Altseason Stalls as BTC Dominates: Large, Mid, and Small Caps Left in the Dust

Bitcoin isn't waiting for altcoins to catch up—metrics show it's sprinting ahead while the rest lag.

The king isn't sharing its throne

While crypto traders keep praying for an altseason miracle, BTC keeps flexing. It's outpacing large caps, mid caps, and small caps like a marathoner lapping joggers. The 'diversification' crowd isn't laughing anymore.

The brutal truth behind the numbers

Market data doesn't lie: Bitcoin's performance makes altcoins look like risky side bets rather than viable alternatives. But hey—at least those 500% APY DeFi farms are still printing... until they're not.

A cynical footnote for the 'patient' investors

Remember when 'waiting for altseason' was a strategy? Neither does your portfolio. While BTC keeps cutting through resistance levels, most alts can't even hold support. Maybe those 'fundamentals' need a reality check.

Altseason Still Waiting For Its True Breakout

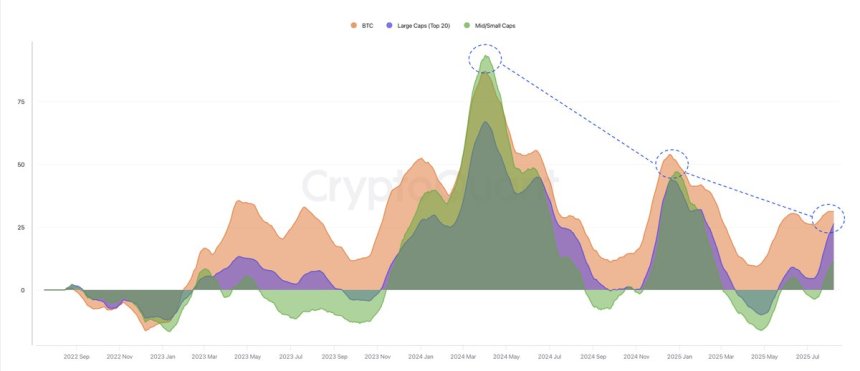

According to top analyst Darkfost, the much-anticipated altseason hasn’t truly begun. By examining a comparative chart of Bitcoin, large caps (top 20), and mid/small caps, Darkfost notes that the current cycle is showing the weakest altcoin performance so far. While altcoins have made notable moves in recent weeks, their gains still pale in comparison to Bitcoin’s dominant run.

The last instance that resembled a genuine altseason occurred in early 2024, when altcoins—particularly mid- and small-cap projects—outpaced Bitcoin over a short but intense period. That surge marked a clear capital rotation away from BTC into the broader market, delivering outsized returns for altcoin holders. However, the present market conditions suggest that kind of broad-based outperformance has yet to materialize.

Even though Ethereum has broken above multi-year highs and several altcoins are posting impressive gains, the rally appears selective rather than widespread. Large caps are recovering steadily, but mid- and small-cap coins—often the hallmark of an explosive altseason—are still lagging. This disparity suggests that institutional and retail capital remains concentrated in more established assets.

For a confirmed altseason, analysts will be watching for a sustained breakout in mid- and small-cap performance relative to BTC. Until that shift occurs, the current market may be better described as a strong altcoin rally within Bitcoin’s dominant phase rather than the start of a full-scale altseason.

Altcoin Market Nears Key Resistance

The Total crypto market Cap excluding Bitcoin (TOTAL2) is showing strong bullish momentum, currently sitting at $1.57 trillion after a sharp 13.21% weekly surge. This rally brings the market close to retesting its 2025 highs around the $1.6 trillion level, a critical resistance zone that has capped altcoin gains in previous attempts.

The chart reveals that the market has been in a sustained uptrend since early 2024, with price action consistently holding above the 50-week moving average (blue line) and maintaining bullish structure. Both the 100-week (green) and 200-week (red) moving averages are trending higher, reinforcing long-term support and signaling healthy market conditions.

If the breakout occurs, TOTAL2 could target the previous all-time high zone near $1.75–$1.8 trillion, marking a potential acceleration in capital rotation from bitcoin into altcoins. Conversely, failure to clear this resistance could lead to a short-term pullback toward $1.4 trillion support, which aligns with the 50-week MA. The coming weeks will be crucial for determining whether altseason truly ignites.

Featured image from Dall-E, chart from TradingView