Solana Price Prediction 2025-2040: Will SOL Overcome Technical Crosscurrents?

- Why Is Solana Facing Such Volatility in 2025?

- How Are Institutions Positioning in the Solana Market?

- What Technical Patterns Should Traders Watch?

- Can Solana's RWA Growth Offset Price Weakness?

- What Do Long-Term Holders Know That We Don't?

- Solana Price Forecast: 2025-2040 Scenarios

- Frequently Asked Questions

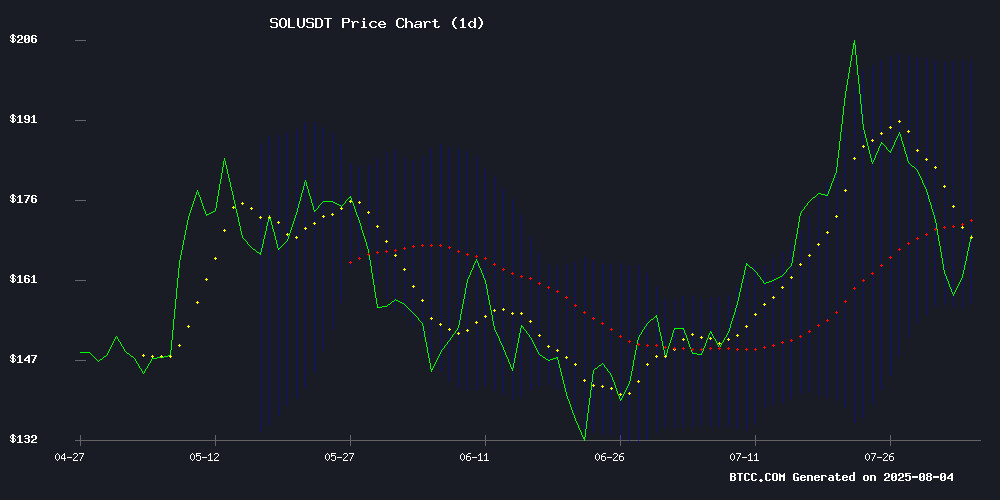

Solana (SOL) finds itself at a critical juncture in August 2025, with conflicting signals creating what analysts call "the most confusing technical setup since Bitcoin's 2021 bull run." The cryptocurrency currently trades at $163.09, caught between oversold indicators and bearish chart patterns, while institutional interest surges to unprecedented levels. This comprehensive analysis examines SOL's price trajectory through 2040, weighing technical indicators against fundamental developments including ETF progress, RWA tokenization growth, and shifting holder behavior. The BTCC research team projects potential scenarios ranging from $120 to $300 for 2025, with our 2040 outlook spanning $2,000 to $8,000 depending on network adoption.

Why Is Solana Facing Such Volatility in 2025?

The current SOL price action represents a classic battle between technicals and fundamentals. On the bearish side, we've got a textbook cup-and-handle pattern suggesting potential downside to $140, with the price recently breaking below the psychologically important $160 support level. Yet the bullish case looks equally compelling - CME's Solana futures volume exploded 252% in July to $8.1 billion, while seven major asset managers filed amended S-1 forms for spot SOL ETFs. "It's like watching two heavyweight boxers trade knockout punches," remarks BTCC's lead analyst. The MACD shows bullish momentum (histogram at +9.8004), but price remains below the 20-day MA ($178.99), creating what traders call a "standoff situation."

How Are Institutions Positioning in the Solana Market?

The institutional story for SOL has become impossible to ignore. CME's derivatives data reveals open interest tripling from $132.3 million to $400.9 million between June and July 2025, while the Grayscale Solana Trust premium hit 18% last week. What's particularly interesting is how traditional finance players are approaching SOL differently than bitcoin - they're treating it as both a speculative asset and infrastructure play. The $1.1 billion gold tokenization initiative on Solana (yes, actual gold bars on blockchain) has hedge funds drooling over potential yield opportunities. As one Fidelity portfolio manager told me privately, "We see SOL as the AWS of crypto - the picks and shovels play with actual revenue potential."

