents a strategic pivot toward regulated infrastructure rather than peripheral disruption.

What Are the Technical Price Targets for XRP?

Analysts have proposed several scenarios for XRP's price trajectory:

| Scenario | Price Target | Conditions |

|---|---|---|

| Bullish Flag Breakout | $5-$6 | Hold above $2.83 support |

| Wave Pattern | $20 | Overcome $4 resistance |

| Near-term | $3 | ETF approvals + institutional inflows |

What Are the Risks Preventing XRP from Reaching $3?

Despite the potential catalysts, several factors could delay or prevent XRP from hitting $3:

The Chaikin Money FLOW (CMF) metric has hit a nine-month low, reflecting significant capital outflows. New address growth has slowed to near two-month lows, indicating dwindling interest from new investors.

With the Federal Reserve's September policy decision looming, crypto markets broadly face risk-off sentiment that particularly impacts altcoins like XRP.

While the SEC's stance has softened under the current administration, the 15 pending XRP ETF applications still face an uncertain approval process.

Expert Predictions: Will XRP Hit $3 Soon?

Market analysts remain divided on XRP's near-term prospects:

"Reaching $3 is plausible if XRP maintains support at the Bollinger lower band and benefits from positive regulatory developments. However, weak retail demand may delay this MOVE until institutional inflows strengthen," suggests the BTCC research team.

Crypto analyst XForce maintains a bullish long-term outlook with a $20 target, dismissing fears of a 60-70% downturn like previous cycles. Meanwhile, technical analysts note that XRP has broken out of a bullish flag formation on weekly charts, with $5-$6 possible if key supports hold.

XRP Price Prediction FAQs

What is XRP's current price and key technical levels?

As of August 30, 2025, XRP trades at $2.79. Key levels include support at $2.78 (Bollinger lower band) and resistance at $3.03 (20-day moving average). The MACD shows positive momentum at 0.0388.

What are the main factors that could push XRP to $3?

The primary catalysts are: 1) Positive developments at Ripple Swell 2025, 2) Approval of XRP ETFs, 3) Continued institutional adoption through Flare Network's solutions, and 4) Ripple's expansion in cross-border payments.

Why is XRP struggling to break through $3 resistance?

XRP faces headwinds from weak retail demand (evidenced by declining active addresses), capital outflows (CMF at nine-month low), and broader crypto market uncertainty ahead of Fed policy decisions.

What are analysts saying about XRP's long-term potential?

While near-term predictions focus on the $3 level, some analysts see potential for $20 if XRP can overcome key resistance points and benefit from institutional adoption and regulatory clarity.

How does XRP's technical setup compare to previous cycles?

Current technicals show similarities to past accumulation phases, though the MACD divergence suggests stronger underlying momentum than during some previous consolidation periods.