BTC Price Prediction October 2025: Navigating the Correction - Is Bitcoin Still a Smart Investment?

- Where Does Bitcoin Stand Technically in October 2025?

- What's Driving Bitcoin's Current Market Sentiment?

- How Are Macro Factors Impacting Bitcoin's Price?

- What Are the Key Fundamental Developments?

- Is Bitcoin Following Historical Patterns?

- BTC Investment Outlook: Bullish or Bearish?

- Frequently Asked Questions

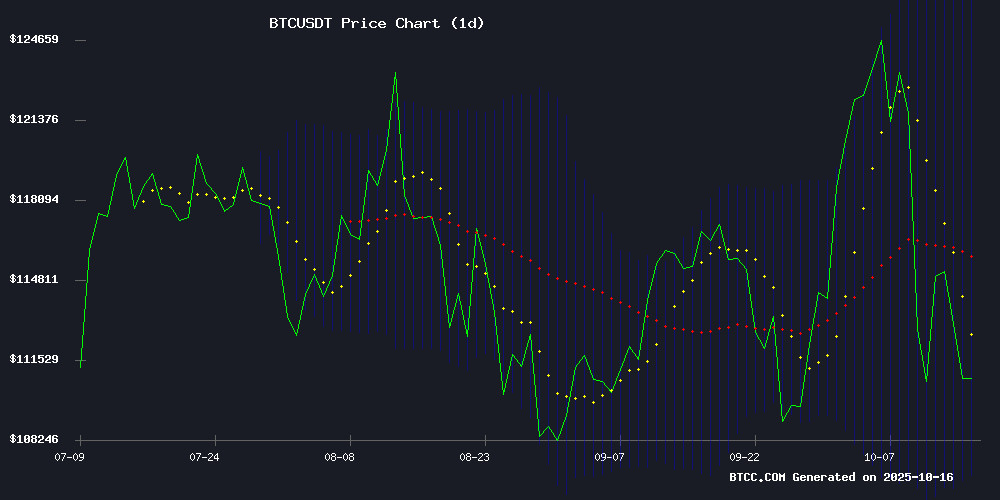

Bitcoin's rollercoaster ride continues in October 2025, with BTC currently trading at $107,966 amid a market correction. While technical indicators show short-term bearish pressure, several fundamental factors suggest this dip might present a buying opportunity for long-term investors. The cryptocurrency finds itself at a critical juncture - trading below its 20-day moving average but showing early signs of potential momentum reversal. This analysis dives deep into the current market dynamics, examining everything from institutional flows to mining developments, while answering the burning question: Is BTC still a good investment at these levels?

Where Does Bitcoin Stand Technically in October 2025?

As of October 17, 2025, Bitcoin's technical picture presents a mixed bag. The price currently sits below the psychologically important $110,000 level and the 20-day moving average of $116,683, which typically indicates bearish short-term momentum. However, the MACD histogram shows a positive reading of +2,043.49, suggesting we might be seeing early signs of a potential trend reversal.

The Bollinger Bands tell an interesting story - with BTC hovering near the lower band at $106,234, this level could serve as strong support. In my experience watching crypto markets for years, these bands often act like rubber bands - when price stretches too far in one direction, it tends to snap back. The current positioning makes me wonder if we're setting up for such a rebound.

What's Driving Bitcoin's Current Market Sentiment?

Market sentiment right now feels like a tug-of-war between bears and bulls. On the negative side, we've got Binance-led selling pressure and that unsettling wallet vulnerability news affecting 220,000 addresses - never great for confidence. But then you look at the institutional side and see Ark Invest filing for four new bitcoin ETFs and significant outflows from exchanges suggesting accumulation.

It reminds me of that classic Wall Street saying: "The market climbs a wall of worry." Right now, that wall seems pretty tall. The BTCC research team notes that while retail investors might be spooked, the big players appear to be using this dip to accumulate. Data from CoinMarketCap shows exchange reserves at their lowest levels since early 2025, which historically has preceded price rallies.

How Are Macro Factors Impacting Bitcoin's Price?

The broader financial landscape is creating some interesting dynamics for Bitcoin. With the S&P 500 slipping below its 125-day moving average, we're seeing capital rotate into alternative assets. Gold and silver have been hitting record highs, but Bitcoin's correlation with traditional markets has been decreasing - it's starting to behave more like the digital gold it was meant to be.

MicroStrategy's recent stock movements provide a fascinating case study. Their shares have become almost a Leveraged Bitcoin ETF in themselves, swinging wildly with BTC's price. The US Treasury's decision to waive that multi-billion dollar tax liability on their BTC holdings was huge - instantly adding $8 billion to their market cap. Makes you wonder how many other corporations are watching this playbook.

What Are the Key Fundamental Developments?

On the mining front, Bitdeer's ascent to fifth place among public miners is noteworthy. Their new Sealminer rigs added 5 EH/s of capacity, and they mined 452 BTC in September - a 20.5% increase from August. This expansion comes as mining difficulty continues hitting all-time highs, showing the network's underlying strength.

Then there's the whale activity - over $160 million moved from Binance and FalconX to new wallets. When big players start moving coins to cold storage, it often signals accumulation rather than distribution. CryptoQuant data shows Coinbase Premium remains positive despite the price drop, suggesting US institutions are still buying.

Is Bitcoin Following Historical Patterns?

Technical analysts are buzzing about Bitcoin filling its weekly CME gap between $109,680 and $111,310 - a move that in late 2024 preceded a two-month rally from $68,785 to $108,000. The current higher low structure mirrors that setup, and RektCapital analysts point to a bullish divergence forming on daily charts.

Yet market sentiment feels oddly similar to 2017's pessimism - that exhausted, "is this cycle over?" feeling. History suggests that when everyone's convinced the bull run is done, that's often when the next leg up begins. The "Uptober" seasonal trend could provide additional tailwinds.

BTC Investment Outlook: Bullish or Bearish?

Let's break down the key metrics in a simple table:

| Metric | Current Value | Interpretation |

|---|---|---|

| Price vs 20-day MA | $107,966 vs $116,683 | Short-term bearish |

| Bollinger Band Position | Near lower band ($106,234) | Potential support level |

| MACD Histogram | +2,043.49 | Positive momentum building |

| Exchange Outflows | Increasing | Accumulation signal |

From my perspective, this looks like one of those "be fearful when others are greedy" moments. The technicals suggest caution in the short-term, but the fundamentals - institutional interest, mining expansion, exchange outflows - all point to long-term strength. As always in crypto, timing is everything.

Frequently Asked Questions

Is now a good time to buy Bitcoin?

For long-term investors, current levels might present an attractive entry point. The price is NEAR potential support with positive momentum indicators developing, though short-term volatility could continue.

How low could Bitcoin go in this correction?

The $106,234 level (lower Bollinger Band) appears as immediate support. A break below could see a test of psychological support at $100,000, though strong fundamentals may prevent deeper declines.

What's the outlook for Bitcoin by year-end 2025?

Historical patterns and current technical setups suggest potential for a rally toward $130,000 if key resistance levels are broken. However, macroeconomic factors will play a significant role.

How does Bitcoin compare to gold as an investment?

While gold has outperformed recently (BTC is down 32% in gold terms since August), Bitcoin's long-term growth trajectory remains significantly stronger. They serve different portfolio purposes.

Should I be worried about the wallet vulnerability?

Only if you're using older wallets. Modern wallet solutions aren't affected. Always ensure you're using up-to-date, secure storage methods for your crypto assets.