US Bitcoin Reserves Could Catapult BTC to $1M—Fueling Projects Like Bitcoin Hyper to New Highs

The US government's growing Bitcoin stash might just be the rocket fuel BTC needs to hit seven figures—and it's sending projects like Bitcoin Hyper into overdrive.

When nation-states start hodling, markets listen. The Fed's balance sheet now looks more like a crypto whale's portfolio, and that changes everything.

Bitcoin Hyper and similar protocols are positioning themselves as the turbochargers for this potential million-dollar ascent. Their pitch? When the asset moon, the ecosystem moons harder.

Of course, Wall Street will still find a way to charge 2% management fees for exposure to 'this risky new asset class'—even as their vaults fill with Satoshis.

Analysts suggest that the governmental Bitcoin reserves could push Bitcoin to $1M, as central banks and sovereign wealth funds turn to crypto as a hedge against inflation and high geopolitical risks.

The growing institutional trust in bitcoin resulted in attention to the crypto industry, bringing in more investors and taking the community sentiment into the green zone.

It all started with El Salvador adopting Bitcoin as legal tender in 2021, a decision which they reversed in February 2025.

This was partly due to the people’s low trust in Bitcoin in the context of economic turmoil.

But since 2021, Bitcoin has grown to be recognized as a valuable asset, one that could change the economic system as we know it.

The Wave of Bitcoin Adoption at the Heart of a New-Age Financial System

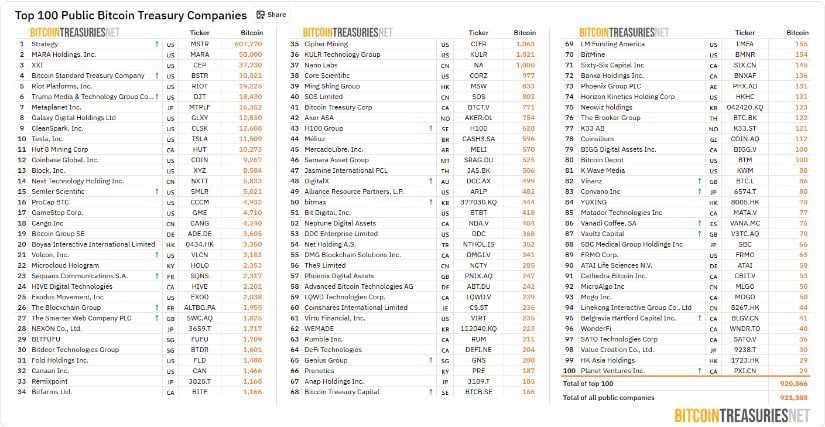

Increasingly more institutions have started investing in Bitcoin, with some even becoming Bitcoin-centric, like Strategy, which currently holds the largest Bitcoin reserves, with 607,770 $BTC, valued at over $71B.

According to Bitcoin Treasuries, 3.60M Bitcoins are already spread out between different treasuries, with 281 entities holding 921,388 $BTC. The shift is clear and it seems to show that the global financial system is slowly tokenizing, becoming more decentralized and consumer-oriented.

But the main catalyst comes from the US government itself, following the passing of Trump’s GENIUS Act, which establishes a clear regulatory framework for crypto issuers and stablecoin payment processors.

Among its specifications, the GENIUS Act states:

‘The GENIUS Act requires 100% reserve backing with liquid assets like U.S. dollars or short-term Treasuries and requires issuers to make monthly, public disclosures of the composition of reserves.

The GENIUS Act explicitly subjects stablecoin issuers to the Bank Secrecy Act, thereby clearly obligating them to establish effective anti-money laundering and sanctions compliance programs with risk assessments, sanctions list verification, and customer identification.’

To put it simply, the GENIUS Act creates the foundation for a safer, more well-regulated, and more stable crypto ecosystem, which increases the trust in the tokenized financial system to come.

This explains why the crypto market has been up since the beginning of 2025, with Bitcoin breaking a new ATH of $123K on July 14, marking the fastest price ascent in 16 years, as it gained $13,000 in just 53 days.

While it retracted to $117K since, Bitcoin packs a $2.46T market cap and a bullish community sentiment that is likely here to stay.

So, it’s only normal that the US government WOULD aim for a growing Bitcoin reserve, which Senator Lummis’ Bitcoin Act has already set in motion:

‘The BITCOIN Act directs the acquisition of 1 million Bitcoin over a five-year period, mirroring the scale and strategic importance of U.S. Gold reserves.’

This new pro-crypto context has the power to take Bitcoin to never-before-seen heights, in which case projects like Bitcoin Hyper will follow along.

How Bitcoin Hyper Aims to Push the Bitcoin Network Into 21st Century

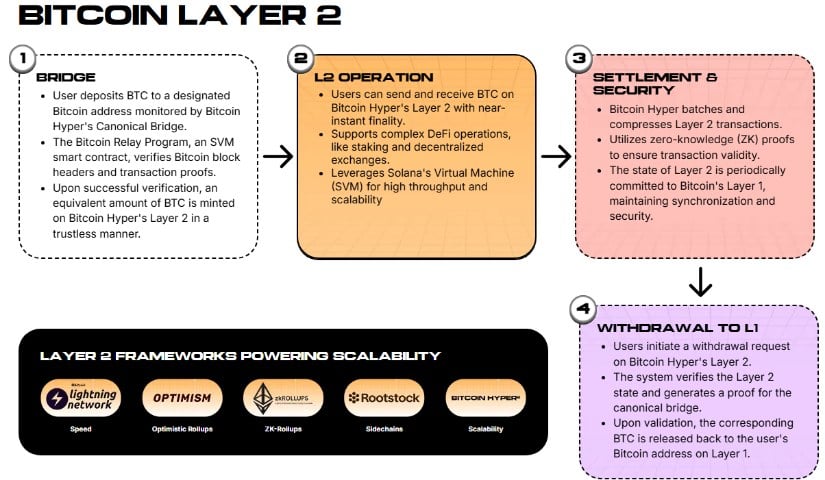

Bitcoin Hyper ($HYPER) is Bitcoin’s official LAYER 2 upgrade which aims to achieve what the Lightning Network couldn’t: imbue the Bitcoin network with Solana-level performance.

The Canonical Bridge is the first step in the right direction, minting the users’ Bitcoins onto Hyper’s Layer 2 tokens, which they can then withdraw to the native layer whenever they need them.

This is designed to decongest the network and ensure near-instant finality, with Zero-Knowledge (ZK) proofs verifying the transaction’s validity.

The Solana VIRTUAL Machine (SVM) also enables the ultra-fast execution of DeFi apps and smart contracts, further expanding on the network’s overall performance.

The increase in performance will also reflect in the transaction costs, with the users experiencing lower on-chain fees.

Bitcoin Hyper has been in presale since May, 2025, during which it has accumulated close to $5M, making it one of the fastest-growing presales of 2025.

$HYPER’s presale price is $0.0124, but the token is likely to explode post-launch, given the project’s ambition and utility and especially if it sees successful implementation, which would drive mass adoption.

If you want to join the project, go to the presale page and buy your $HYPER while they trade for their presale price.

The Bitcoin Bull is Coming

The US government acquiring more Bitcoin could set a fire under the entire crypto market, but it could also achieve something bigger: add legitimacy to the crypto ecosystem and give birth to a mixed financial system.

Such a scenario could push Bitcoin even beyond $1M, with projects like Bitcoin Hyper ($HYPER) seeing massive gains on the side.

This isn’t financial advice. Do your own research (DYOR) before investing.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.