Sleepless In Crypto: $900M Liquidated As Bitcoin’s Brutal Plunge Hammers Traders

Bloodbath on the blockchain as Bitcoin's nosedive triggers massive liquidation carnage.

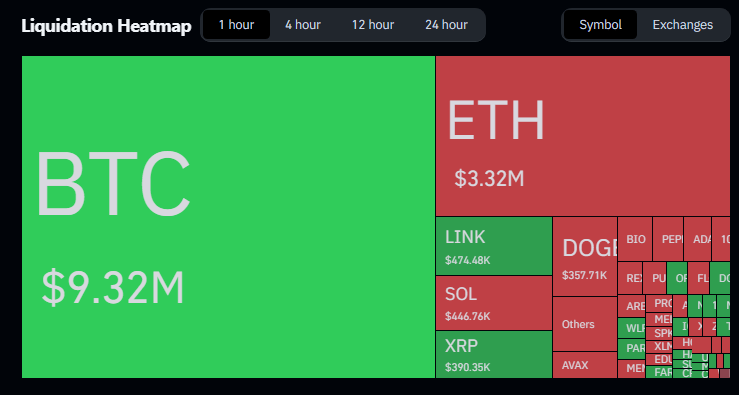

The $900 Million Wipeout

Leveraged positions evaporated faster than a memecoin's utility when BTC decided to take the express elevator down. That's nine hundred million dollars—poof—gone from overconfident portfolios in a single swoop.

Margin Calls Echo Through the Market

Exchanges flashed margin warnings like disco strobes at a bear party. Traders who bet big on perpetual green candles got a brutal reminder that crypto doesn't do safety nets.

Volatility Isn't a Bug—It's a Feature

This is the market's way of separating the diamond hands from the over-leveraged tourists. While traditional finance folks clutch their pearls, crypto natives just see another Tuesday.

Remember: in crypto, the only thing that drops faster than prices are the jaws of traders watching their life savings get rekt. Maybe diversify beyond leverage next time—or just embrace the pain like the rest of us degenerates.

Liquidations Hit Retail Traders

Reports have disclosed that a single large sale helped set off the cascade. Selling pressure intensified as a large holder offloaded 24,000 BTC, triggering a wave of liquidations, said Rachael Lucas, a crypto analyst at BTC Markets.

On Coinbase, Bitcoin briefly fell below $109,000 — its weakest level since July 9. Market participants felt the shock fast; traders who were long were the ones most exposed.

Macro Signals And Market Reaction

A recent hint from Federal Reserve Chair Jerome Powell at Jackson Hole about potential interest rate cuts changed how some investors priced risk.

Since August 14, when bitcoin reached an all-time high just over $124,000, the asset has corrected by over 10%. Based on data, the drop since Powell’s speech is about 7%.

The single-day MOVE was measured at close to 3% decline for Bitcoin, and total crypto market value slipped back below $4 trillion to about $3.83 trillion as almost $200 billion flowed out of the space.

Ether Is Holding UpEther traded NEAR $4,340 and, for now, looks steadier than Bitcoin. It did fall, but it did not breach last week’s low. Institutional interest in Ether remains a talking point. According to Lucas, institutions continue to focus on Ethereum, even as traders reassess risk across smaller coins.

Many smaller tokens fell harder than the majors. Solana, Dogecoin, Cardano, Chainlink, and sui were among the worst hit.

That pushed losses beyond the headline Bitcoin numbers and left traders in altcoin-heavy positions nursing larger drawdowns.

Thin weekend liquidity served to enhance the price gyrations, making the action more extreme than it WOULD have been on a more active trading day.

September’s Track Record And OutlookThere is also a historical component to the tale. September has a history of strong pullbacks in bull markets, with strong corrections in 2017 and 2021.

Featured image from Meta, chart from TradingView