XRP Price Prediction 2025: Is This the Make-or-Break Moment for Investors?

- XRP Technical Analysis: The Battle Between Bulls and Bears

- Market Sentiment: Why XRP Investors Are Nervous

- The $10 Dream: Reality Check

- Ripple's Fundamentals: The Bull Case

- Critical Price Levels to Watch

- Investment Strategies for Current Market Conditions

- XRP Price Prediction FAQs

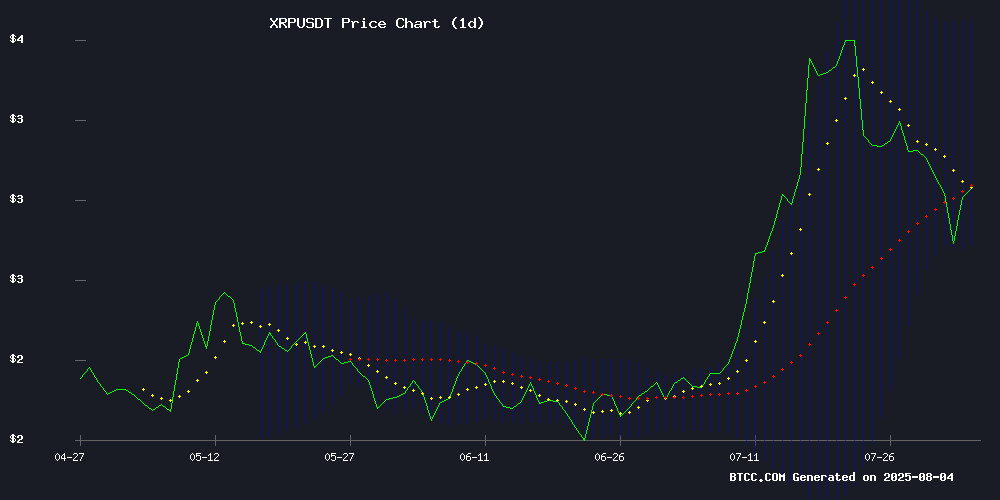

XRP stands at a critical technical crossroads in August 2025, trading between key Bollinger Bands while MACD hints at potential momentum shifts. The cryptocurrency's price action reflects a tug-of-war between Ripple's fundamental developments (including their RLUSD stablecoin success) and broader market skepticism. Our analysis reveals $2.76 as the make-or-break support level, with $3.62 resistance defining the next major move. While some analysts warn of a potential drop to $0.26, others point to Ripple's $15 billion valuation and institutional backing as reasons for long-term optimism.

XRP Technical Analysis: The Battle Between Bulls and Bears

As of August 4, 2025, XRP trades at 3.0625 USDT on BTCC, sitting below its 20-day moving average of 3.1950 - typically a bearish short-term signal. However, the MACD tells a different story with its positive histogram reading of 0.2719, suggesting underlying bullish momentum might be building. The Bollinger Bands paint a clear picture of the current battleground: support at 2.7713 (lower band) and resistance at 3.6187 (upper band).

What's particularly interesting is how these technical levels align with psychological price points. That $2.76 support isn't just a Bollinger Band - it's also the 50% Fibonacci retracement level and matches up with what traders call the "annual value area high." In my experience, when multiple indicators converge like this, the resulting bounce or breakdown tends to be more significant.

Market Sentiment: Why XRP Investors Are Nervous

The mood around XRP reminds me of that awkward moment at a party when everyone's checking their watches. On one hand, you've got Ripple making solid progress with their stablecoin (RLUSD circulation jumped 32.3% to $602 million in July) and transparent escrow strategies. On the other, trading volume dropped 22.83% during the recent price increase - never a great sign.

Analyst Ali Martinez pointed out something concerning on TradingView: the Market Value to Realized Value (MVRV) ratio suggests we might see deeper corrections. Meanwhile, whales have offloaded $2.1 billion worth of XRP recently. It's like watching big money play hot potato with their bags.

The $10 Dream: Reality Check

Let's address the elephant in the room - all those "$10 XRP" predictions from July. The math simply doesn't work right now. A 250% spike WOULD be needed to hit that target, which would require either:

- Massive institutional adoption beyond current projections

- A crypto market cap explosion that makes 2021 look tame

- Some black swan event benefiting Ripple specifically

With a $177 billion market cap already, XRP would need nearly half a trillion dollars in new money to reach $10. Not impossible in crypto, but let's just say I wouldn't bet my grandma's retirement fund on it happening this quarter.

Ripple's Fundamentals: The Bull Case

Now for the good news. Ripple's recent $15 billion valuation (per CB Insights) puts them in elite company - they're the 23rd most valuable private firm globally. Their backers include heavyweights like IDG Capital, and the RLUSD stablecoin just received an 'A' rating from Bluechip.

The escrow strategy deserves particular attention. With 35.9 billion XRP (40% of supply) locked in smart contracts, Ripple's avoiding the supply floods that tank other projects. Analyst Wrath of Kahneman called their distribution chart "the best infographic about total XRP circulation" - high praise in our data-obsessed industry.

Critical Price Levels to Watch

Here's where things get technical (and where you should pay attention if trading):

| Level | Significance | Breakout Implication |

|---|---|---|

| $3.62 | Upper Bollinger Band | Could signal start of new uptrend |

| $3.20 | Recent resistance | Bullish if broken with volume |

| $2.76 | Multi-indicator support | Break could trigger sharp decline |

| $2.48 | Next major support | Heavy accumulation zone |

The $2.76 level is particularly crucial - it's where we'll see whether this is just a healthy pullback or the start of something uglier. Personally, I'm watching the TTM Squeeze indicator here; those compression bars suggest volatility is coming, we just don't know which way yet.

Investment Strategies for Current Market Conditions

Given this mixed picture, here's how different investors might approach XRP:

Dollar-cost averaging NEAR $2.76 makes sense if you believe in Ripple's fundamentals. The escrow strategy and institutional adoption could pay off over 3-5 years.

Wait for a confirmed breakout above the 20-day MA (3.1950) with volume before entering longs. For shorts, a break below $2.76 with increasing sell volume could present opportunities.

Consider waiting until after the next quarterly escrow release (typically first day of the quarter) to see how the market absorbs the new supply.

Remember what happened in July 2023 when everyone FOMO'd in at the top? Let's not do that again. As the BTCC team often says, "Trade the chart, not the cheerleading."

XRP Price Prediction FAQs

What is the current XRP price?

As of August 4, 2025, XRP trades at 3.0625 USDT on BTCC, below its 20-day moving average of 3.1950.

What are the key support and resistance levels for XRP?

The crucial support sits at $2.76 (lower Bollinger Band + Fibonacci level), while resistance appears at $3.62 (upper Bollinger Band). A break in either direction could determine the next major trend.

Is XRP a good long-term investment?

Ripple's institutional backing and escrow strategy provide fundamental support, but the cryptocurrency faces technical challenges in the near term. Long-term potential depends on broader adoption of Ripple's payment solutions.

Why did XRP drop below $3?

The decline reflects broader market corrections combined with profit-taking after July's rally. Technical patterns like the descending triangle formation also contributed to bearish sentiment.

Can XRP reach $10 in 2025?

While possible, a $10 XRP would require extraordinary market conditions given current valuations. More realistic near-term targets cluster between $3.20-$3.62 if bullish momentum returns.