XRP Price Prediction 2025: Can XRP Surge to $3 Amid Bullish ETF News and Technical Breakout?

- XRP Technical Analysis: The Make-or-Break Levels

- The Institutional Tsunami: How ETFs Are Changing the Game

- The Staking Wildcard: Could XRPL Get Yield Functionality?

- The $3 Question: Realistic Target or Wishful Thinking?

- Market Psychology: Why $3 Matters More Than You Think

- Risk Factors: What Could Derail the Rally?

- XRP Price Prediction: FAQ

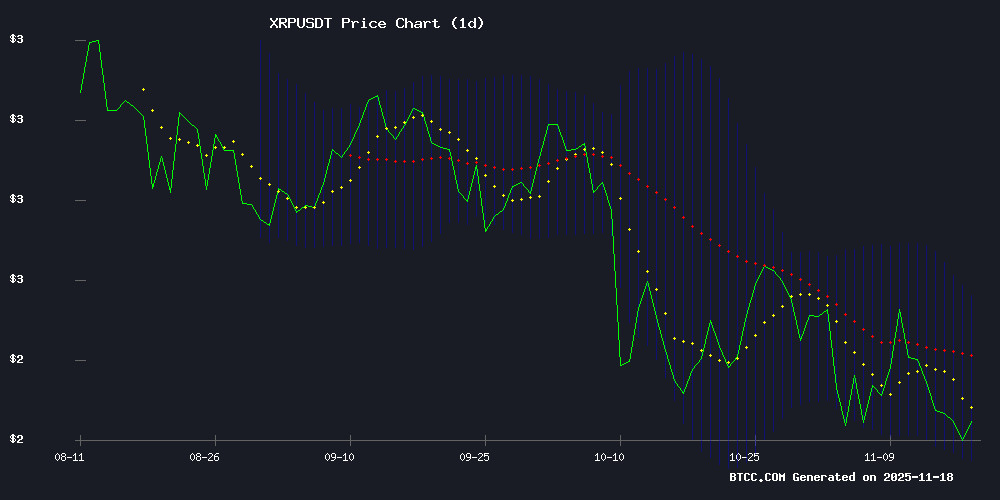

As we approach the end of 2025, XRP finds itself at a critical juncture. Currently trading at $2.2266, the digital asset shows both technical consolidation and fundamental strength from recent institutional developments. The crypto market has been buzzing about three major catalysts: Franklin Templeton's new XRP ETF, Amplify's innovative options income fund, and potential staking functionality on the XRP Ledger. This perfect storm of positive news comes as XRP tests key technical levels, with analysts debating whether it can break through resistance to reach the psychologically important $3 mark. Let's dive deep into the charts, market sentiment, and institutional flows that could determine XRP's trajectory in these final weeks of 2025.

XRP Technical Analysis: The Make-or-Break Levels

Looking at the daily chart (Source: TradingView), XRP presents an interesting technical picture. The price currently sits below the 20-day moving average at $2.3367, which has turned from support to resistance. The MACD histogram shows slight bearish momentum at -0.0088, but here's where it gets interesting - the Bollinger Bands tell a different story with the price comfortably within the $2.1091 to $2.5644 range.

In my experience watching these charts, when we see this kind of divergence between indicators, it often precedes significant moves. The $2.10 level has held as strong support multiple times in November, while the upper band around $2.56 has capped rallies. A decisive break above the 20-day MA could open the path to test that upper band, and if that gives way... well, $3 starts looking much more achievable.

The Institutional Tsunami: How ETFs Are Changing the Game

November 2025 will likely be remembered as the month institutional adoption went mainstream for XRP. Franklin Templeton's entry with their EZRP ETF marked a watershed moment - when a $1.5 trillion asset manager jumps in, the market takes notice. Their fund's launch on the CBOE followed Canary Capital's surprisingly successful XRP ETF, which pulled in $247 million on its first day alone.

But the real game-changer might be Amplify's XRP 3% Monthly Premium Income ETF (XRPM). This innovative product combines direct XRP exposure with an options strategy targeting 36% annual yield. For income-focused investors, this is like finding the holy grail - cryptocurrency upside with steady cash flow. The fund systematically sells out-of-the-money calls on 30-60% of its portfolio while keeping the rest for pure price appreciation.

The Staking Wildcard: Could XRPL Get Yield Functionality?

Ripple's CTO David Schwartz recently reignited discussions about native staking on the XRP Ledger - a feature that could fundamentally change XRP's value proposition. While XRPL wasn't originally designed for staking (it prioritized speed over programmability), the ecosystem's growth in DeFi and tokenization projects has developers reconsidering.

What makes this particularly intriguing is how other platforms like Flare and Axelar have been using XRP. If the ledger adds staking, we could see a flood of capital chasing yield in a market that's been yield-starved compared to proof-of-stake chains. Of course, implementing this on XRPL's unique architecture presents technical challenges, but the mere possibility is enough to get traders excited.

The $3 Question: Realistic Target or Wishful Thinking?

Let's crunch the numbers. At current prices, XRP needs about a 35% rally to hit $3. The path there involves clearing several technical hurdles:

| Current Price | Target | Required Gain | Key Resistance Levels |

|---|---|---|---|

| $2.2266 | $3.00 | 34.7% | $2.3367, $2.5644 |

The BTCC research team notes that while the technical setup appears challenging, the fundamental backdrop has rarely been stronger. If ETF inflows continue at their current pace and the staking narrative gains traction, that 35% MOVE becomes much more plausible. However, traders should watch Bitcoin's performance closely - no altcoin can sustain a rally if BTC decides to take a dive.

Market Psychology: Why $3 Matters More Than You Think

There's something magical about round numbers in trading, and $3 for XRP WOULD represent both a psychological and technical milestone. It would confirm the breakout from a multi-year accumulation pattern and likely trigger FOMO buying from retail investors who've been waiting on the sidelines.

I've noticed an interesting pattern - every time XRP approaches a round number, trading volume spikes dramatically. The $1 level took multiple attempts before finally breaking in early 2025. If history rhymes, we might see similar battles around $3, with stop runs and fakeouts before any sustained move higher.

Risk Factors: What Could Derail the Rally?

While the outlook appears bright, several risks loom on the horizon:

- Regulatory surprises: The SEC's case against Ripple may be settled, but crypto regulation remains fluid

- ETF flows: Early enthusiasm could fade if investors rotate to other asset classes

- Macro environment: Rising interest rates or stock market weakness could dampen crypto appetite

- Technical failure: If XRP can't hold $2.10, we could see a retest of $1.80 support

This article does not constitute investment advice. Always do your own research before making financial decisions.

XRP Price Prediction: FAQ

What is the current price of XRP?

As of November 19, 2025, XRP is trading at $2.2266 according to data from BTCC and TradingView.

Can XRP reach $3 by the end of 2025?

While possible, XRP would need to overcome several resistance levels and maintain its current bullish momentum. The $3 target represents a 34.7% increase from current prices.

What are the key technical levels to watch for XRP?

The immediate resistance sits at the 20-day moving average ($2.3367), followed by the Bollinger Band upper limit at $2.5644. Support can be found around $2.1091.

How are the new XRP ETFs affecting the price?

The Franklin Templeton and Amplify ETFs have brought significant institutional interest, with Canary Capital's product seeing $247 million in first-day inflows.

Could staking functionality be added to XRP?

Ripple's CTO has discussed the possibility, but implementing staking on XRPL's unique architecture presents technical challenges that would need to be overcome.