Ethereum Targets $5,500 As Illiquid Supply Squeeze Meets Explosive ETF Momentum

Ethereum's supply crunch just hit critical levels—and the timing couldn't be more explosive.

Supply Shock Intensifies

Illiquid supply continues drying up as institutional players lock away ETH. Fewer coins available means higher pressure on prices—basic economics, though Wall Street still needs flowcharts to understand it.

ETF Fuel Ignites

Spot Ethereum ETFs are gobbling up supply faster than traders can say 'decentralization.' Massive inflows create relentless buying pressure while traditional finance finally plays catch-up with crypto natives.

Price Momentum Builds

The path to $5,500 looks increasingly inevitable as technicals align with fundamental demand. Resistance levels crumble under institutional weight—turns out money talks louder than crypto Twitter debates.

Just remember: bankers will take credit for the rally after calling it a scam for years. Some things never change.

Ethereum To Hit $5,500 In September?

According to a CryptoQuant Quicktake post by contributor Arab Chain, Ethereum’s latest upswing in August which pushed the digital asset from a range of $3,700 – $4,000 to its latest all-time high (ATH) of $4,946, was largely buoyed by broader market rally and positive ETF inflows.

The analyst noted that ETH reserves on Binance crypto exchange witnessed a sharp uptick in August. The quick surge in inflow of tokens to the exchange shows that holders are choosing to sell or take profits at higher prices.

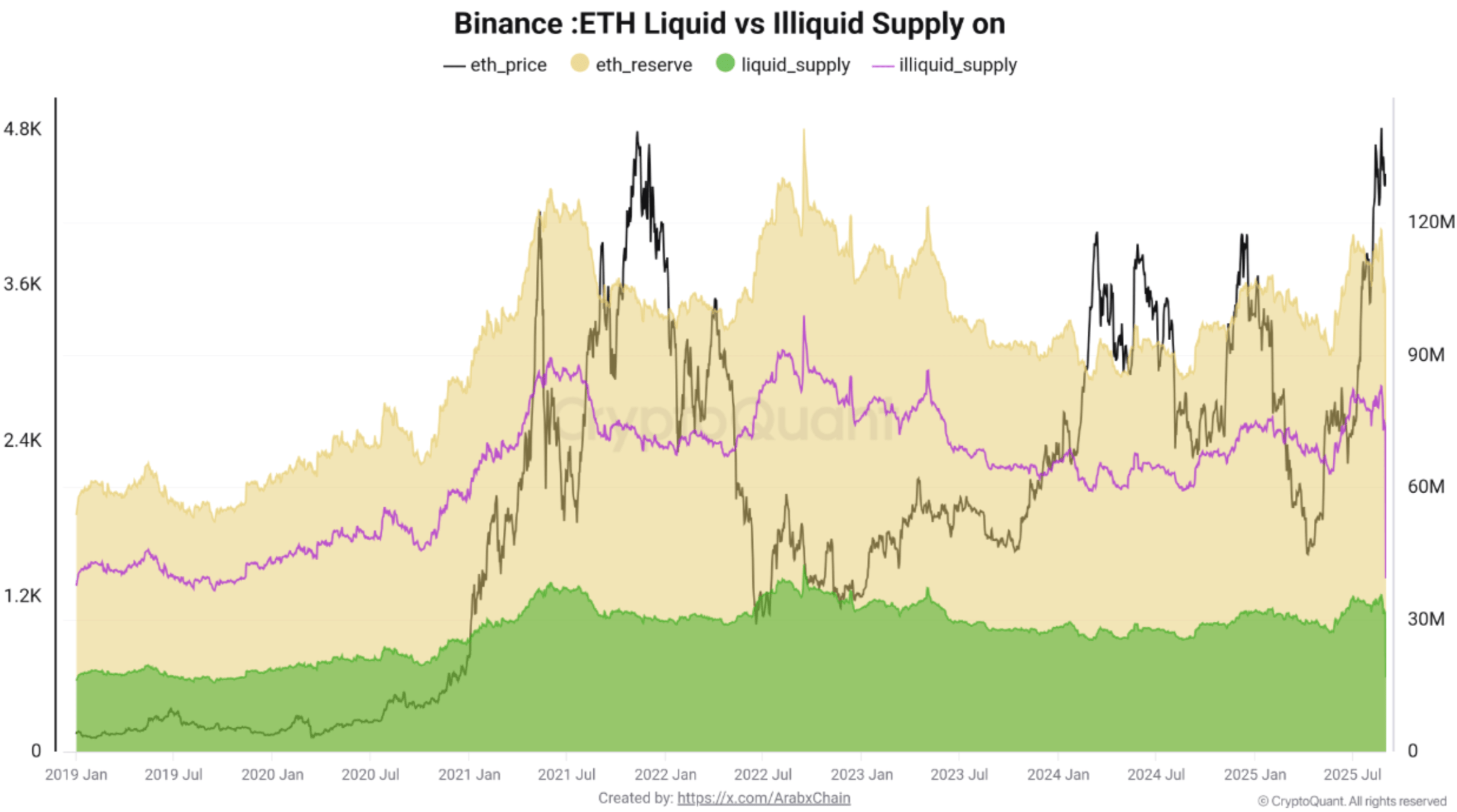

Arab Chain shared the following chart which shows both liquid (green) and illiquid (beige) ETH supply. According to the chart, the vast majority of ETH supply remains illiquid, creating a structural supply shortage.

On the other hand, the chart shows a slight increase in the liquid supply, suggesting that a portion of ETH has returned to circulation and could add to short-term selling pressure. The analyst remarked:

The overall illiquidity of the supply reinforces the long-term bullish outlook. Short-term cautionary signals – rising Binance reserves combined with a small increase in liquid supply – suggest a potential correction after the recent strong upswing.

If the growth in ETH reserves on Binance shows signs of slowing down or withdrawals resume, the digital asset’s supply shortage will remain pronounced. Consequently, a clear and decisive break above the $4,800 resistance level could propel ETH toward $5,200 – $5,500 in the NEAR term.

The CryptoQuant analyst concluded by saying that September is likely to witness sideways to a slightly bullish MOVE for ETH between $4,300 to $5,000. However, a failure to break through the $4,800 level – coupled with rising exchange reserves – could raise the possibility of a correction to $4,200.

What’s In Store For ETH?

While a breakout above $4,800 is possible, some analysts are tempering their expectations by saying that ETH may test the psychologically important $4,000 level before resuming its uptrend.

Meanwhile, on-chain data shows whales accumulating ETH at record pace. According to a recent report, ETH whales added a whopping 260,000 ETH to their wallets on September 1.

Offering a more ambitious prediction, Ethereum co-founder and ConsenSys CEO Joseph Lubin recently said that “ETH will likely 100x from here.” At press time, ETH trades at $4,429, up 2% in the past 24 hours.