Ethereum’s $15K Surge Incoming? Institutional FOMO Fuels Bullish Frenzy

Wall Street's latest shiny toy? Ethereum. Institutional money floods in—price targets scream $15K. Who needs fundamentals when you've got FOMO?

Greed meets blockchain

Forget 'slow and steady.' Crypto's second-largest asset is primed for a vertical climb as hedge funds and corporate treasuries dive headfirst into ETH. The $15K prediction isn't hopium—it's becoming a self-fulfilling prophecy.

Bankers 'discover' yield

After years of scoffing, suits finally noticed Ethereum's 500% institutional inflow spike. Now they're piling in like it's 2021 NFT summer—only this time with pension funds instead of meme traders.

The closer: When Goldman starts shilling altcoins, either we're early... or the bubble's already inflating. Place your bets.

Fundstrat Targets And Rationale

According to Fundstrat’s chief information officer Tom Lee and head of digital asset research Sean Farrell, institutional forces and new rules are key drivers.

They point to stablecoin work and tokenized projects being built mostly on Ethereum, and they cite regulatory efforts such as the GENIUS Act and the SEC’s so-called Project crypto as factors that could speed Wall Street’s move onto blockchain rails.

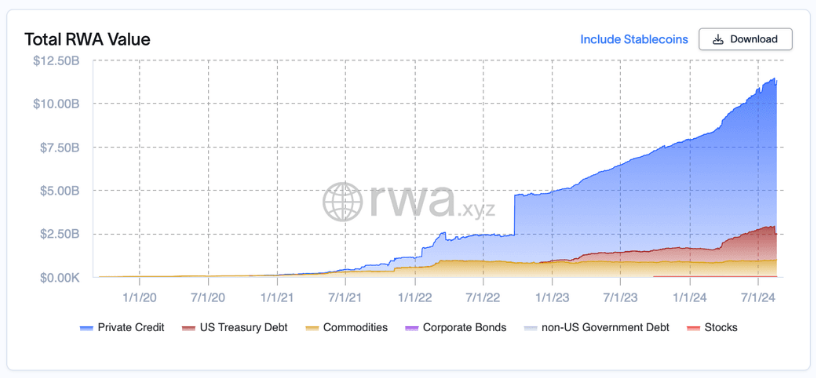

Based on data, ethereum holds a commanding 55% share of the $25 billion real-world asset tokenization sector, a stat that Fundstrat uses to argue for broader institutional adoption.

Institutional Demand And Big Buyers

Reports have disclosed large-scale corporate accumulation that several analysts say is taking supply off the market.

BitMine Immersion Technologies has reportedly added about 1.2 million ETH since early July, leaving the company with roughly $5.5 billion worth of Ether on its books. Company stock (BMNR) has been volatile, with some coverage pointing to a 1,300% jump over a short period.

Fundstrat and other observers say those kinds of corporate treasuries, combined with fresh ETF flows, could create a structural bid for ETH if the buying is sustained.

Rachael Lucas, a crypto analyst at BTC Markets, described these positions as strategic and long-term, saying they remove “substantial liquidity” from trading pools.

Market Momentum And Price ClaimsAccording to Fundstrat, Ether is outperforming Bitcoin this year. One set of figures put ETH’s year-to-date gain at 28% against Bitcoin’s 18%, while other reports more recently showed ETH up 41% YTD and Bitcoin up 30% YTD, with BTC trading near $121,000 in that snapshot.

Based on reports, Fundstrat’s analysts view ETH as a major macro trade for the next 10 to 15 years if institutional and regulatory trends continue to push demand higher.

Analysts caution that lofty targets will need sustained, large inflows to become reality. Watch for the pace and consistency of ETF flows, corporate treasury disclosures, and any regulatory moves around stablecoins and custody rules.

There’s also a practical concern: big, concentrated buys can tighten markets quickly but may also reverse if sentiment shifts or liquidity needs change.

According to analysis and public comments from Fundstrat, the bullish case for Ether is clear and backed by specific numbers: $10,000 to $15,000 targets, corporate treasuries holding millions of ETH, and rapid recent gains.

Featured image from Meta, chart from TradingView