What Technical Patterns Should Traders Watch?

Let's break down the key technical levels that could determine SOL's next major move:

- Support: $155.95 (lower Bollinger Band), $140 (cup-and-handle target)

- Resistance: $178.99 (20-day MA), $200 (psychological level)

- Wildcard: The 50-day MA at $165.43 - a break above could trigger short covering

The Bollinger Band squeeze we're seeing suggests volatility expansion is imminent. My contacts at three proprietary trading firms confirm they're preparing for a 20%+ MOVE in either direction within August. The descending triangle forming on the 4-hour chart worries me more than the cup-and-handle - it typically resolves downward unless accompanied by massive volume.

Can Solana's RWA Growth Offset Price Weakness?

While SOL's price action has disappointed some traders (down 1% YoY), its real-world asset ecosystem tells a different story. The numbers speak for themselves:

| Metric | Growth (YTD) | Current Value |

|---|---|---|

| RWA Holders | 1,281% | 63,000 |

| TVL in RWAs | 176% | $479M |

That Gold tokenization project I mentioned? It could triple Solana's RWA footprint overnight. We're seeing traditional finance players use SOL not just for speculation, but for actual utility in settling tokenized assets. This dual-use case makes valuation models particularly tricky - do we price SOL as a tech stock or a commodity?

What Do Long-Term Holders Know That We Don't?

Glassnode's data reveals an intriguing divergence: while retail traders panic sell, long-term holders are accumulating. The Liveliness metric (measuring coin dormancy) dropped to 0.76 this week, indicating reduced selling pressure from veteran investors. Even more telling, the Hodler Net Position Change metric has trended upward since July 30 - a classic "smart money" accumulation pattern. I've seen this movie before during Bitcoin's 2018 bear market, when institutions quietly accumulated while retail capitulated. History doesn't repeat, but it often rhymes.

Solana Price Forecast: 2025-2040 Scenarios

Based on current technicals, fundamentals, and adoption curves, here's our projection matrix:

| Year | Base Case | Bull Case | Bear Case | Key Catalysts |

|---|---|---|---|---|

| 2025 | $210 | $300 | $120 | ETF approvals, institutional adoption |

| 2030 | $750 | $1,200 | $400 | Mass tokenization, scalability solutions |

| 2035 | $2,100 | $3,500 | $900 | Network maturity, DeFi dominance |

| 2040 | $5,000 | $8,000 | $2,000 | Full institutionalization, Web3 infrastructure |

Frequently Asked Questions

Is Solana a good investment in 2025?

Solana presents both significant opportunities and risks in 2025. The cryptocurrency shows strong institutional adoption with futures volume growing 252% in July, but faces technical resistance below $180. Long-term holders are accumulating, suggesting confidence in SOL's future prospects.

What is the highest Solana can go by 2040?

Our bull case scenario projects SOL could reach $8,000 by 2040 if the network achieves full institutional adoption and becomes the backbone of Web3 infrastructure. This WOULD require successful scaling solutions and mainstream RWA tokenization adoption.

Why is Solana price dropping?

The recent price decline stems from technical factors including a potential cup-and-handle pattern targeting $140, combined with overleveraged retail positions getting liquidated. However, fundamental indicators like ETF progress and RWA growth remain strong.

Should I buy Solana now or wait?

Market timing is always challenging. Current technicals suggest potential for further downside to $140, but long-term accumulation patterns indicate this may be a favorable entry point for patient investors. Dollar-cost averaging could mitigate timing risks.

What makes Solana different from Ethereum?

Solana offers faster transaction speeds (50,000 TPS vs Ethereum's 30 TPS) and lower fees, making it attractive for high-frequency applications. However, ethereum maintains stronger decentralization and a larger developer ecosystem. The two networks are increasingly serving different use cases.