Crypto Bloodbath Rattles Markets—Is This Just The Calm Before The Real Storm?

Digital assets got hammered today in a brutal market correction that wiped billions from portfolios worldwide. The sell-off triggered margin calls and liquidations across major exchanges as fear gripped traders.

The Domino Effect

Bitcoin's sudden 15% plunge dragged everything down with it—from Ethereum to meme coins. Trading volumes spiked 300% as panic set in, creating a classic capitulation event that veteran crypto investors recognize all too well.

Institutional Whispers

Meanwhile, traditional finance sharks are circling. They're either preparing bailout packages for distressed crypto firms or shorting the rebound—because why pick sides when you can profit from both fear and hope?

This volatility isn't a bug—it's a feature of an asset class rewriting finance. The real question isn't whether markets will recover, but which projects will survive to see the next ATH.

Crypto Watch: ETH, XRP, DOGE, ADA

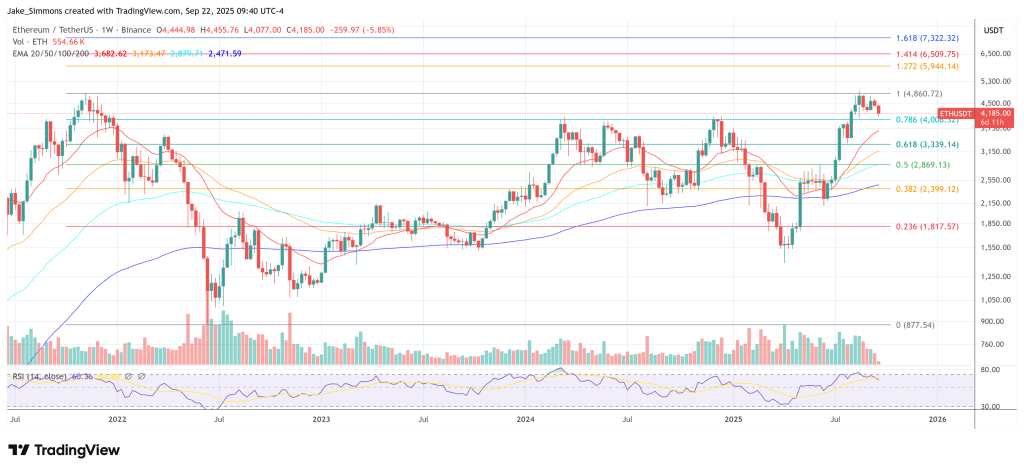

He cited fresh examples across majors. For ETH, a drawdown from “about $4,400 down to $4,000” knifed through a “dense” cluster of below-price liquidity that had accumulated for weeks. “This is the first time we’ve seen more liquidity above us than we have below since” the prior five-wave advance, he argued, consistent with an ABC correction that may be maturing.

XRP, he said, “pinpointed” its only notable pocket of sub-price liquidity, wicking to $2.66, a level he mapped against $2.8–$2.69. He now sees the “main liquidity… above us for XRP at $3.40, while allowing that a brief wick-fill toward today’s low could complete the divergence pattern he’s watching.

Bitcoin’s dominance spike during the flush also fits his playbook. He described the dominance RSI as “massively overbought… probably like on the hourly as overbought as I’ve seen it,” noting that prior forays into this zone have coincided with local peaks in BTC relative strength before rotation back into large caps and selective alts. That context—together with his “zoomed-out” view—underpins his claim that “bullish sentiment gets rewarded over time,” even if the path includes unnerving resets.

Dogecoin, he cautioned, can still probe the $0.19–$0.20 zone after reclaiming the $0.22 support region, but he flagged that the 4-hour RSI is as depressed as at prior cyclical lows. He disclosed a “2x” Doge long around $0.225, acknowledging no hard stop given his conviction in the higher-timeframe trend and accepting the risk of further chop.

Cardano “wicked into” a mapped liquidity shelf NEAR $0.77, with “main liquidity… up at $1.00 and $1.20” on the daily, a configuration he views as asymmetrically favorable once the market stabilizes.

What To Watch Now

Throughout, he emphasized that today’s damage was amplified by leverage, not fundamentals. “We’ve had a liquidity flush,” he said, referencing a social post he saw that “a billion dollars of leverage got flushed out in 30 minutes.” For him, that is “positive; we want to see this leverage reset.” He cautioned that near-term direction is hostage to US cash-market flows—“The US might wake up and… sell, or… buy the [dip]”—but insisted the larger structures are intact: “Weekly… we’re still sitting at all-time highs… Whether the top’s in or not, I don’t think so. I really, really, really, really, really don’t think so.”

His near-term checklist is straightforward: let volatility run its course, look for the RSI higher-low against a marginal price lower-low, and respect predefined support/target zones. “Take your emotion away and look for structures that you know are bottoming structures,” he said.

The trader psychology, in his telling, is as critical as the levels. “These things happen and it feels like a culmination of sentiment… anger, frustration, and now probably despair… If it’s too much… go for a run,” he advised, adding that “the market doesn’t care” about anyone’s mood and will “do what it’s going to do anyway.”

If the “real storm” is still to come, he implies it’s the post-flush move that matters—whether a final liquidity sweep completes the divergence or a swift rotation lifts majors into the overhead liquidity he’s mapped. Either way, he argues, the decisive phase is ahead, not behind: “Let’s see how things play out… It’s not a time to panic… If you want to be buying things… when we’re oversold like this, it’s a decent time to buy,” he said.

At press time, ETH traded at $4,185.