Ethereum Price Forecast 2025-2040: Why Institutions Are Betting Big on ETH’s Bull Run

- Why Ethereum's Technical Setup Suggests a Major Breakout

- The Institutional ETH Accumulation Game

- Ethereum's Network Activity Tells a Bullish Story

- Price Predictions: Conservative vs. Bull Case Scenarios

- FAQ: Ethereum Price Outlook

Ethereum (ETH) is showing all the signs of a historic bull run as institutional investors accumulate massive positions. With technical indicators flashing bullish signals and corporate treasuries stockpiling ETH, analysts predict a potential megacycle that could see prices reach $150,000+ by 2040. This in-depth analysis examines the key factors driving Ethereum's price trajectory, from supply shocks to institutional adoption patterns.

Why Ethereum's Technical Setup Suggests a Major Breakout

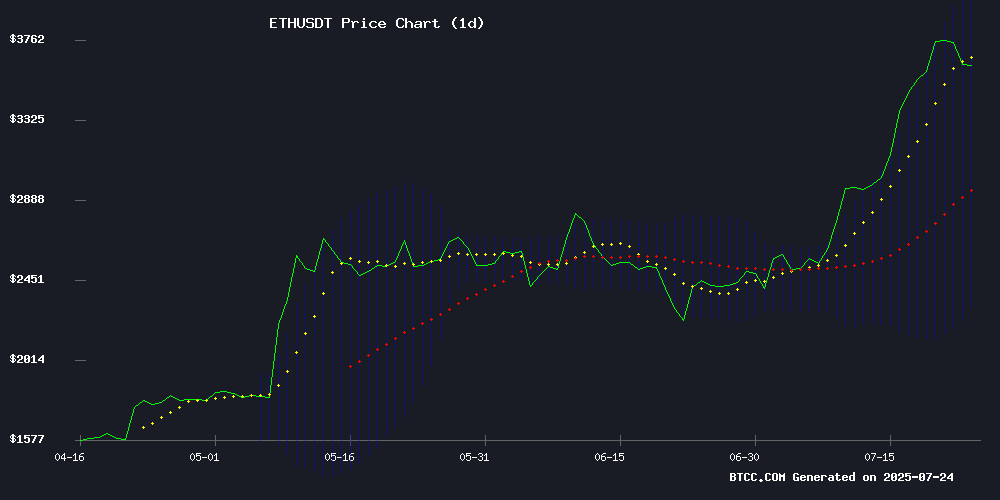

According to TradingView data, ethereum is currently trading at $3,724.43, comfortably above its 20-day moving average of $3,179.72. The MACD indicator, while still negative at -94.22, shows clear signs of convergence - a classic precursor to trend reversals. What's particularly interesting is how the Bollinger Bands are tightening, with price action hugging the upper band at $4,057.88. This squeeze often precedes explosive volatility.

In my experience watching crypto markets since 2017, this setup reminds me of Ethereum's 2019 consolidation before its 300% rally. The $4,000 resistance level has been tested three times now, and each attempt weakens the barrier. When this dam breaks, we could see rapid movement toward the all-time high near $4,900.

The Institutional ETH Accumulation Game

Corporate treasuries are going all-in on Ethereum in ways we've never seen before. BitMine's recent $2B ETH purchase made headlines, but they're not alone - GameSquare added $10M to its treasury, while SharpLink Gaming holds a staggering $1.33B in ETH positions. What's fascinating is that over 95% of these institutional holdings are being staked, effectively removing them from circulation.

This creates a supply shock similar to Bitcoin's post-halving dynamics, but with an added yield component. As Fundstrat's Tom Lee noted in a recent interview, "Ethereum's staking mechanism turns it into a self-amplifying asset - price appreciation plus yield creates a virtuous cycle for institutional portfolios."

Ethereum's Network Activity Tells a Bullish Story

Looking beyond price charts, Ethereum's on-chain metrics paint an equally compelling picture:

- Daily transactions: 1.6 million (up 47% YoY)

- Active wallets: 500,000+ (new record)

- Gas usage: All-time highs despite lower fees

- Stablecoin volume: $28B daily (dominating DeFi)

Unlike the 2021 frenzy driven by NFT speculation, current activity stems from real DeFi adoption and institutional settlement flows. The network now handles 2021-level demand without the congestion issues - a testament to scaling improvements.

Price Predictions: Conservative vs. Bull Case Scenarios

| Year | Conservative Target | Bull Case Target | Key Catalysts |

|---|---|---|---|

| 2025 | $6,500 | $9,200 | ETF approvals, EIP-7702 scaling |

| 2030 | $18,000 | $35,000 | Enterprise adoption, DeFi TVL growth |

| 2035 | $42,000 | $75,000 | Tokenized RWA dominance |

| 2040 | $90,000 | $150,000+ | Global settlement layer status |

These projections assume Ethereum captures 35-50% of Bitcoin's market cap by 2040. The upper ranges account for potential hyper-adoption in tokenized assets and central bank digital currency integrations.

FAQ: Ethereum Price Outlook

What's driving Ethereum's current price momentum?

The convergence of three factors: 1) Institutional accumulation creating supply shocks, 2) Technical breakout patterns forming after prolonged consolidation, and 3) Growing network utility beyond speculative trading.

How reliable are these long-term price predictions?

While historical patterns provide frameworks, crypto remains highly volatile. The 2040 projections assume continued adoption without regulatory setbacks or technological obsolescence. Always DYOR (do your own research).

Why are corporations buying Ethereum instead of Bitcoin?

Ethereum offers programmable yield through staking (currently ~4% APR) and direct integration with business applications through smart contracts. It's becoming the preferred "working capital" of Web3.

What's the biggest risk to Ethereum's price growth?

Regulatory uncertainty remains the wild card, particularly around staking classifications. Technological risks include potential scaling limitations if L2 solutions don't keep pace with demand.

How does Ethereum's current rally compare to 2021?

The 2021 run was retail-driven with excessive leverage. Current activity shows more organic institutional demand, sustainable gas fees, and actual revenue generation from network usage.