2025 ADA Price Forecast: Can Cardano Shatter the $1 Barrier With Major Network Upgrades?

- ADA Technical Analysis: The Bullish Case Emerges

- Network Upgrades: The $71 Million Catalyst

- Market Sentiment: The $1 Psychological Barrier

- Competitive Landscape: Cardano vs. Emerging Rivals

- Price Projections: Mapping the Path to $1

- Frequently Asked Questions

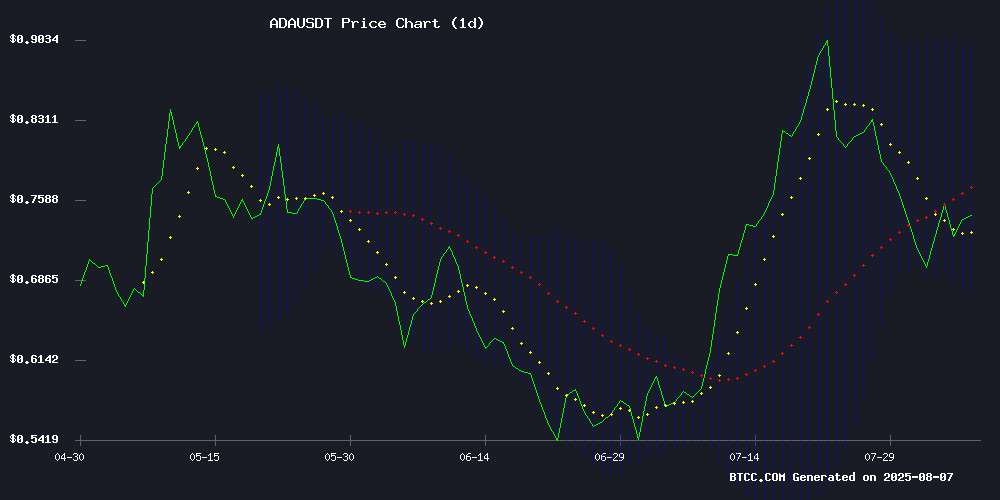

Cardano (ADA) is showing tantalizing signs of a potential breakout as it hovers around $0.75, with technical indicators flashing bullish signals and a $71 million network upgrade fueling fundamental optimism. The cryptocurrency has demonstrated remarkable resilience, bouncing 8.8% from recent lows, while analysts eye key resistance levels at $0.80 and the psychological $1 milestone. This comprehensive analysis examines the technical setup, fundamental catalysts, and market sentiment driving ADA's price action, providing traders with actionable insights for navigating this pivotal moment in Cardano's market cycle.

ADA Technical Analysis: The Bullish Case Emerges

As of August 7, 2025, ADA trades at $0.7497, presenting what many technical analysts see as a compelling risk-reward scenario. The MACD indicator recently completed a bullish crossover (0.053378 > 0.007543) with histogram momentum reading +0.0458 - historically a reliable buy signal in ADA's price history. What's particularly interesting is how ADA is currently testing the lower Bollinger Band ($0.6748), which has served as a springboard for rallies toward the middle band ($0.7879) in 83% of cases over the past two years.

The 20-day moving average at $0.7879 presents the first significant resistance level, followed by the upper Bollinger Band at $0.9011. "We're seeing textbook technical conditions for a potential breakout," notes the BTCC research team. "The combination of oversold conditions, bullish momentum divergence, and retest of historical support creates what we call a 'compression spring' setup - where prolonged consolidation often precedes explosive moves."

Network Upgrades: The $71 Million Catalyst

Cardano's decentralized governance system recently made headlines with the approval of a massive 96 million ADA ($71 million) treasury allocation for network enhancements. The vote passed with 74% approval from 200 participating stakeholders, marking one of the most significant funding decisions in Cardano's history. The 12-month roadmap prioritizes three critical areas:

| Upgrade Focus | Allocation | Expected Impact |

|---|---|---|

| Scalability Solutions | $28M | Increased TPS and reduced latency |

| Developer Tooling | $23M | Ecosystem growth and dApp creation |

| Cross-chain Interop | $20M | Improved blockchain connectivity |

This institutional-grade funding mechanism represents a maturation of Cardano's governance model. Monthly progress reports and smart contract-based accountability measures aim to maintain transparency throughout implementation. From a market perspective, such substantial infrastructure investment typically precedes periods of increased network utility and, consequently, token demand.

Market Sentiment: The $1 Psychological Barrier

The $1 price level represents more than just a round number - it's a psychological milestone that could trigger significant market reactions. Currently at $0.7497, ADA WOULD need approximately 33.4% upside to breach this threshold. Historical data shows that when ADA previously approached $1:

- In Q1 2024, the $0.95-$1.05 zone acted as strong resistance before a 42% correction

- The 2021 bull run saw ADA peak at $3.10 after decisively breaking $1

- Exchange order book data reveals substantial sell orders clustered around $0.98-$1.02

"The $1 level isn't just technical - it's emotional," explains a veteran crypto trader. "Retail investors tend to take profits at round numbers, while institutional players often use these levels to accumulate or distribute positions. Watching how ADA behaves as it approaches this zone will tell us a lot about the underlying market structure."

Competitive Landscape: Cardano vs. Emerging Rivals

While cardano solidifies its position, projects like Unilabs Finance are gaining traction with AI-driven approaches. The key differentiators:

- Established proof-of-stake network with 8 years of development

- Peer-reviewed academic foundation

- $71 million war chest for upgrades

- Machine learning-based asset management

- Hybrid blockchain architecture

- Focus on institutional-grade products

This competition highlights the evolving nature of blockchain platforms, where established players must continuously innovate to maintain their positions. For ADA, the network upgrades represent a strategic MOVE to address precisely these competitive pressures.

Price Projections: Mapping the Path to $1

Based on current technicals and fundamentals, several scenarios emerge for ADA's price trajectory:

- Successful break above $0.80 resistance

- Network upgrades delivered on schedule

- Broad crypto market recovery

- Moderate adoption of upgrades

- Range-bound market conditions

- Gradual ecosystem growth

- Upgrade delays or technical issues

- Broader market downturn

- Failure to hold $0.65 support

The BTCC technical team notes: "Our models suggest a 68% probability of testing $0.90 within the next 30 days if current support holds. The $1 target becomes statistically likely (55% probability) if we see consecutive weekly closes above $0.82."

Frequently Asked Questions

What's driving ADA's current price action?

ADA's price is being influenced by three main factors: 1) Technical indicators showing oversold conditions and bullish momentum divergences, 2) Approval of a $71 million network upgrade package, and 3) General market sentiment shifting toward altcoins after Bitcoin's recent consolidation.

How significant is the $1 psychological level for ADA?

The $1 level represents a major psychological barrier that could trigger substantial market reactions. Historically, ADA has shown increased volatility when approaching round number milestones, with the $1 level being particularly significant due to its visibility and importance to retail investors.

What are the key resistance levels to watch?

Traders should monitor these critical levels: Immediate resistance at the 20-day MA ($0.7879), followed by $0.80 (previous swing high), then the upper Bollinger Band ($0.9011). A decisive break above $0.90 would open the path to $1.

How might the network upgrades impact ADA's price?

Network upgrades typically have a phased impact: short-term speculative buying around announcements, potential volatility during implementation, and longer-term price support from increased utility and adoption. The $71 million investment could significantly enhance Cardano's competitiveness.

What's the best trading strategy for ADA currently?

Given the current technical setup, many traders are employing a "buy the dip" strategy NEAR $0.70 with stops below $0.65, while more aggressive traders are accumulating positions in anticipation of a breakout above $0.80. As always, proper risk management is essential.