Bitcoin Defies Gravity Near ATH – Market Still Has Room to Run, On-Chain Data Reveals

Bitcoin isn't just flirting with its all-time high—it's rewriting the rules of gravity. While traditional analysts hyperventilate about 'overheated' conditions, cold hard blockchain metrics tell a different story.

The Unshakable Bull Case

Network fundamentals scream undervaluation. Exchange reserves are bleeding dry, miner capitulation never materialized, and that 'overleveraged' derivatives market? Mostly institutional hedging rather than degenerate speculation (this time).

Wall Street's FOMO Moment

Private client desks report record inflows from family offices who finally understand: you can't short a protocol with 99.9% uptime. Meanwhile, gold ETFs hemorrhage assets faster than a Boomer's portfolio during a taper tantrum.

The Cynical Kick

Bankers still whispering 'tulip mania' between martini lunches? They're the same geniuses who missed the internet—and now they're paying 2% management fees on underperforming 'digital asset' mutual funds.

On-Chain Activity Still Lags Behind Price

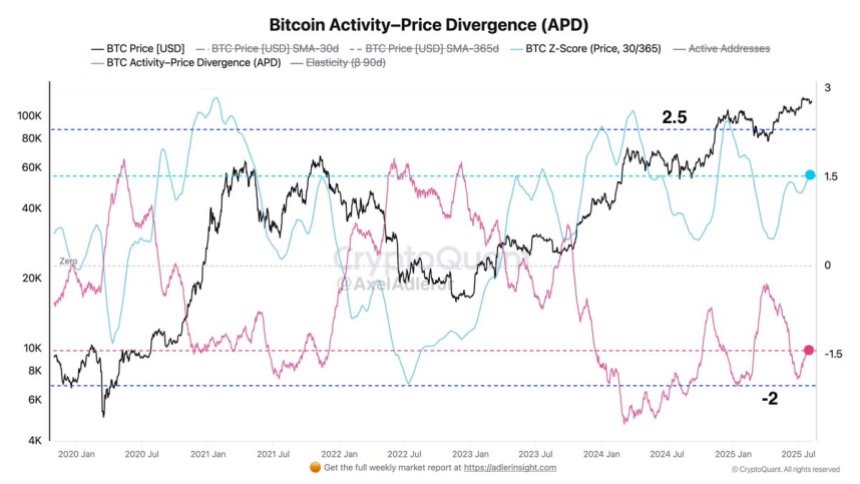

According to Adler, Bitcoin’s current market setup is showing a positive backdrop but with some important caveats. Adler points out that the Adjusted Price Divergence (APD) remains negative NEAR −1.5 after rebounding from local lows around −2. This metric suggests that Bitcoin’s price is still outpacing on-chain activity, although the gap between the two is narrowing. In other words, while price momentum is firm, the network’s transactional activity and usage haven’t yet fully caught up.

This discrepancy creates an interesting dynamic for the market. Adler explains that the bias still favors price, meaning momentum is being driven more by investor positioning and sentiment than by on-chain fundamentals. For the rally to gain more structural support, a healthier setup WOULD see APD move toward zero. This could happen in one of two ways: either network activity increases significantly while price moves sideways or posts modest gains, or Bitcoin’s price cools off to better align with current usage levels.

Importantly, Adler warns against interpreting APD moving toward zero as a direct buy or sell signal. Instead, it represents a sign of normalization — a point where market price and underlying network fundamentals are better aligned. For now, Bitcoin’s technical and macro backdrop remains bullish, but sustained long-term growth will likely require the network to catch up with price action.

Bitcoin Price Holds Key Support Near $115K

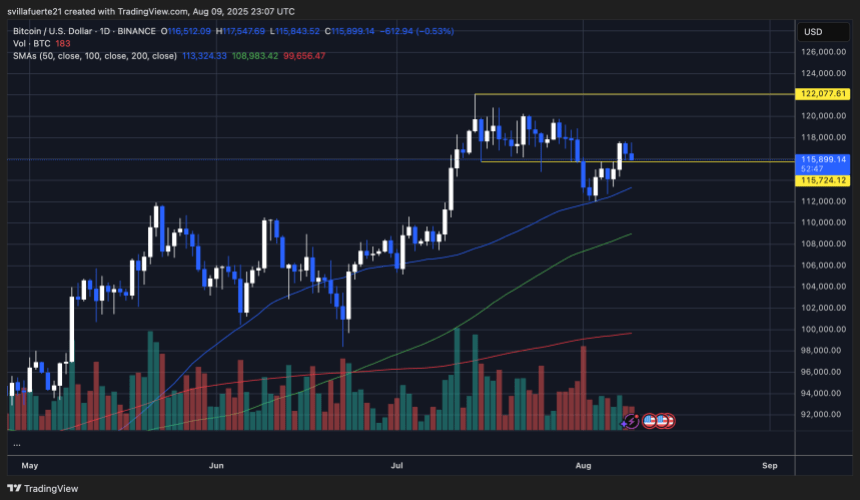

Bitcoin is consolidating above the $115,724 support level after a brief dip below it earlier this month. The daily chart shows price stabilizing just above the 50-day simple moving average (SMA), currently near $113,324, which has acted as a strong dynamic support throughout the recent uptrend. The short-term structure remains bullish, with BTC trading inside a range between $115,724 support and the $122,077 resistance level.

Volume has tapered off slightly since the early August rebound, suggesting the market is in a wait-and-see mode before a potential breakout. A decisive close above $118,000 could invite another test of the $122,077 resistance, a key level that has capped upside attempts multiple times. If broken, this could open the door toward new all-time highs.

On the downside, losing $115,724 would shift focus to the 100-day SMA at $108,983 as the next major support. Until then, the higher-lows pattern suggests buyers are defending the mid-$115K zone aggressively.

Featured image from Dall-E, chart from TradingView